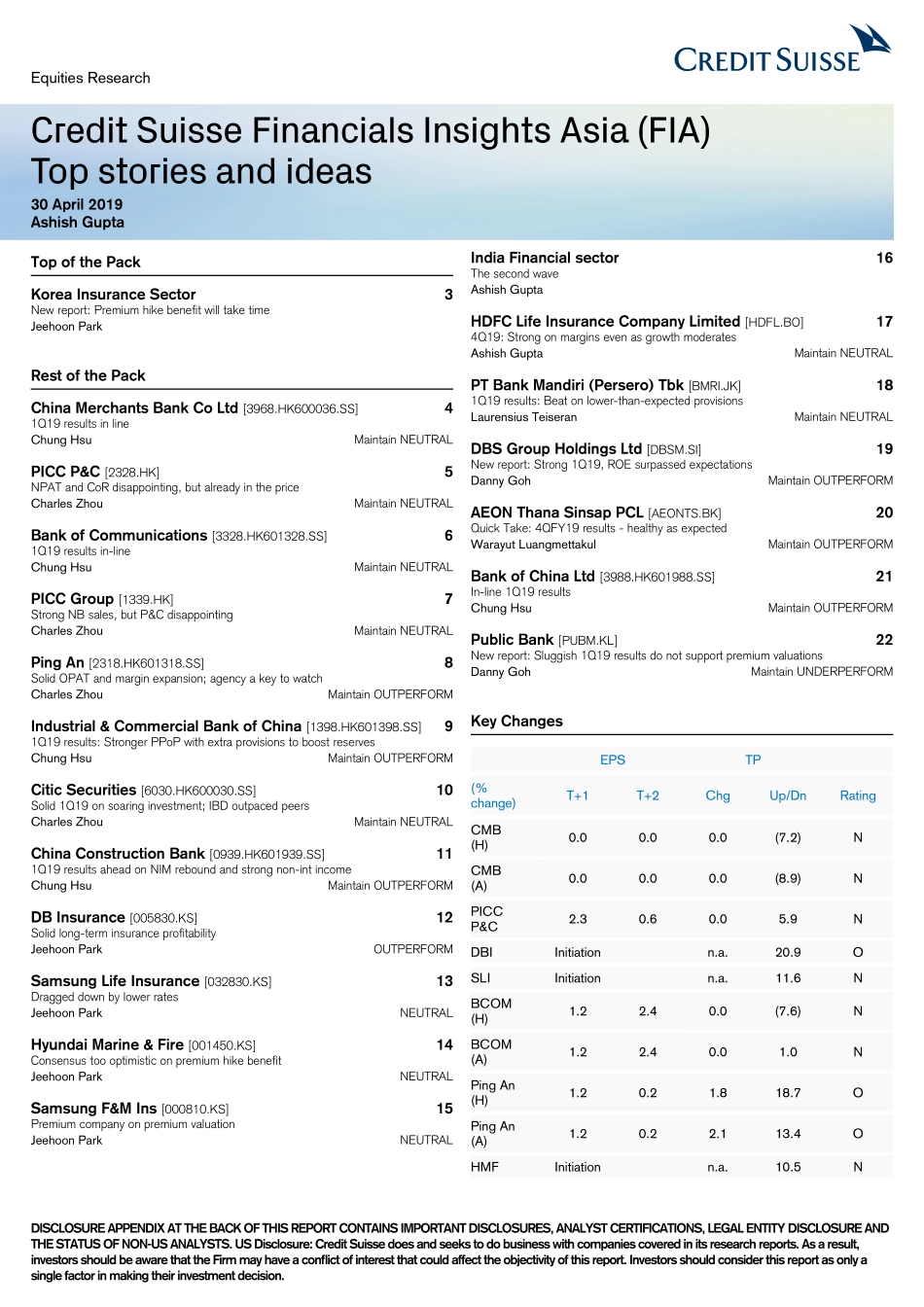

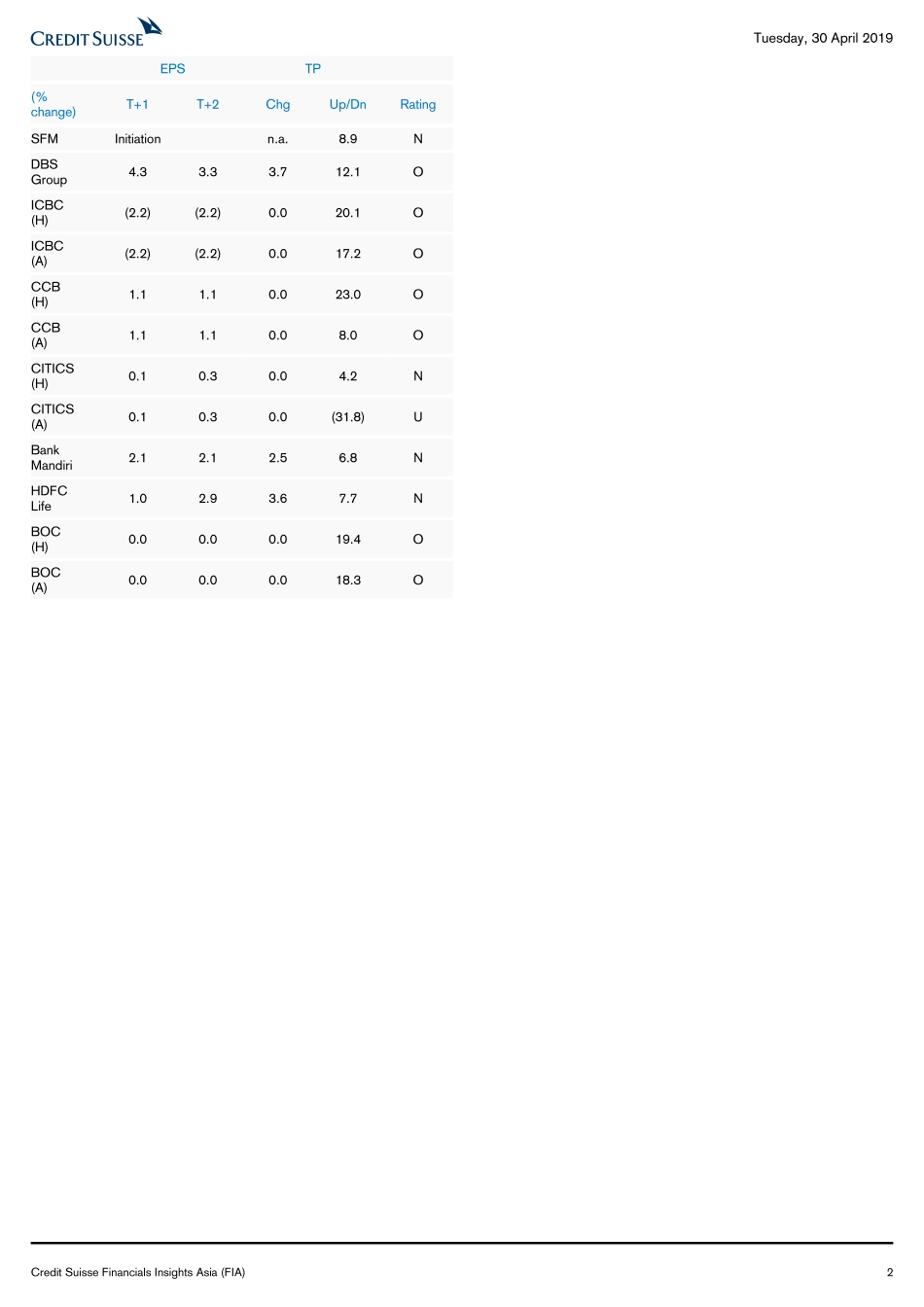

CreditSuisseFinancialsInsightsAsia(FIA)Topstoriesandideas30April2019AshishGuptaTopofthePack3KoreaInsuranceSectorNewreport:PremiumhikebenefitwilltaketimeJeehoonParkRestofthePack4ChinaMerchantsBankCoLtd[3968.HK600036.SS]1Q19resultsinlineMaintainNEUTRALChungHsu5PICCP&C[2328.HK]NPATandCoRdisappointing,butalreadyinthepriceMaintainNEUTRALCharlesZhou6BankofCommunications[3328.HK601328.SS]1Q19resultsin-lineMaintainNEUTRALChungHsu7PICCGroup[1339.HK]StrongNBsales,butP&CdisappointingMaintainNEUTRALCharlesZhou8PingAn[2318.HK601318.SS]SolidOPATandmarginexpansion;agencyakeytowatchMaintainOUTPERFORMCharlesZhou9Industrial&CommercialBankofChina[1398.HK601398.SS]1Q19results:StrongerPPoPwithextraprovisionstoboostreservesMaintainOUTPERFORMChungHsu10CiticSecurities[6030.HK600030.SS]Solid1Q19onsoaringinvestment;IBDoutpacedpeersMaintainNEUTRALCharlesZhou11ChinaConstructionBank[0939.HK601939.SS]1Q19resultsaheadonNIMreboundandstrongnon-intincomeMaintainOUTPERFORMChungHsu12DBInsurance[005830.KS]Solidlong-terminsuranceprofitabilityOUTPERFORMJeehoonPark13SamsungLifeInsurance[032830.KS]DraggeddownbylowerratesNEUTRALJeehoonPark14HyundaiMarine&Fire[001450.KS]ConsensustoooptimisticonpremiumhikebenefitNEUTRALJeehoonPark15SamsungF&MIns[000810.KS]PremiumcompanyonpremiumvaluationNEUTRALJeehoonPark16IndiaFinancialsectorThesecondwaveAshishGupta17HDFCLifeInsuranceCompanyLimited[HDFL.BO]4Q19:StrongonmarginsevenasgrowthmoderatesMaintainNEUTRALAshishGupta18PTBankMandiri(Persero)Tbk[BMRI.JK]1Q19results:Beatonlower-than-expectedprovisionsMaintainNEUTRALLaurensiusTeiseran19DBSGroupHoldingsLtd[DBSM.SI]Newreport:Strong1Q19,ROEsurpassedexpectationsMaintainOUTPERFORMDannyGoh20AEONThanaSinsapPCL[AEONTS.BK]QuickTake:4QFY19results-healthyasexpectedMaintainOUTPERFORMWarayutLuangmettakul21BankofChinaLtd[3988.HK601988.SS]In-line1Q19resultsMaintainOUTPERFORMChungHsu22PublicBank[PUBM.KL]Newreport:Sluggish1Q19resultsdonotsupportpremiumvaluationsMaintainUNDERPERFORMDannyGohKeyChangesEPSTP(%change)T+1T+2ChgUp/DnRatingCMB(...