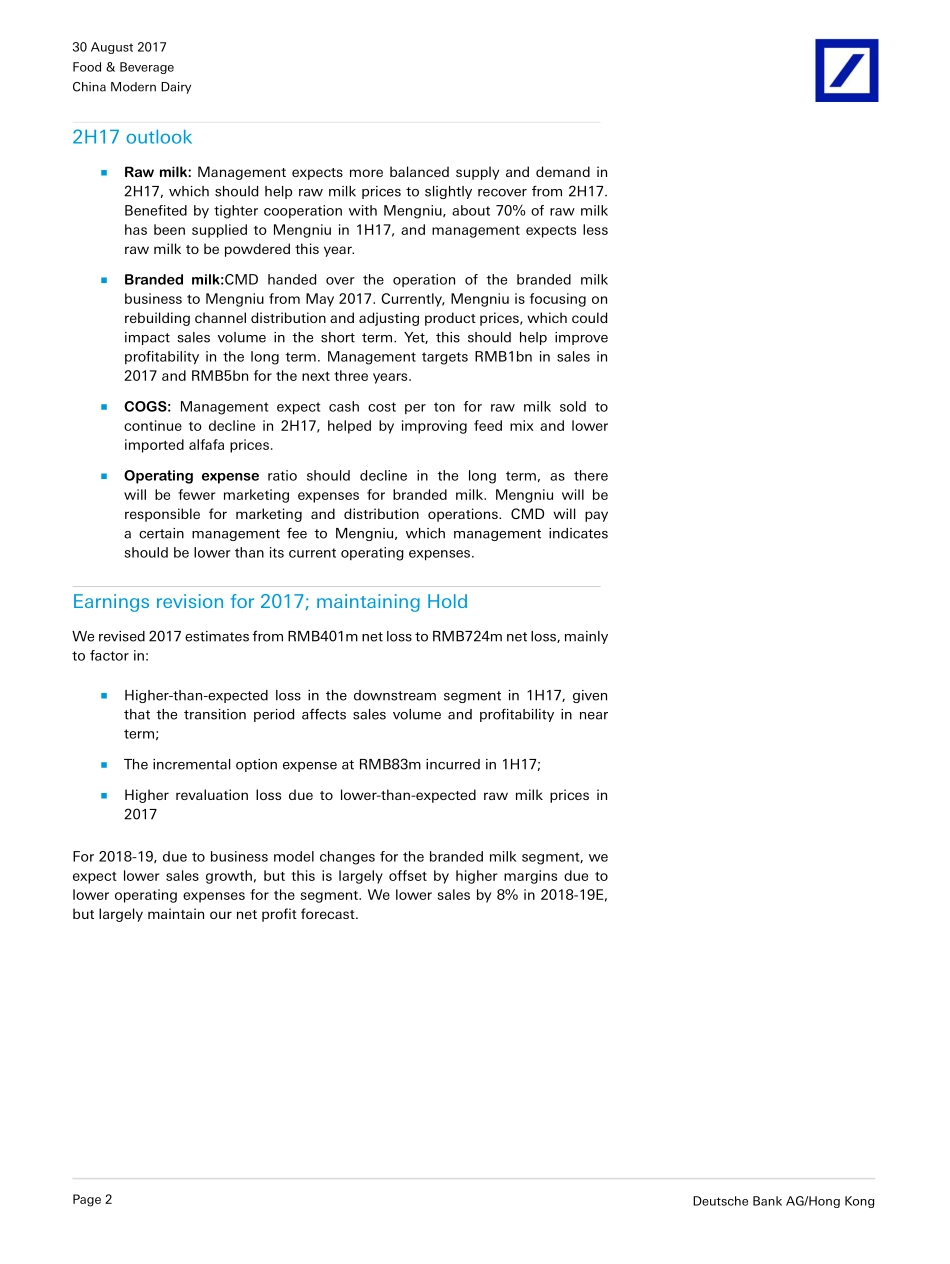

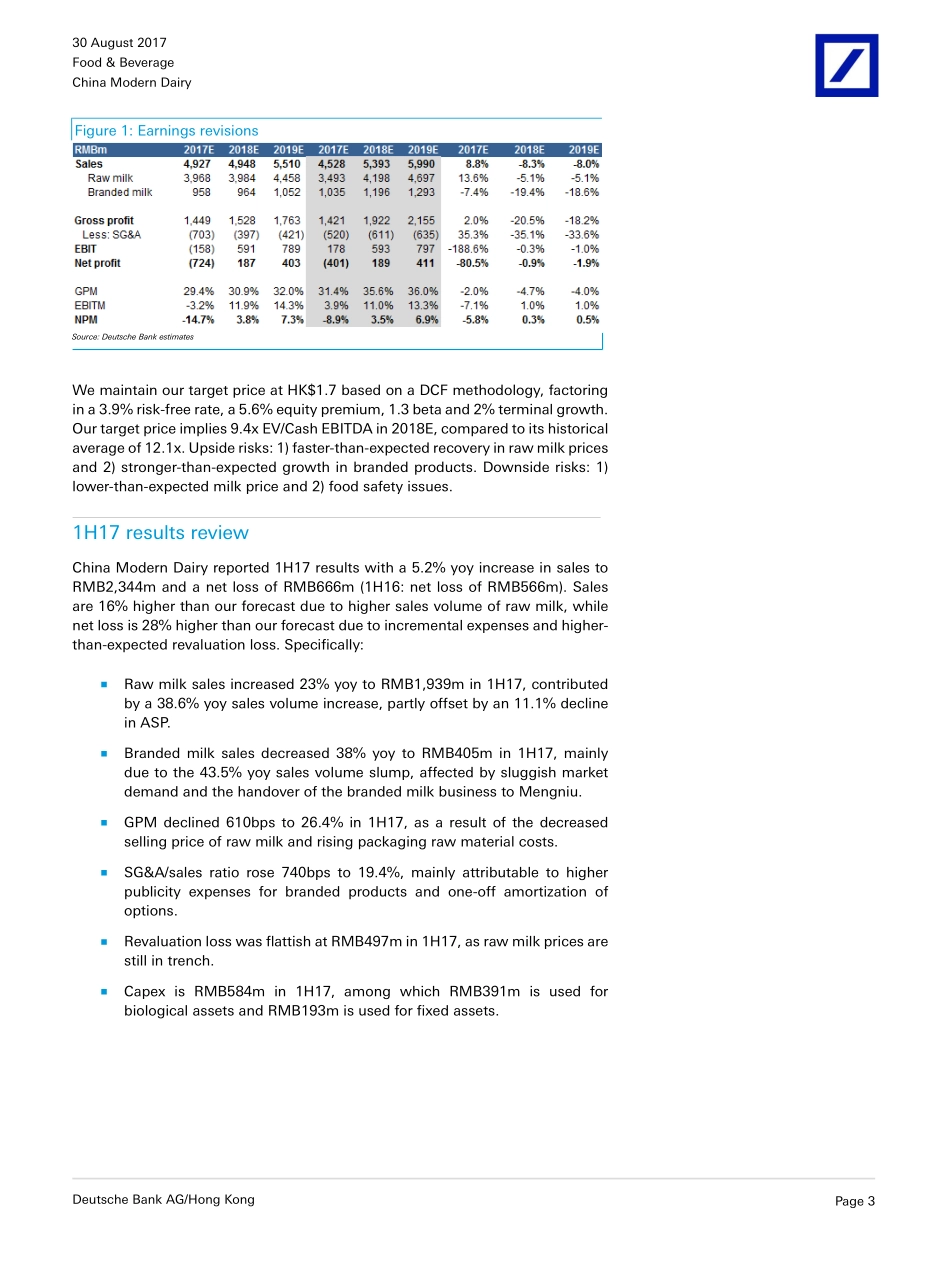

gChinaModernDairyRatingHoldValuation&RisksConsumerFood&BeveragePriceat29Aug2017(HKD)1.52Pricetarget-12mth(HKD)1.7052-weekrange(HKD)2.13-1.22HANGSENGINDEX27,765ForecastChangeAsiaChinaCompanyChinaModernDairyReutersBloombergExchangeTicker1117.HK1117HKHSI1117Date30August2017DeutscheBankMarketsResearchExpectingmarginstoimprovefrom2H171H17missonhigher-than-expectedbrandedmilklossChinaModernDairyreported1H17resultswitha5%yoysalesincreasetoRMB2,344mandanetlossofRMB666m(1H16:netlossofRMB566m).ThelossishigherthanitsprofitwarningofoverRMB500mannouncedinJuneandourestimateofRMB520m.Bysegment:■Rawmilksalesgrew23%yoy,helpedby39%volumegrowthonMengniu'sincreasingdemand,whilepartlyoffsetbyan11%yoyASPdecline.■Brandedmilksalesdeclined38%yoy,mainlyduetoitbeinginatransitionperiodfromselfoperationtotheMengniuoperationmodel.FromMay2017,Mengniuwillberesponsibleforitsmarketinganddistributionofbrandedmilkbusiness.■ThenetlossofRMB666mismainlyattributableto:1)abrandedmilksalesdeclineduetooperatingdeleveraging,2)aRMB156maccountsreceivableimpairmentlossforbrandedmilk,3)anincrementalRMB83mexpenseforstockoptions.Profitabilitytoimprovefrom2H17Fortheupstreamrawmilksegment,managementexpectsamorebalancedsupplyanddemandenvironmentin2H17,helpedbypeakconsumptionseason,lowersupplyinthehigh-temperatureweatherandrecoveringrawmilkprices.Managementexpectsrawmilkpricesin2H17toimprovefrom1H17.Forthedownstreambrandedmilksegment,withinanewcooperationcontractwithMengniu,CMDwillchargeastablemark-uponbrandedmilksoldtoMengniu,whichshouldhelpitreducelossesinthesegment(RMB306moperatinglossindownstreamin1H17).MaintainingHoldWerevisedour2017estimatesfromRMB401mnetlosstoRMB724mnetloss,mainlytofactorinthehigher-than-expectednetlossinthebrandedmilksegmentandrevaluationlossincurredin1H17.Welargelymaintainourearningsforecastin2017-18E.WemaintainourTPatHK$1.7,basedonaDCFmodel(factoringin3.9%RFR,a5.6%equitypremium,1.3betaand2%TG),andmaintainHoldoncurrentfairvaluation.Downsideandupsiderisks:higher-orlower-than-expectedrawmi...