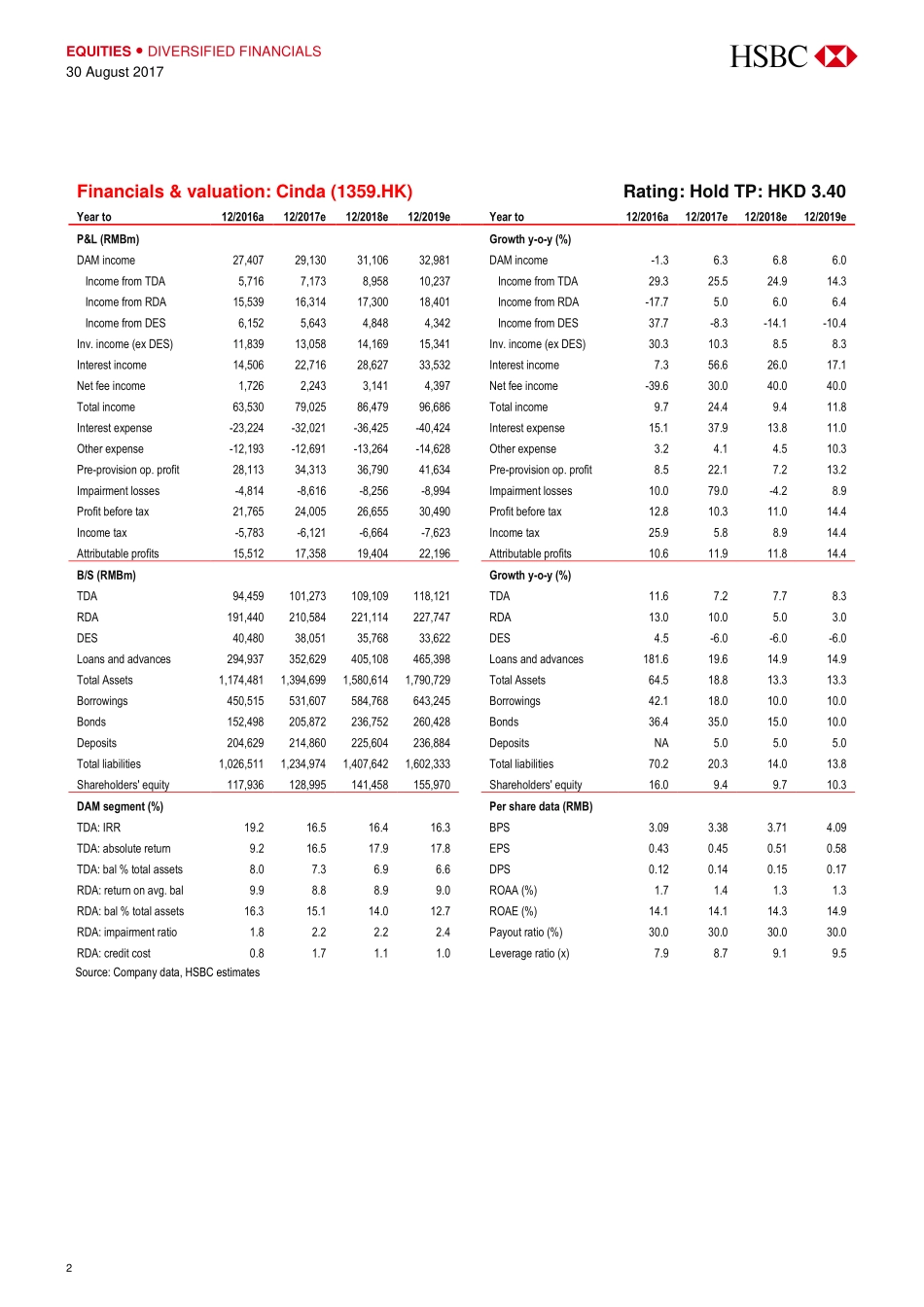

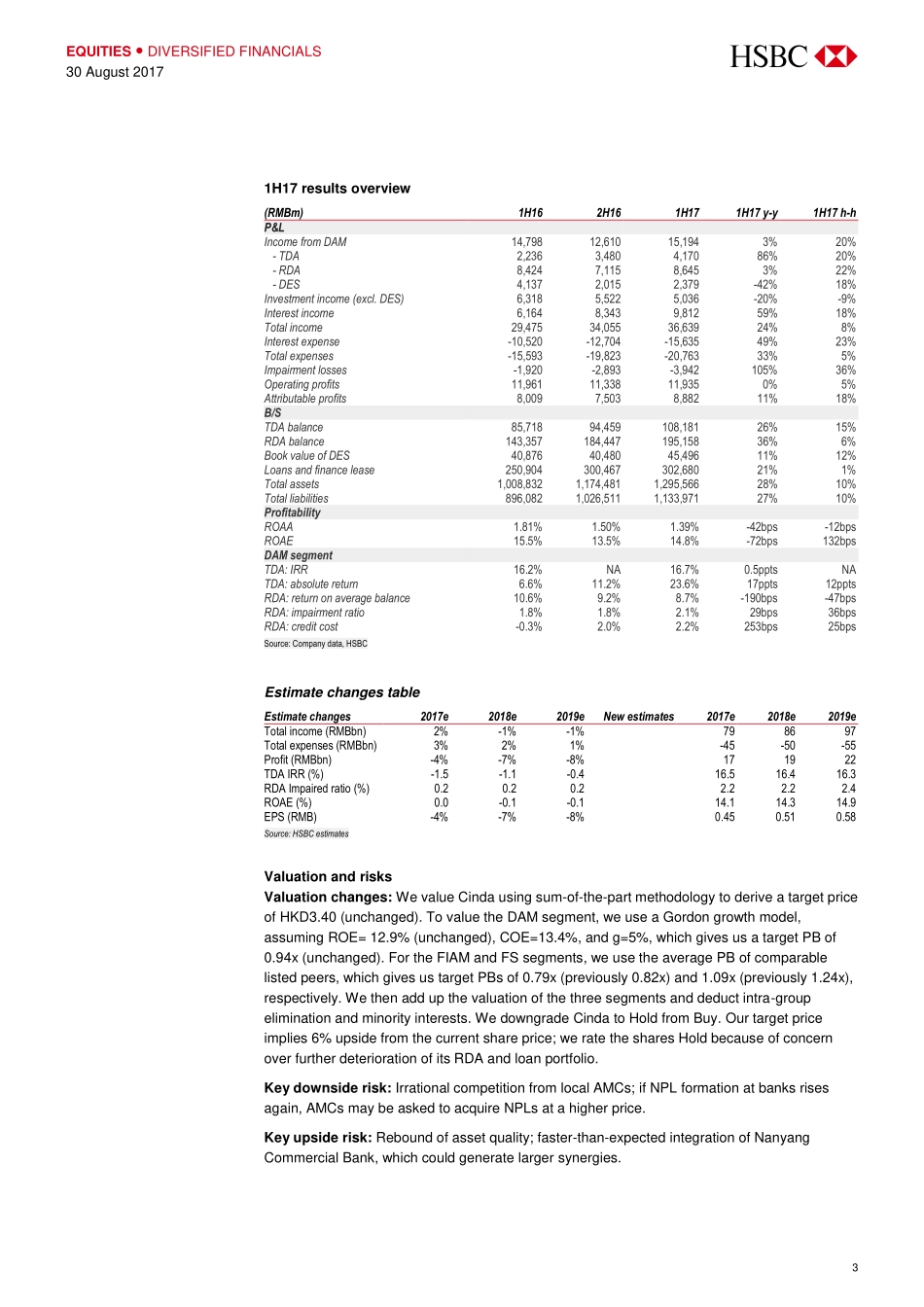

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:TheHongkongandShanghaiBankingCorporationLimitedViewHSBCGlobalResearchat:https://www.research.hsbc.comMiFIDII–ResearchIsyouraccessagreed?CONTACTustodayAssetqualitydeterioratedonbothrestructureddistressedassetsandloanportfoliodespitelowerriskappetiteImprovingprofitabilityatNanyangCommercialBank,withprogressiveintegrationandsynergygeneratedDowngradetoHoldwithunchangedtargetpriceofHKD3.40;lower2017-19eearningsestimatesby6%onaverage1H17profitgrowthwasup11%y-o-y,butbelowourfull-yearearningsgrowthestimates,mainlyduetolower-than-expectedinvestmentincomeandhigherimpairmentchargesondeteriorationofassetquality.Whatwedisliked:(i)RDAbalancegrewby7%h-o-hwhileimpairedRDAroseby28%;asaresult,impairedRDAratioincreasedby35bph-o-hto2.13%.Suchdeteriorationoccurreddespitecontinuousreductionofriskappetite,asindicatedbytheloweryieldoftheRDAportfolioto8.7%in1H17,from9.2%in2H16and10.6%in1H16.CreditcostforRDAwas2.25%,surgingfrom0.8%in2016.(ii)NPLratioofitsloanportfoliowas2.05%,accordingourcalculation,up48bph-o-h.Thedeteriorationwasdrivenbyeitherentrustedloansorleasingreceivablesbyourestimation,asassetqualityatNCBwaslargelystable(seebelow).Whatweliked:(i)NanyangCommercialBank(NCB)hadlargelystableperformancein1H17.1H17ROEwas7.8%,upfrom6.7%in1H16despiteflatROAof0.82%.NCB’sNPLratioroseby18bph-o-hto0.57%,mainlydrivenbyNCBChina,whoseNPLratiogrewby28bph-o-hto1.15%.Integrationhasbeensteadilypushedforward,withrevenuegrowthin1H1710ppthigherthanthe3-yearaveragepriortoacquisition.WeexpectNCB’sROEtograduallyrisethroughfurtherintegrationandclientreferralsfromCinda.(ii)IncomefromTDAincreasedby86%y-o-ytoRMB4.2bn.TheaverageholdingperiodofTDAdisposedroseto16monthsin1H17(vs.6monthsin2016),indicatingthatthecompanyfocusedmoreonmarginthanvolumeandinlinewithHuarong.Otherpointsofinterest:(i)TheIRRforTDAwas16.7%in1H17,upfrom16.2%in1...