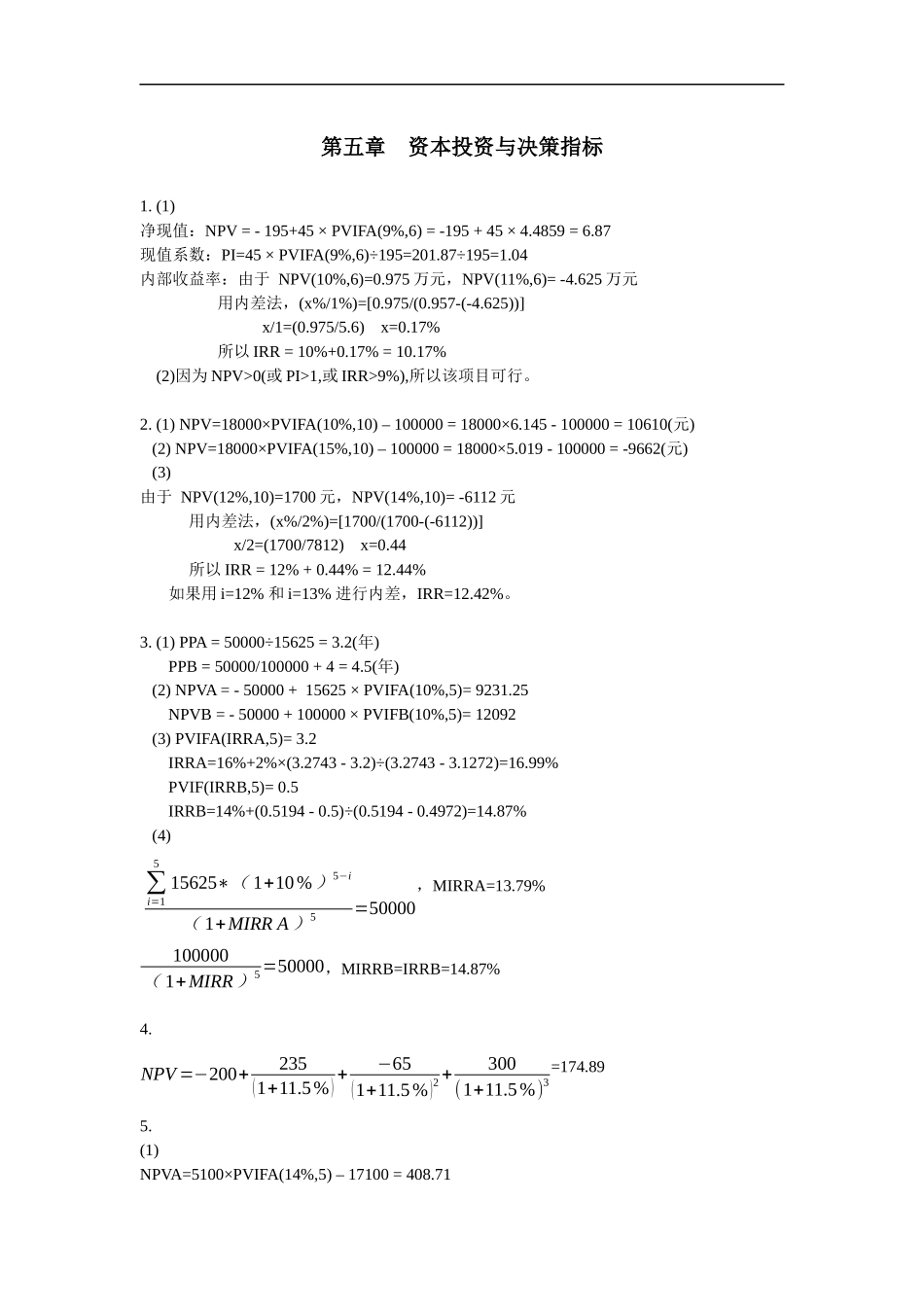

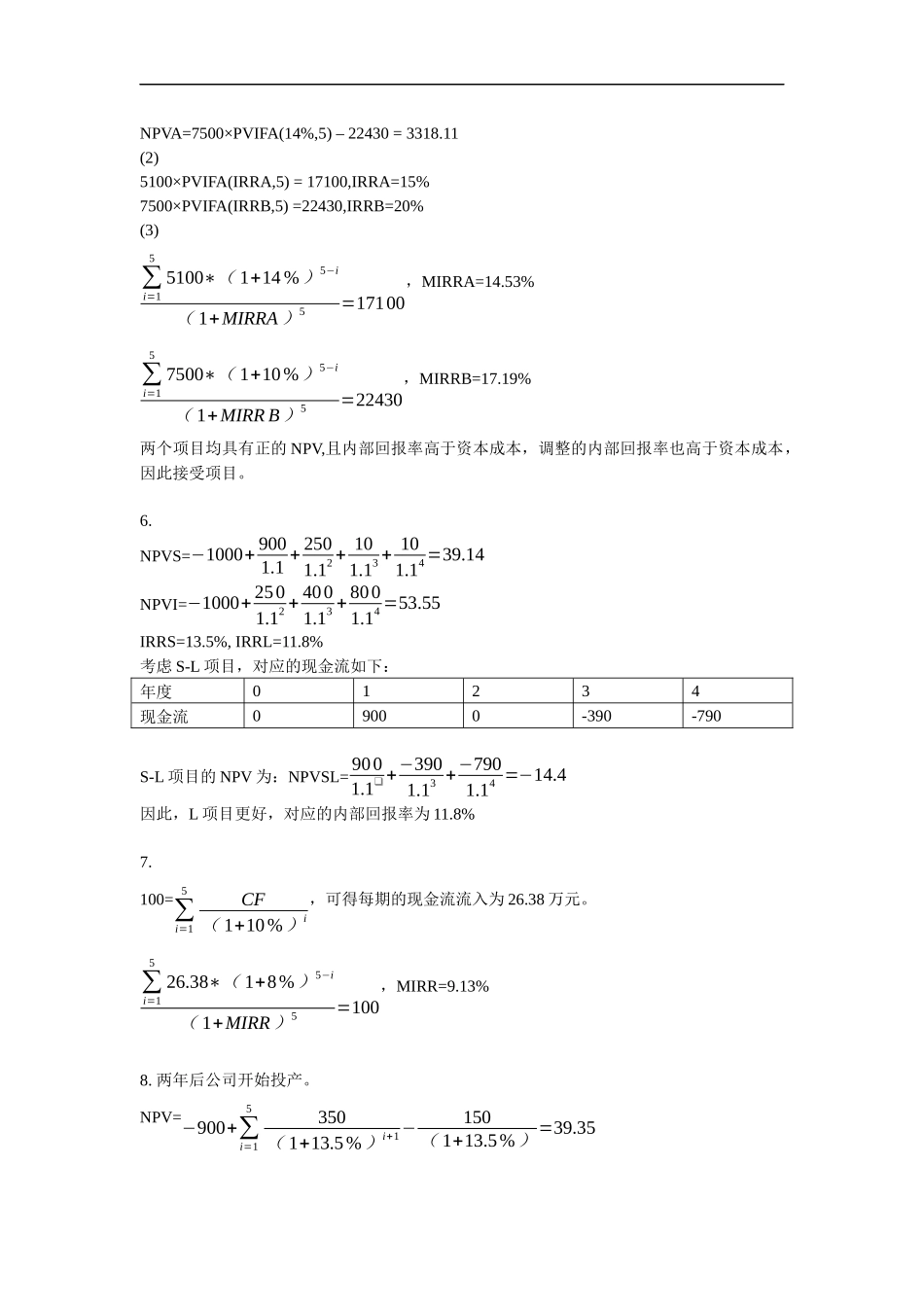

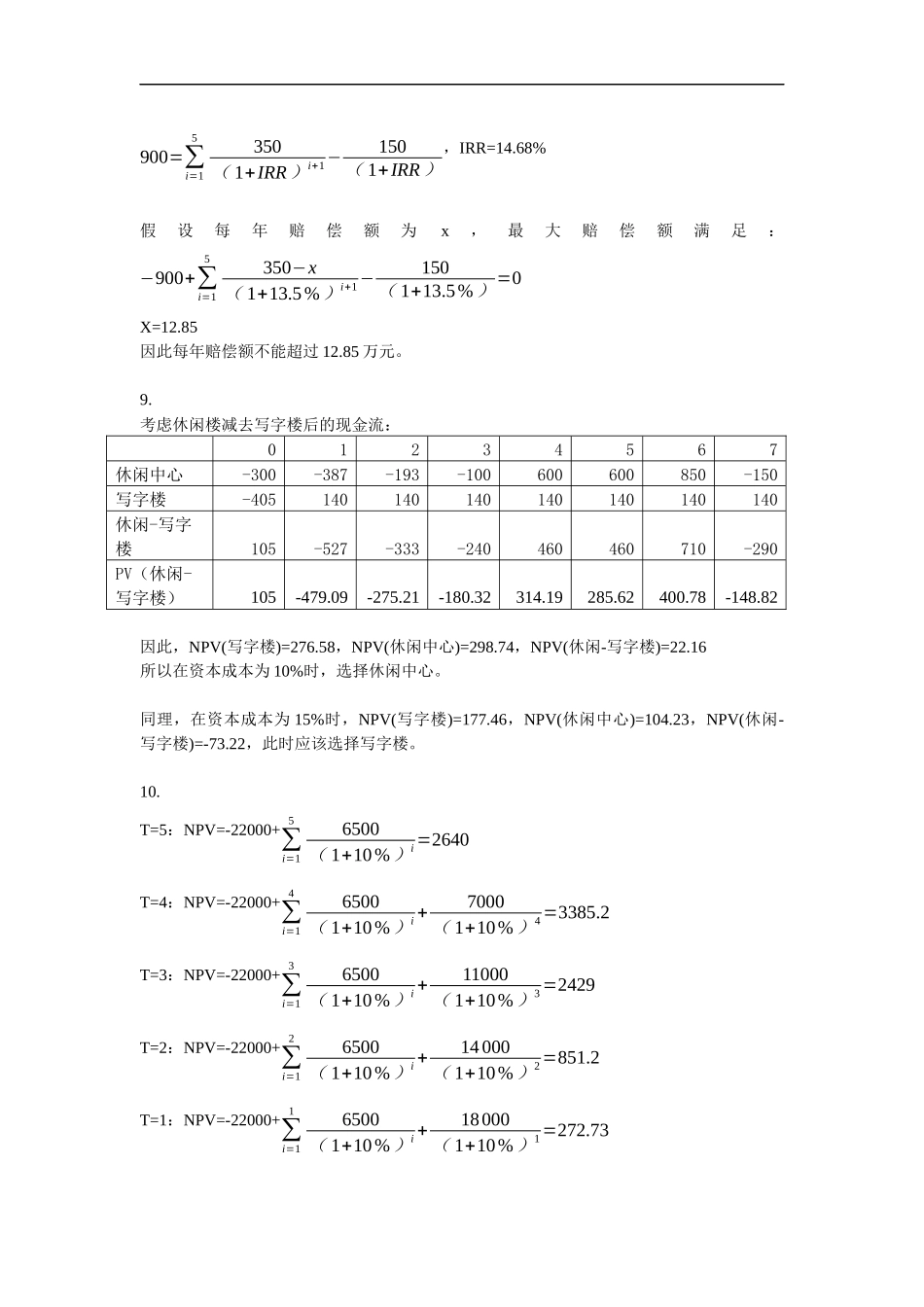

第五章资本投资与决策指标1.(1)净现值:NPV=-195+45×PVIFA(9%,6)=-195+45×4.4859=6.87现值系数:PI=45×PVIFA(9%,6)÷195=201.87÷195=1.04内部收益率:由于NPV(10%,6)=0.975万元,NPV(11%,6)=-4.625万元用内差法,(x%/1%)=[0.975/(0.957-(-4.625))]x/1=(0.975/5.6)x=0.17%所以IRR=10%+0.17%=10.17%(2)因为NPV>0(或PI>1,或IRR>9%),所以该项目可行。2.(1)NPV=18000×PVIFA(10%,10)–100000=18000×6.145-100000=10610(元)(2)NPV=18000×PVIFA(15%,10)–100000=18000×5.019-100000=-9662(元)(3)由于NPV(12%,10)=1700元,NPV(14%,10)=-6112元用内差法,(x%/2%)=[1700/(1700-(-6112))]x/2=(1700/7812)x=0.44所以IRR=12%+0.44%=12.44%如果用i=12%和i=13%进行内差,IRR=12.42%。3.(1)PPA=50000÷15625=3.2(年)PPB=50000/100000+4=4.5(年)(2)NPVA=-50000+15625×PVIFA(10%,5)=9231.25NPVB=-50000+100000×PVIFB(10%,5)=12092(3)PVIFA(IRRA,5)=3.2IRRA=16%+2%×(3.2743-3.2)÷(3.2743-3.1272)=16.99%PVIF(IRRB,5)=0.5IRRB=14%+(0.5194-0.5)÷(0.5194-0.4972)=14.87%(4)∑i=1515625∗(1+10%)5−i(1+MIRRA)5=50000,MIRRA=13.79%100000(1+MIRR)5=50000,MIRRB=IRRB=14.87%4.NPV=−200+235(1+11.5%)+−65(1+11.5%)2+300(1+11.5%)3=174.895.(1)NPVA=5100×PVIFA(14%,5)–17100=408.71NPVA=7500×PVIFA(14%,5)–22430=3318.11(2)5100×PVIFA(IRRA,5)=17100,IRRA=15%7500×PVIFA(IRRB,5)=22430,IRRB=20%(3)∑i=155100∗(1+14%)5−i(1+MIRRA)5=17100,MIRRA=14.53%∑i=157500∗(1+10%)5−i(1+MIRRB)5=22430,MIRRB=17.19%两个项目均具有正的NPV,且内部回报率高于资本成本,调整的内部回报率也高于资本成本,因此接受项目。6.NPVS=−1000+9001.1+2501.12+101.13+101.14=39.14NPVI=−1000+2501.12+4001.13+8001.14=53.55IRRS=13.5%,IRRL=11.8%考虑S-L项目,对应的现金流如下:年度01234现金流09000-390-790S-L项目的NPV为:NPVSL=9001.1❑+−3901.13+−7901.14=−14.4因此,L项目更好,对应的内部回报率为11.8%7.100=∑i=15CF(1+10%)i,可得每期的现金流流入为26.38万元。∑i=1526.38∗(1+8%)5−i(1+MIRR)5=100,MIRR=9.13%8.两年后公司开始投产。NPV=−900+∑i=15350(1+13.5%)i+1−150(1+13.5%)=39.35900=∑i=15350(1+IRR)i+1−150(1+IRR),IRR=14.68%假设每年赔偿额为x,最大赔偿额满足:−900+∑i=15350−x(1+13.5%)i+1−150(1...