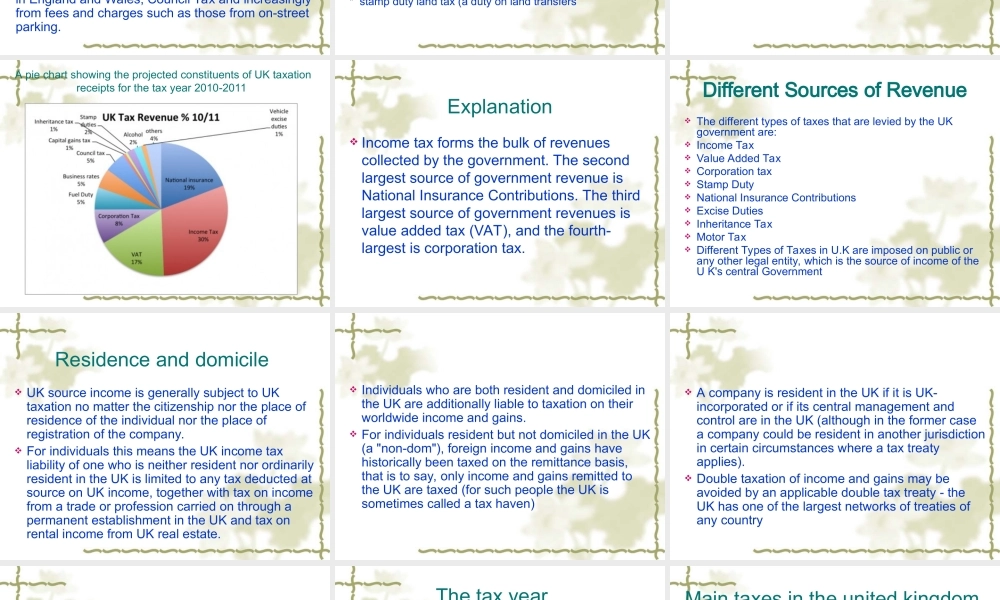

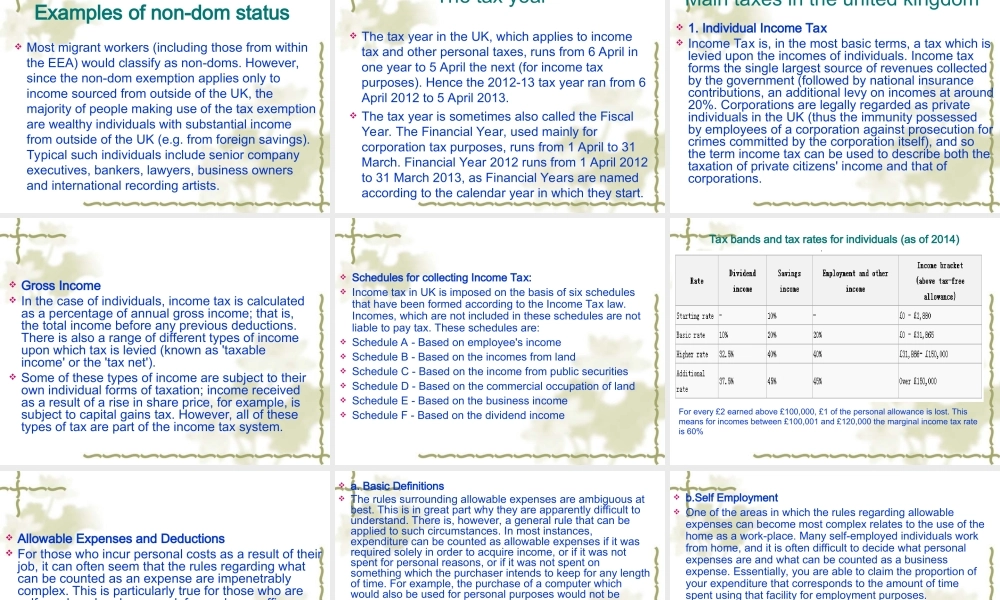

ChapterVTaxationintheUnitedKingdomWordsandphrases1.Domicile2.Residence3.HMRevenueandCustoms4.doubletaxtreaty5.fiscalyear6.taxyear7.personalallowanceAfiscalyear(orfinancialyear,orsometimesbudgetyear)isaperiodusedforcalculatingannual("yearly")financialstatementsinbusinessesandotherorganizations.Inmanyjurisdictions,regulatorylawsregardingaccountingandtaxationrequiresuchreportsoncepertwelvemonths,butdonotrequirethattheperiodreportedonconstitutesacalendaryear(i.e.,JanuarythroughDecember).Fiscalyearsvarybetweenbusinessesandcountries.Fiscalyearmayalsorefertotheyearusedforincometaxreporting.A“taxyear”isanannualaccountingperiodforkeepingrecordsandreportingincomeandexpenses.Anannualaccountingperioddoesnotincludeashorttaxyear.Thetaxyearsyoucanuseare:Calendaryear-Acalendartaxyearis12consecutivemonthsbeginningJanuary1andendingDecember31.Fiscalyear-Afiscaltaxyearis12consecutivemonthsendingonthelastdayofanymonthexceptDecember.A52-53-weektaxyearisafiscaltaxyearthatvariesfrom52to53weeksbutdoesnothavetoendonthelastdayofamonth.OverviewTaxationintheUnitedKingdommayinvolvepaymentstoaminimumoftwodifferentlevelsofgovernment:Thecentralgovernment(HMRevenueandCustoms)andlocalgovernment.Centralgovernmentrevenuescomeprimarilyfromincometax,NationalInsurancecontributions,valueaddedtax,corporationtaxandfuelduty.Localgovernmentrevenuescomeprimarilyfromgrantsfromcentralgovernmentfunds,businessratesinEnglandandWales,CouncilTaxandincreasinglyfromfeesandchargessuchasthosefromon-streetparking.TaxsystemThemaintaxesintheUKare:*incometax*corporationtax*capitalgainstax*NIC(NationalInsurancecontributions,apayrolllevy)*inheritancetax(ongiftsanddeathtransfers)*VAT(ValueAddedTax-themainindirecttax)*stampduty(adutyoncertaintransfersofassets,primarilyshares)*stampdutylandtax(adutyonlandtransfersThereareothertaxeswhicharelessimportantorspecifictocertainindustriessuchasIPT(insurancepremiumtax)andPRT(petroleumrevenuetax)anddutiesonsuchitemsastobacco,alcoholandpetrol.Apiechartsho...