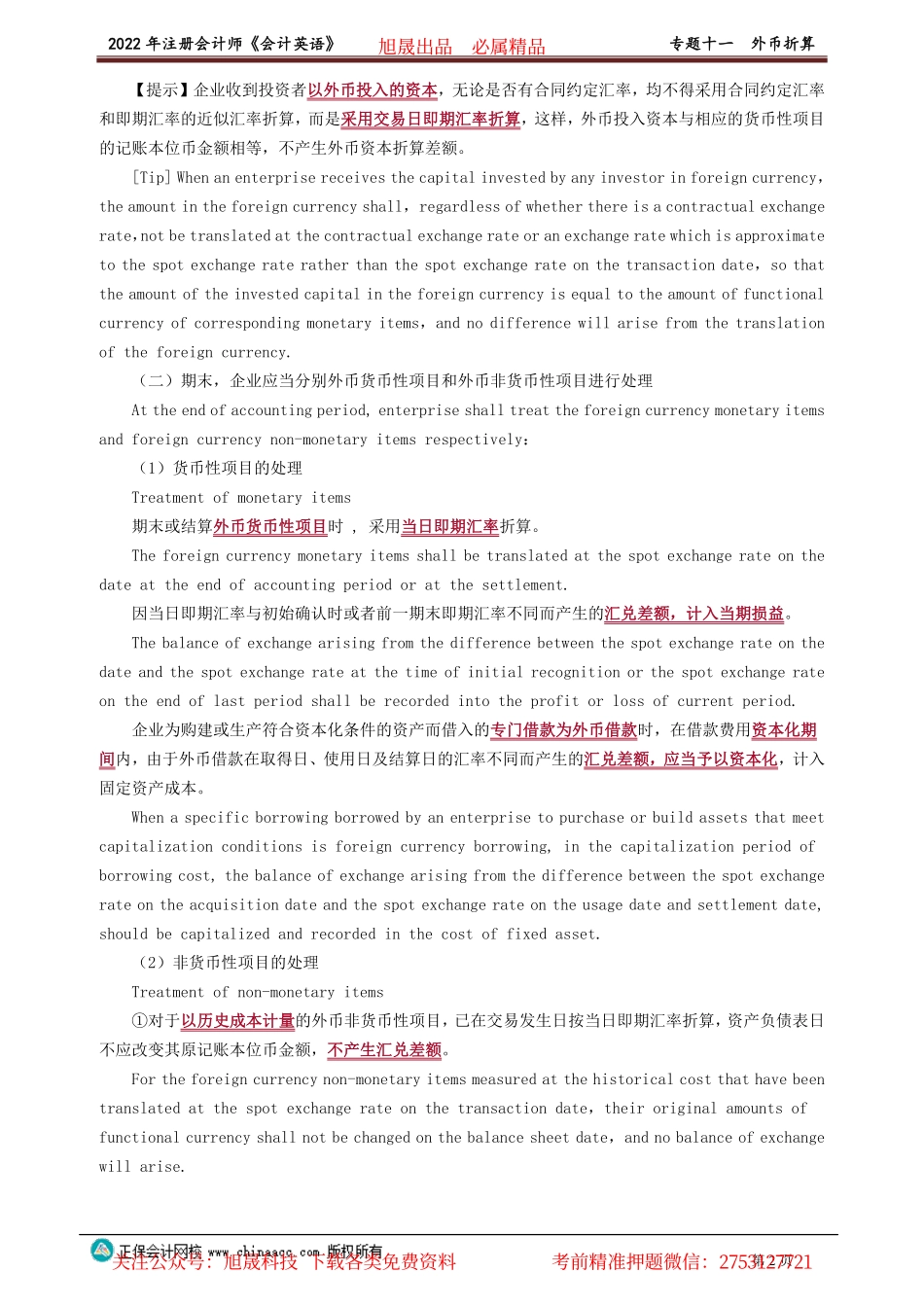

2022年注册会计师《会计英语》专题十一外币折算第1页目录01考情分析02词汇归纳总结03重点、难点讲解04同步系统训练考情分析本部分内容相对比较简单,但是也可能在主观题中进行考查,从近年专业阶段考试情况来看,曾在2010年主观题中考查外币报表折算差额的计算。本章在复习过程中应重点关注期末外币货币性项目汇兑差额的计算、外币报表折算汇率的选择以及外币报表折算差额的计算。词汇归纳总结外币交易Foreigncurrencytransaction即期汇率Spotexchangerate交易发生日Transactiondate记账本位币Functionalcurrency即期汇率的近似汇率Approximateexchangerateofspotexchangerate外币货币性项目Foreignmonetaryitem外币非货币性项目Foreignnon-monetaryitem历史成本Historicalcost未分配利润Undistributedprofits外币报表折算差额Exchangedifferenceinforeigncurrencyfinancialstatement境外经营Foreignoperations重点、难点讲解考点一:外币交易的会计处理AccountingTreatmentsforForeignCurrencyTransactions(一)初始确认Initialrecognition外币交易应当在初始确认时,采用交易发生日的即期汇率将外币金额折算为记账本位币金额;Atthetimeofinitialrecognitionofaforeigncurrencytransaction,theamountintheforeigncurrencyshallbetranslatedintotheamountinthefunctionalcurrencyatthespotexchangerateofthetransactiondate;也可以采用按照系统合理的方法确定的、与交易发生日即期汇率的近似汇率折算。oratanexchangeratewhichisdeterminedthroughasystematicandreasonablemethodandisapproximatetothespotexchangerateofthetransactiondate.旭晟出品必属精品关注公众号:旭晟科技下载各类免费资料考前精准押题微信:27531277212022年注册会计师《会计英语》专题十一外币折算第2页【提示】企业收到投资者以外币投入的资本,无论是否有合同约定汇率,均不得采用合同约定汇率和即期汇率的近似汇率折算,而是采用交易日即期汇率折算,这样,外币投入资本与相应的货币性项目的记账本位币金额相等,不产生外币资本折算差额。[Tip]Whenanenterprisereceivesthecapitalinvestedbyanyinvestorinforeigncurrency,theamountintheforeigncurrencyshall,regardlessofwhetherthereisacontractualexchangerate,notbetranslatedatthecontractualexchangerateoranexchangeratewhichisapproximatetothespotexchangerateratherthanthespotexchangerateonthetran...