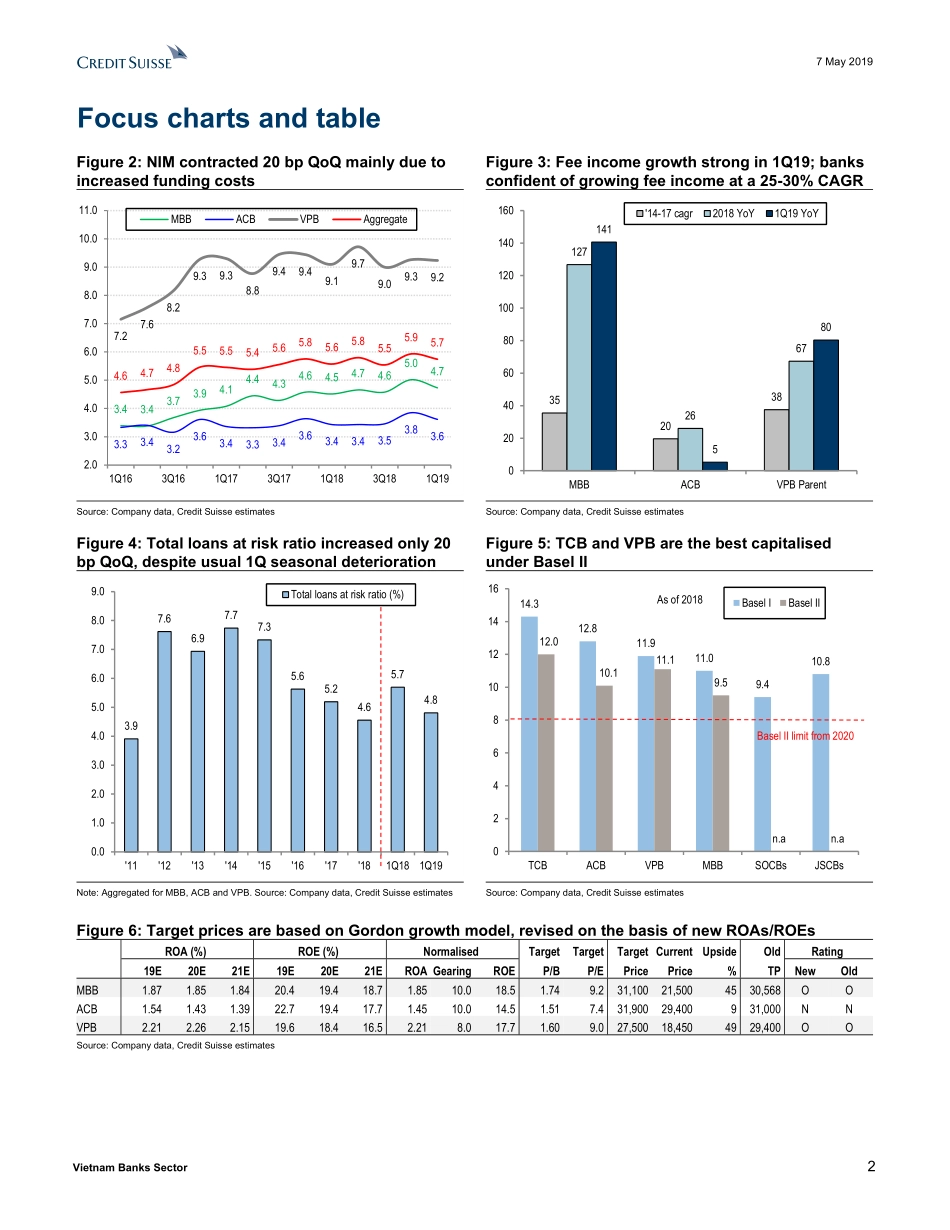

DISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.7May2019AsiaPacific/VietnamEquityResearchBanksVietnamBanksSectorSECTORREVIEWResearchAnalystsRikinShah6562123098rikin.shah@credit-suisse.comFarhanRizvi,CFA6562123036farhan.rizvi@credit-suisse.comCapitalraisingtodrivere-rating?Figure1:MBBshoulddeliverthestrongestPBTgrowthin2019E19822116140510152025MBBACBVPBCSeConsensusCompanyguidance2019EPBTgrowth(%)Source:Companydata,CreditSuisseestimates■Thegoodandthebad.MBBdeliveredthebestsetof1Q19results,whiletheywereweakatVPBandinlineatACB.Intermsofoveralltrendsobserved,keypositivesare:(1)strongloangrowth;(2)continuedassetyieldexpansion;(3)strongfeeincome;and(4)stableassetquality.Keynegatives:(1)margincontractionduetohigherfundingcostQoQ;(2)adeclineinCASAdepositsQoQ;and(3)weakbaddebtrecoveries.■Capitalraisingtobethefocusin2019.Loansgrewstrongly(4.6%QoQ)in1Q19,butwouldbecappedbythecreditquotaof~13%for2019(likelytobeincreasedin2H19).Aftermarginexpansionof200bpinthepastfiveyears,weexpectNIMstostabiliseasincreaseinfundingcostsoffsetmix-shift-ledassetyieldgains.Thecostoffundswentup30bpQoQduetoafallinCASAdepositsandincreaseindepositrates(up10-30bp),asbankslockinlongertenurefundstomeetregulatoryrequirements.Feeincomegrowthremainsrobust(+59%YoY)andassetqualitywasresilientdespiteseasonalityin1Q.WithBaselIIimplementationonthehorizon(fromJan-20),bothMBBandVPBarelookingtomake10%privateplacementsin2H19andtoopentheremainingforeignroomavailable(10%and~7%,respectively).Thisshouldbeakeycatalystforthestockprice,inourview.■MBBremainsourtoppick.Following1Q19results,wereviseour2019-21EearningsforMBB(up2-3%),VPB(down2-8%)andACB(...