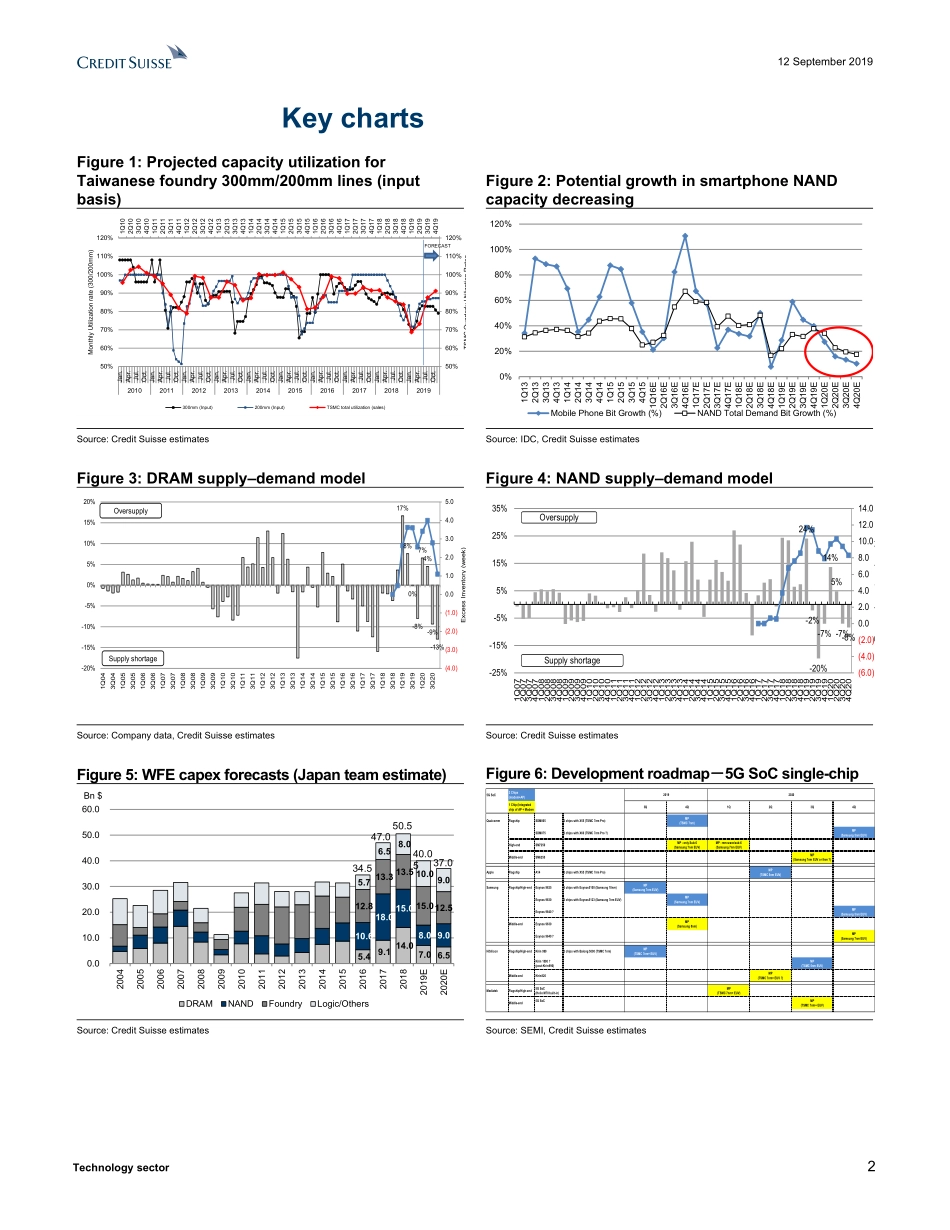

DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.12September2019AsiaPacific/JapanEquityResearchTechnologyTechnologysectorCOMMENTResearchAnalystsHideyukiMaekawa81345509723hideyuki.maekawa@credit-suisse.comAkinoriKanemoto81345507363akinori.kanemoto@credit-suisse.comMikaNishimura81345507369mika.nishimura@credit-suisse.comYoshiyasuTakemura81345507358yoshiyasu.takemura@credit-suisse.comSayakaShimonishi81345507364sayaka.shimonishi@credit-suisse.comDaisukeTanimoto81345507371daisuke.tanimoto@credit-suisse.comAsiaFeedback(Semiconductor/SPE):Nextfanfareover5Gchipproduction;underlyingmemorydemandweak■Event:FromlateAugustthroughearlySeptemberwecarriedoutanAsiamarketsurvey.Wefoundnothingthatwouldchangeourcautiousviewofthefundamentalsasidefromupbeat5Gchipproductionplansfor2020.Themajorityopinionamongsurveyrespondentswasthat4Q2019and1Q2020couldseeapullbackfollowing3Qsupplychaintrendsthatexceededunderlyingdemand,suchasfront-loadingaheadoftariffhikesduetotheUS–ChinatradedisputeandrestockingduetoJapan'srestrictionsonexportstoKorea.Inasharpdivergencefromstockmarketexpectations,virtuallynoindustryrespondentsexpectedarecoveryfromthecycletrough,particularlyinmemory.■Thenewpositivesconfirmedbyoursurveyare(1)planstoproduce500mn5Gsmartphonechipsin2020,(2)Applehavingapplicationprocessor(AP)fornew2020iPhonemodelsentirelyproducedusing5nmprocesses,(3)planstolaunchasmartphonewithafive-lenscamerain2020,(4)theoutlookforgreateradoptioninChinesedatacentersofARMserverCPUsmanufacturedbyHiSilicon,(5)theadoptionofLP-DDR5bytheGalaxyS11inspring2020,withonemodeltocomewith16GB,and(6)tightsupply–demandconditionsforASICsforcryptocurr...