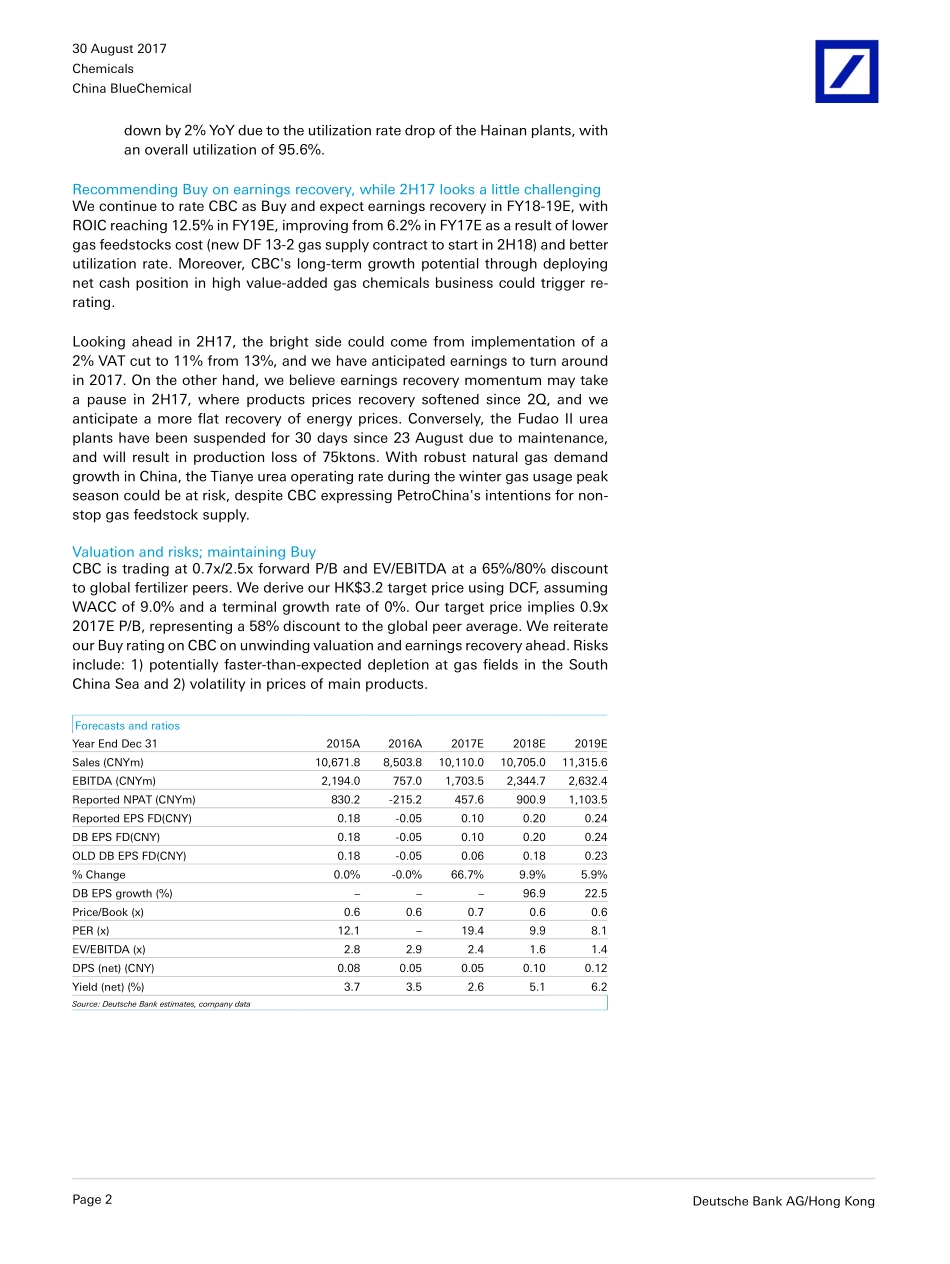

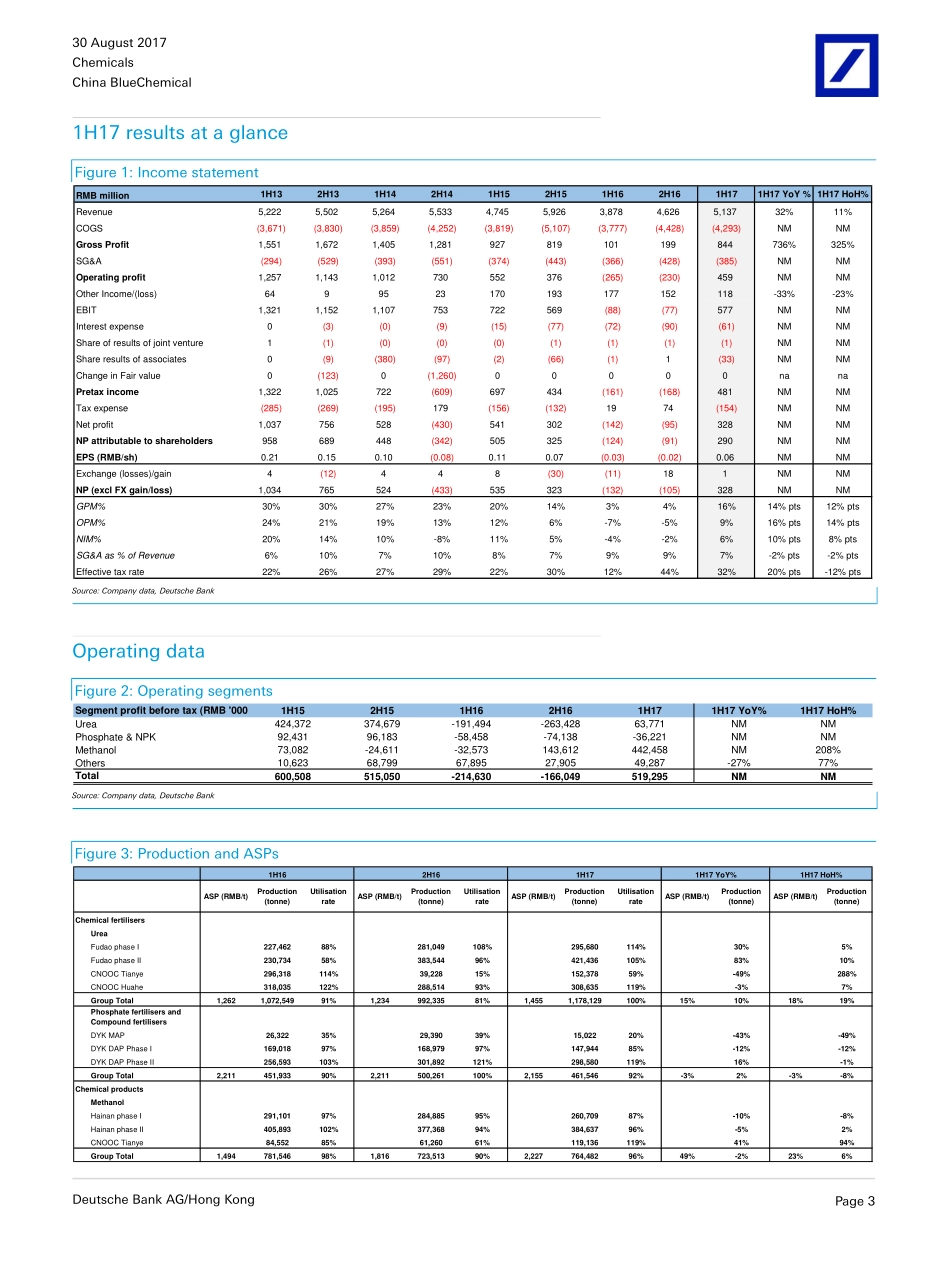

ChinaBlueChemicalRatingBuyValuation&RisksEnergyChemicalsPriceat29Aug2017(HKD)2.27Pricetarget-12mth(HKD)3.2052-weekrange(HKD)2.83-1.41HANGSENGINDEX27,863ForecastChangeAsiaHongKongCompanyChinaBlueChemicalReutersBloombergExchangeTicker3983.HK3983HKHSI3983Date30August2017DeutscheBankMarketsResearch1H17resultsbeatprelim.announcement;liftingTPtoHK$3.21H17resultsbeatonbettermethanolperformanceCBCreported1H17netprofitofRMB290m/EPSRMB0.06,aturnaroundfromanetlossofRMB124min1H16.Reportedearningswerec.9%higherthanminimumnetprofitpreliminaryguidanceofRMB265m,andbeatourexpectationsonbettermethanolperformance.The1H17netprofittracks63%/47%ofDBe/consensusFY17E.ThestrongturnaroundinperformancewasattributedtobetterASPsinureaandmethanol,andhigherureasalesvolume.However,theresultswereovershadowedby1)asluggishphosphatemarketand2)apoorureautilizationrateintheTianyeureaplant.Asof1H17,thecompanyheldnetcashofRMB4.6bnorRMB0.99/share.Withstrong1Hresults,weliftourEPSby67%/10%/6%inFY17E/18E/19EonhighermethanolASPandutilizationrate.WereiterateourBuyratingwithanewDCF-basedtargetpriceofHK$3.2.Operatingsummary:methanolsegmentsavestheday;phosphatestilllossmaking■TheUreasegmentrecordedoperatingprofitofRMB63m,aturnaroundfromalossofRMB191min1H16,drivenby1)aureaASPincreaseof15%YoYtoRMB1,455/ton,2)overallutilizationratehavingreached99.8%(vs.90.9%in1H16)drivenbyutilizationpick-upintheFudaoI&IIplantsand3)salesvolumehavingincreasedby21%YoYto1.2mtons.However,itwaspartlyoffsetbyadropinutilizationrateofCNOOCTianye,recordedat59%(vs.114%in1H16);producing152ktonsofurea(-49%YoY),mainlyduetoproductionhaltsuntilMarch2017.■ThePhosphate&NPKsegmentpostedalossofRMB36m,narrowedfromalossofRMB58min1H16,anddrivenbyutilizationrateimprovementto92.8%(vs.90.4%in1H16).However,itwasoffsetbyweakoverallphosphateandNPKASPs,theaverageASPofwhichdroppedtoRMB2,155/ton(-2.5%YoY).Also,MAPproductionvolumedroppedto15mtons(-43%YoY)duetoasluggishMAPmarket.■TheMethanolsegmentpostedoperatingprofitofRMB442m,aturnaroundfromanetlossofRMB33min...