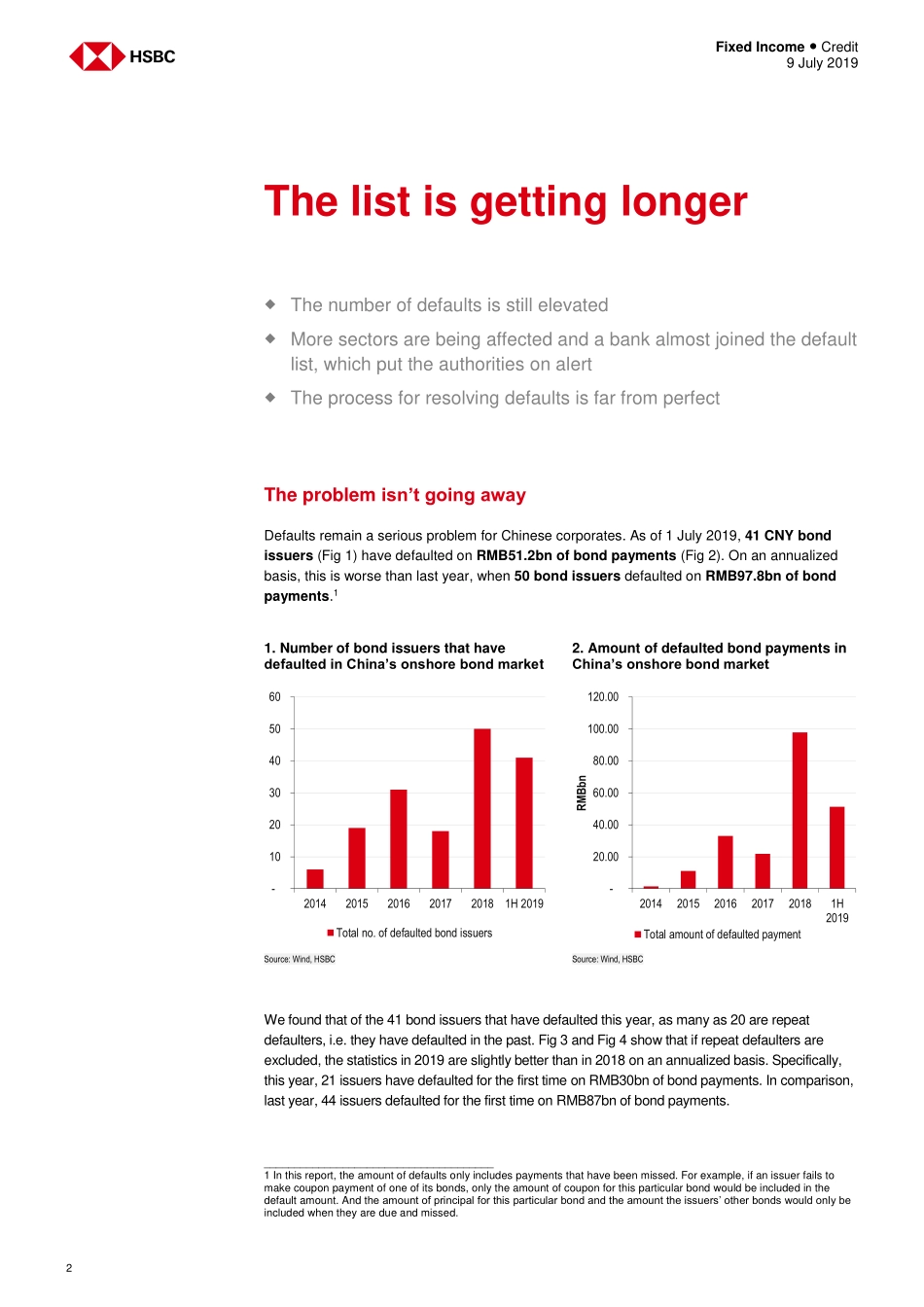

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:TheHongkongandShanghaiBankingCorporationLimitedViewHSBCGlobalResearchat:https://www.research.hsbc.comTHISCONTENTMAYNOTBEDISTRIBUTEDTOTHEPEOPLE'SREPUBLICOFCHINA(THE"PRC")(EXCLUDINGSPECIALADMINISTRATIVEREGIONSOFHONGKONGANDMACAO)ThenumbersarerisinganddefaultsarespreadingtobiggerbondissuersinawiderrangeofsectorsLower-qualityissuersnowfacehigherborrowingcosts,andfinancialinstitutionsarebeingaffected,tooRecoveryratesarelow–wethinkthedefaultresolutionmechanismneedstobeimprovedThisreportanalysesthelatestdataaboutdefaultsinChina’sonshorebondmarket.Welookatthenumberandnatureofdefaults,therepaymentsmadeandthesectorsinvolved,aswellasthemechanisminplacetoresolvedefaults.Wefindthat:Thenumberofdefaultsisrising.Inthefirsthalfof2019,41CNYbondissuershavedefaultedonRMB51.2bnofbondpaymentssofarthisyear.Onanannualisedbasis,thisisworsethanlastyear,when50bondissuersdefaultedonRMB97.8bnofbondpayments.Defaultsnowaffectlargercompaniesinawiderrangeofsectors.Forexample,theaverageleveloftotalassetsofdefaultingissuershasrisenfrombelowRMB20bninandbefore2016toRMB47bnin2019.Defaultshavealsospreadfromtheusualsectorswithover-capacityproblemstoabroadrangeofindustries.Even“neweconomy”sectorssuchaspharmaceuticalsandtechhavejoinedthedefaultlist.Defaultsoccurmostlyintheprivatesectordespitegovernmenteffortstogiveprivatelyownedenterprises(POEs)greateraccesstocredit.Onlytwostate-owned-enterprises(SOEs)havedefaultedthisyearandbotharenotreallySOEsinthestrictestsense.Lower-qualitybondissuersnowfacehigherborrowingcoststhanhigher-qualityissuerstocompensatebondinvestorsforthegreaterriskofadefault.Thisprocessofcreditdifferentiationcontinuestodeepen,andissuancecostshavebeenwideningforayear.ThistrendisnowaffectingfinancialinstitutionsafterBaoshangBankwastakenoverbytheregulator.Adefaultresolutionmechanismisinplace,butmanyobstaclesre...