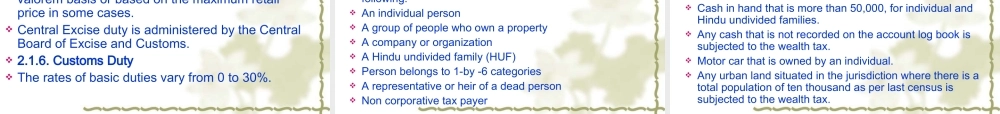

VIIITaxationinIndia1.OverviewIndiahasawelldevelopedtaxstructurewithathree-tierfederalstructure,comprisingtheUnionGovernment,theStateGovernmentsandtheUrban/RuralLocalBodies.ThepowertolevytaxesanddutiesisdistributedamongthethreetiersofGovernments,inaccordancewiththeprovisionsoftheIndianConstitution.1.1Themaintaxes/dutiesthattheUnionGovernmentisempoweredtolevyareIncomeTax(excepttaxonagriculturalincome,whichtheStateGovernmentscanlevy),Customsduties,CentralExciseandSalesTaxandServiceTax.1.2TheprincipaltaxesleviedbytheStateGovernmentsareSalesTax(taxonintra-Statesaleofgoods),StampDuty(dutyontransferofproperty),StateExcise(dutyonmanufactureofalcohol),LandRevenue(levyonlandusedforagricultural/non-agriculturalpurposes),DutyonEntertainmentandTaxonProfessions&Callings.1.3TheLocalBodiesareempoweredtolevytaxonproperties(buildings,etc.),Octroi(taxonentryofgoodsforuse/consumptionwithinareasoftheLocalBodies),TaxonMarketsandTax/UserChargesforutilitieslikewatersupply,drainage,etc.Since1991taxsysteminIndiahasundergonearadicalchange,inlinewithliberaleconomicpolicyandWTOcommitmentsofthecountry.Someofthechangesare:ReductionincustomsandexcisedutiesLoweringcorporateTaxWideningofthetaxbaseandtoningupthetaxadministrationSinceApril01,2005,mostoftheStateGovernmentsinIndiahavereplacedsalestaxwithVAT.ConstitutionallyestablishedschemeofTaxationList-Ientailingtheareasonwhichonlytheparliamentiscompetenttomakelaws,List-IIentailingtheareasonwhichonlythestatelegislaturecanmakelaws,andList-IIIlistingtheareasonwhichboththeParliamentandtheStateLegislaturecanmakelawsuponconcurrently.2.TaxesLeviedbyCentralGovernmentTaxesonincomeotherthanagriculturalincomeDutiesofcustomsincludingexportdutiesDutiesofexciseontobaccoandothergoodsmanufacturedorproducedinIndiaexcept(i)alcoholicliquorforhumanconsumption,and(ii)opium,Indianhempandothernarcoticdrugsandnarcotics,butincludingmedicinalandtoiletpreparationscontainingalcoholoranysubstanceincludedin(ii).CorporationTaxTaxesoncapital...