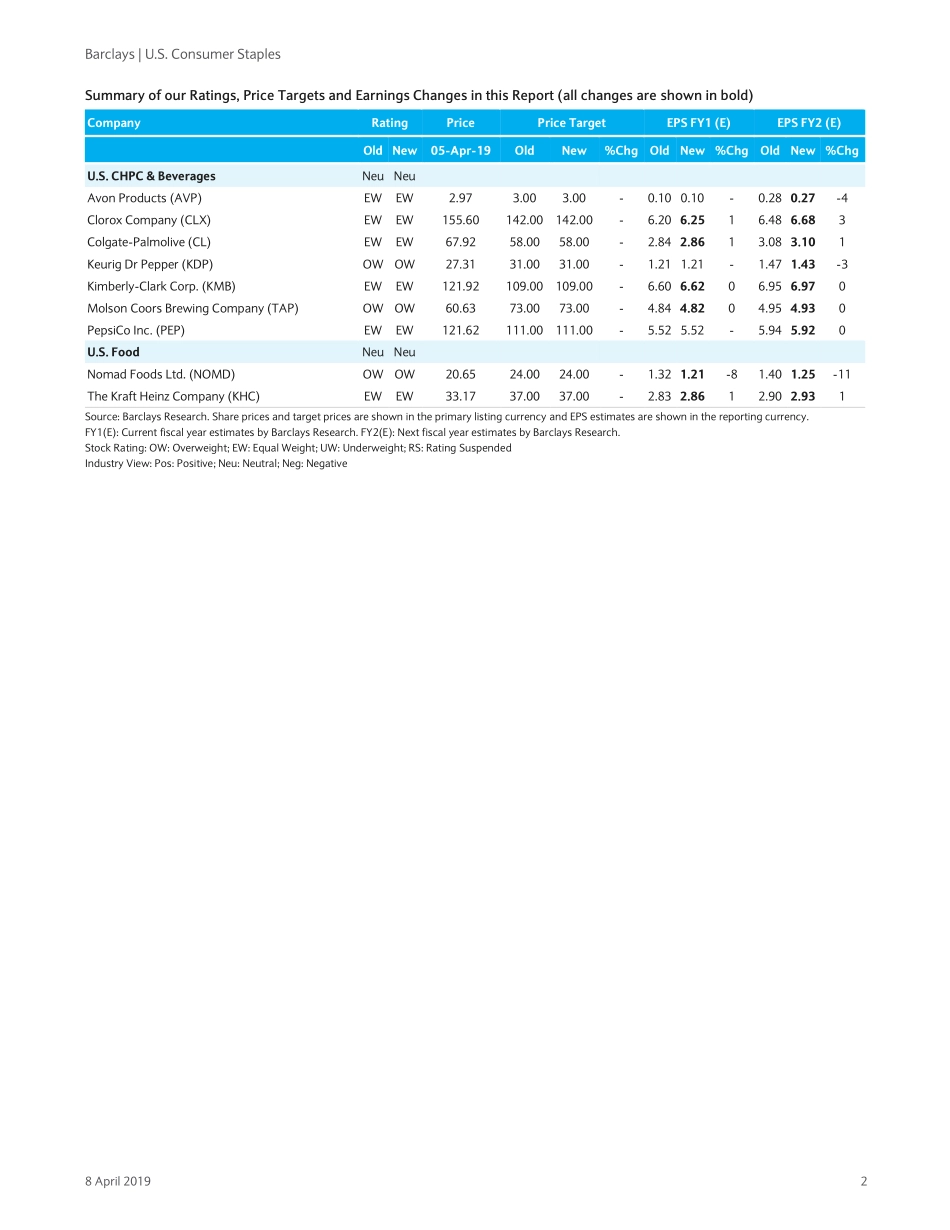

EquityResearch8April2019COREBarclaysCapitalInc.and/oroneofitsaffiliatesdoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.PLEASESEEANALYSTCERTIFICATION(S)ANDIMPORTANTDISCLOSURESBEGINNINGONPAGE58.Restricted-InternalU.S.ConsumerStaples1Q19“AllConsumer”EPSPreviewComingoutofCAGNY,wesensedaclear,continuedemphasisondrivingsustainable,balancedgrowthfrommostStaplescompanies-whichwebelievewaswellreceivedbyinvestors.Withthisinmindheadingintothe1Q19earningsseason,wethinkthere’sacertaindegreeofcautiousoptimismwithregardtomanynameswithinourcoverage.Asweparsethroughhowtheoutlookforthegroupisevolvingduringthenextfewweeksofreporting,we’llbeparticularlyfocusedonthefollowingthreekeytopicsthatweseeasbeingmostrelevant:Withreinvestmentinitiativesunderwayatmany(ifnotmost)ofthecompaniesunderourcoverage,webelieveinvestorswilllookforincrementalvisibilityonbettertop-linegrowth.Giventhisbackdrop,ourprimaryconcernisthatimprovementmaybeunlikelytomanifestnotonlyin1Qbutpotentiallyinsubsequentquarters,aswe’reremindedthatcompaniesthathaveachievedmeaningfultop-lineimprovement(e.g.P&G,KO)tookyears(notquarters)formomentumtofullybuild.Wecancertainlyunderstandtherationaleforpositioninginsomeofthese“re-base”storiesgivenvisibility(andadegreeoffearofmissingout),althoughwethinkthepathtobetterresultsmaynotbelinear,andfranklymaytakeabitlongertoplayoutthansomeanticipate.GiventhatthemajorityofStaplesnameshaveguidedto(orbroadlydiscussed)anetpricingbenefitthisyear,we’llbefocusedonwhetherthisisreflectedinP&Ls,andifexpectationshavechangedaroundthelonger-termimpact(includingwithrespecttovolumeelasticity).Notably,asweaddressedinajointreportwithourU.S.Food&StaplesRetailinganalystKarenShortlastFriday(seeThePricingDebate:FactorF(r)iction?;04/05/19),whilethemajorityofCPGplayershavediscussedeffectivelytaki...