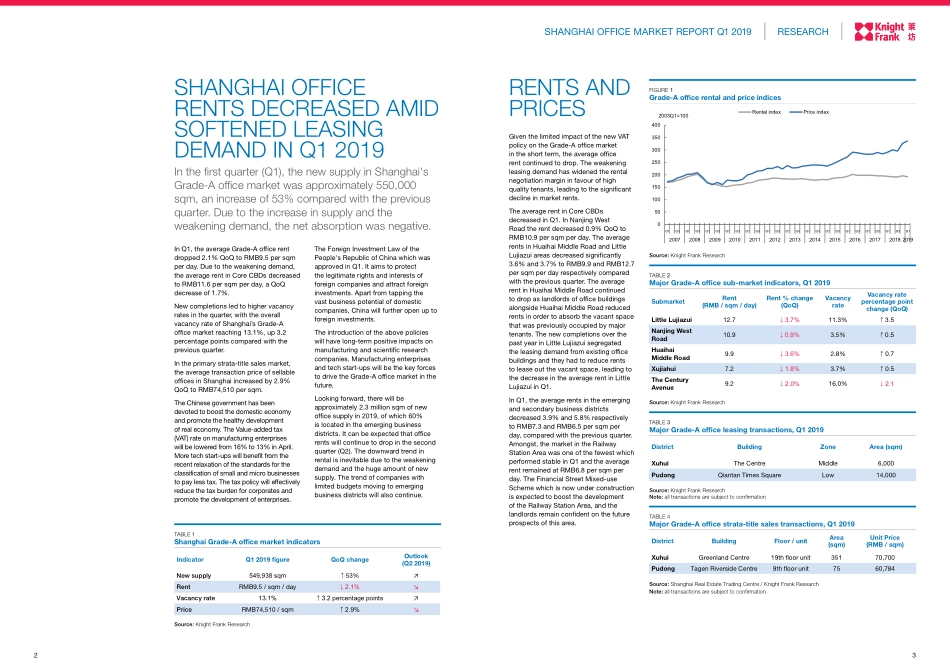

SHANGHAIOFFICEmArkEtrEpOrtQ12019上海写字楼市场报告2019年第一季度RESEARCH研究报告32RESEARCHSHAngHAiOFFiCEMARKETREPORTQ12019tAblE2MajorGrade-Aofficesub-marketindicators,Q12019SubmarketRent(RMB/sqm/day)Rent%change(QoQ)VacancyrateVacancyratepercentagepointchange(QoQ)LittleLujiazui12.7↓3.7%11.3%↑3.5NanjingWestRoad10.9↓0.9%3.5%↑0.5HuaihaiMiddleRoad9.9↓3.6%2.8%↑0.7Xujiahui7.2↓1.8%3.7%↑0.5TheCenturyAvenue9.2↓2.0%16.0%↓2.1Source:knightFrankresearchFIGUrE1Grade-AofficerentalandpriceindicesGiventhelimitedimpactofthenewVATpolicyontheGrade-Aofficemarketintheshortterm,theaverageofficerentcontinuedtodrop.Theweakeningleasingdemandhaswidenedtherentalnegotiationmargininfavourofhighqualitytenants,leadingtothesignificantdeclineinmarketrents.TheaveragerentinCoreCBDsdecreasedinQ1.InNanjingWestRoadtherentdecreased0.9%QoQtoRMB10.9persqmperday.TheaveragerentsinHuaihaiMiddleRoadandLittleLujiazuiareasdecreasedsignificantly3.6%and3.7%toRMB9.9andRMB12.7persqmperdayrespectivelycomparedwiththepreviousquarter.TheaveragerentinHuaihaiMiddleRoadcontinuedtodropaslandlordsofofficebuildingsalongsideHuaihaiMiddleRoadreducedrentsinordertoabsorbthevacantspacethatwaspreviouslyoccupiedbymajortenants.ThenewcompletionsoverthepastyearinLittleLujiazuisegregatedtheleasingdemandfromexistingofficebuildingsandtheyhadtoreducerentstoleaseoutthevacantspace,leadingtothedecreaseintheaveragerentinLittleLujiazuiinQ1.InQ1,theaveragerentsintheemergingandsecondarybusinessdistrictsdecreased3.9%and5.8%respectivelytoRMB7.3andRMB6.5persqmperday,comparedwiththepreviousquarter.Amongst,themarketintheRailwayStationAreawasoneofthefewestwhichperformedstableinQ1andtheaveragerentremainedatRMB6.8persqmperday.TheFinancialStreetMixed-useSchemewhichisnowunderconstructionisexpectedtoboostthedevelopmentoftheRailwayStationArea,andthelandlordsremainconfidentonthefutureprospectsofthisarea.rENtSANDprICESSource:knightFrankresearchSHANGHAIOFFICErENtSDECrEASEDAmIDSOFtENEDlEASINGDEmANDINQ12019Inthefirstquarter(Q1),thenewsupplyinShanghai's...