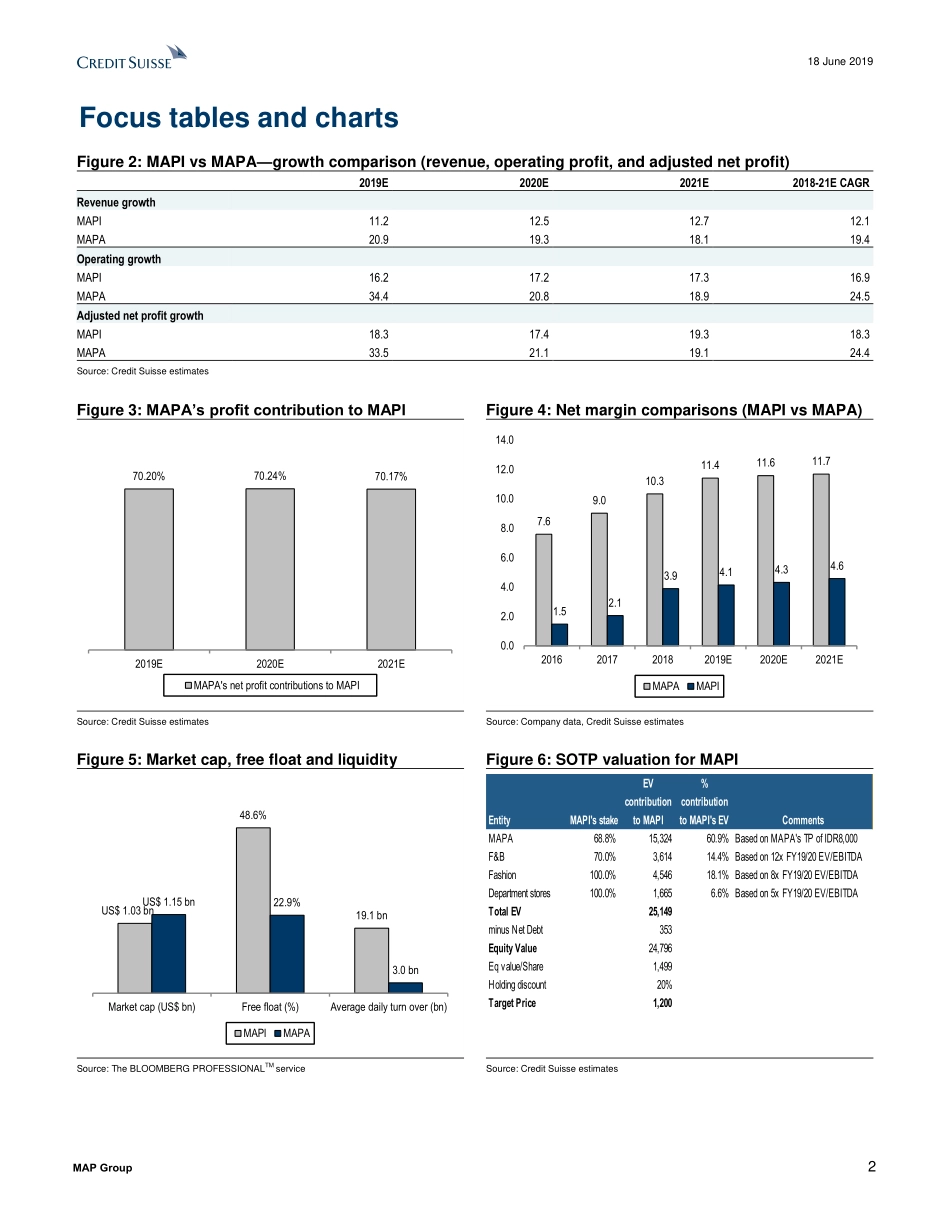

DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.18June2019AsiaPacific/IndonesiaEquityResearchRetailingMAPGroupResearchAnalystsDeidyWijaya,CFA622125537902deidy.wijaya@credit-suisse.comMegaBong622125537977mega.bong@credit-suisse.comINITIATIONHowtodecidebetweenMAPIandMAPA?Figure1:CSproprietaryscoringforMAPI’smajordivisionsSource:CreditSuisseestimates■AssumingcoverageonMAPIandinitiatingcoverageonMAPA.FollowingtheplacementofMAPA’sshares(~22.8%)tothepublicinApril2019,investorsnowhavetheoptiontochoosebetweenMAPI/MAPA.Wedeep-divedintoMAPI’smajordivisionstobetterunderstandthestrengthsandweaknessesofeach.WeconcludethatActive(MAPA)andF&B(MAPB)areMAPI’sbestdivisions.MAPAcurrentlyfacesbenigncompetitionandisthemostprofitabledivision.F&Bhasthehighestgrowthpotentialandthelowestworkingcapitalrequirement,butiscurrentlyfacedwithnewcompetition.Fashionhaslong-termpotentialinsmallercitiesandIndochina(Vietnam,Laos,Cambodia),butislessprofitablethanActive,givenalowergrossmarginandhighercapexrequirement.DepartmentStoreisoveralltheweakestdivisioninthegroup.■HowdowevalueMAPIandMAPA?WevalueMAPAbasedonDCFandderiveaTPofRp8,000(WACC:12.4%andterminalgrowth:6%).WevalueMAPIbasedonSOTP—itsActivedivisionisvaluedbasedonourTPforMAPA;Fashionisvaluedat8xEV/EBITDA;F&Bisvaluedat12xEV/EBITDA;andDepartmentStoreisvaluedat5xEV/EBITDA.WetreatMAPI’sotherbusinessesaspartoftheholdingdiscount.Weuseaholdingdiscountof20%whichislowerthanINDF’sholdingdiscount(30%),aswebelieveMAPI’sF&Bbusiness(currentlynotdirectlyinvestible)isamoreattractivebusinessthanINDF’sBogasaribusiness(unlisted).■Stockcalls:WeratebothMAPI(TPRp1,200;~36%impliedupsid...