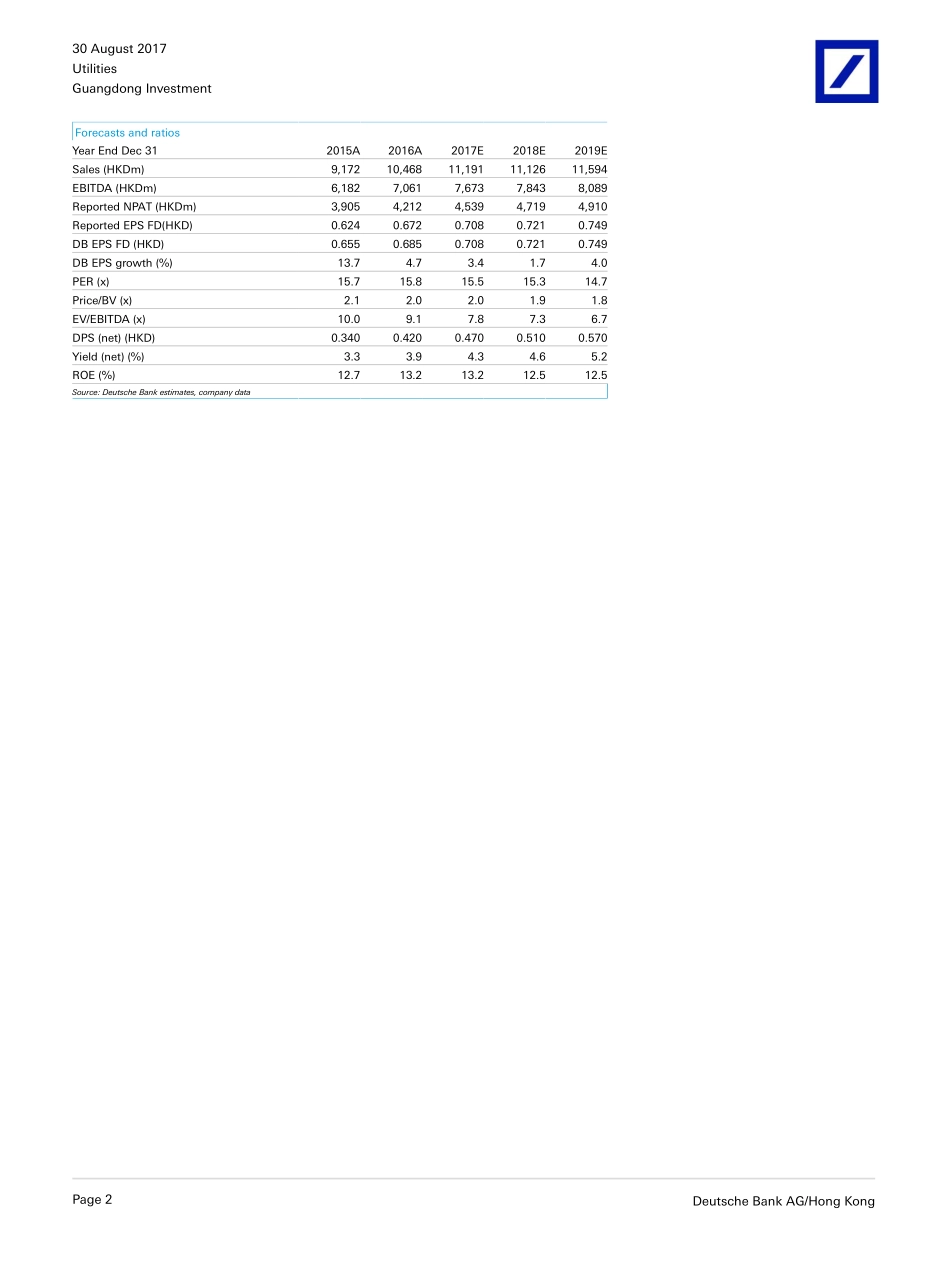

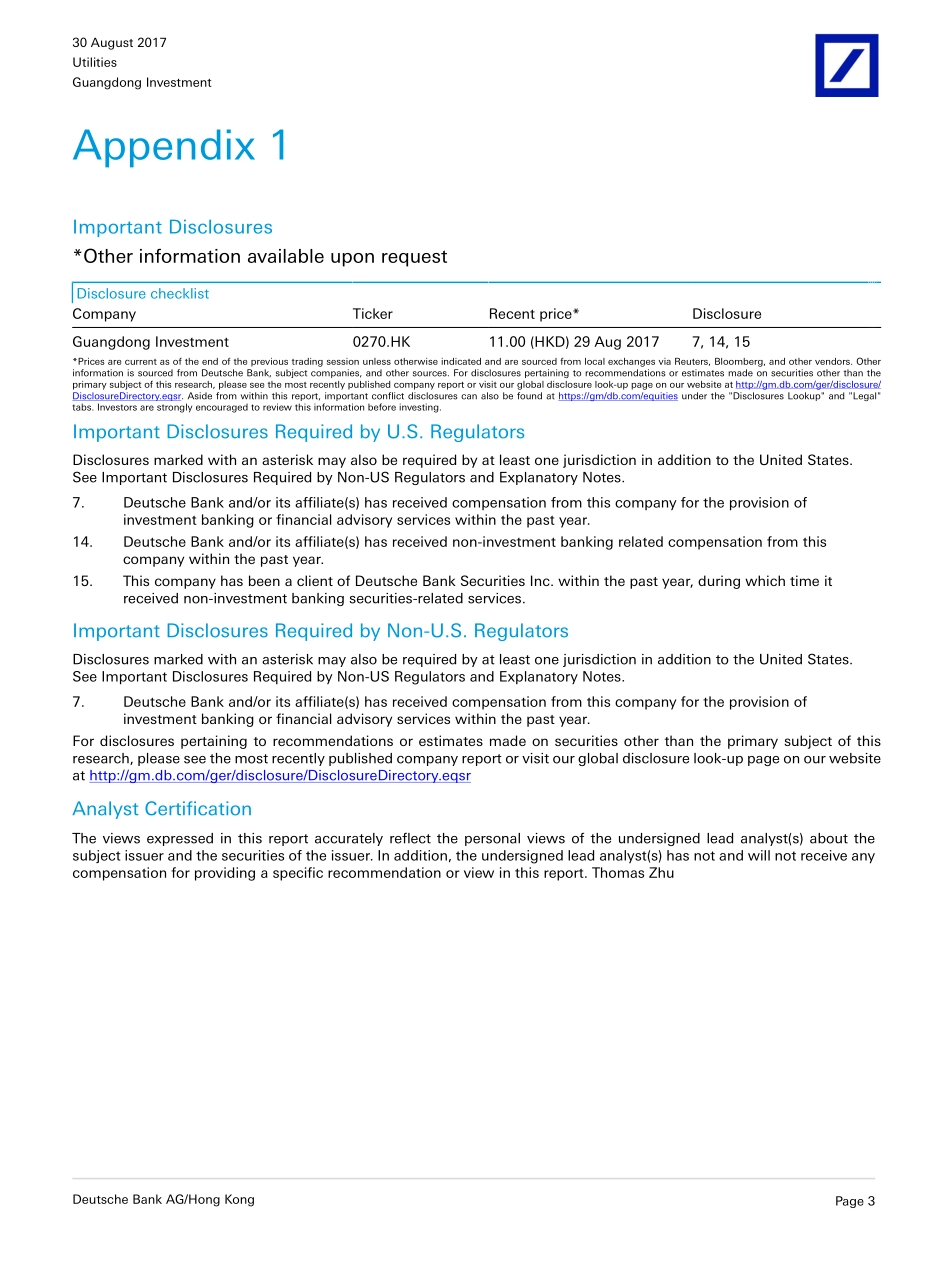

GuangdongInvestmentRatingBuyValuation&RisksUtilitiesUtilitiesPriceat29Aug2017(HKD)11.00Pricetarget-12mth(HKD)13.5052-weekrange(HKD)12.82-9.65HANGSENGINDEX27,863ResultsAsiaChinaCompanyGuangdongInvestmentReutersBloombergExchangeTicker0270.HK270HKHSI0270Date30August2017DeutscheBankMarketsResearchPositivesurprisefromdividenddespitein-line1H17;BuyPositivesurprisefromdividendGuangdongInvestmentannounced1H17resultsaftermarketcloseon29Aug.Despitein-line1H17results,wetakethecompany's20%increaseindividendasapositivesurprise.Keythingstowatchoutforin2H17istheHKwaterrevenue/tariffnegotiation.MaintainBuyonpositivedividendsurprise.Overallearningsin-line...ReportedearningsreachedHKD3.8bnvsitsprofitalertofnotlessthanHKD3.6bn.Recurringprofit(strippingoutHKD1.7bnimpactfrombargainpurchaseandpropertyrevaluationgain,partiallyoffsetbyFXloss)reachedHKD2.4bn,flatyoyandin-linewithDBe.ThecompanydeclaredaninterimdividendofHKD14.5centspershare,up20%yoyandrepresentingpayoutof39%(basedonrecurringearnings).GDI'snetcashposition(includingavailable-for-salefinancialassets)rosefromHKD8.1bnbyDec2016toHKD10.8bnbyJun2017,representingnetcashofHKD1.6pershare....withmajorsurprisesinmarginsMajorsurprisesfromtheresultswerewith1)operatingmarginforthewatersegmentand2)operatingmarginforthepropertysegment.Operatingmarginforwaterreached58%in1H17,upfrom56%in1H16andsupposedlydrivenbythetariff/revenuehikewithHKwatersupplyandalsoprofitabilityimprovementswithChinawaterassets.Operatingmarginforproperty(ex-revaluationgain)wasonly58%in1H17,downfrom81%in1H16anddrivenbyalossrecognizedfortheTianjinTeemShoppingMall(HKD11mpre-taxlossafteritopenedinJun2017)andalsoaprofitdeclinewithTeemToweronthedepartureofamajortenant.Otherfinancialswerebroadlyin-line.OtherupdatesGDIadded220ktpdofwatersupplycapacitiesin2Q17.Thecompanyalsoaddedwatersupplycapacitiesof1.2mtpdandsewagetreatmentcapacitiesof22ktpdinthesubsequentperiodafterJune30.GDIhasinvestedHKD2.2bn(cumulative)intothePanyuWanboCBDprojectbyJunandhasincurredtotalcostsofHKD7.3bnfor...