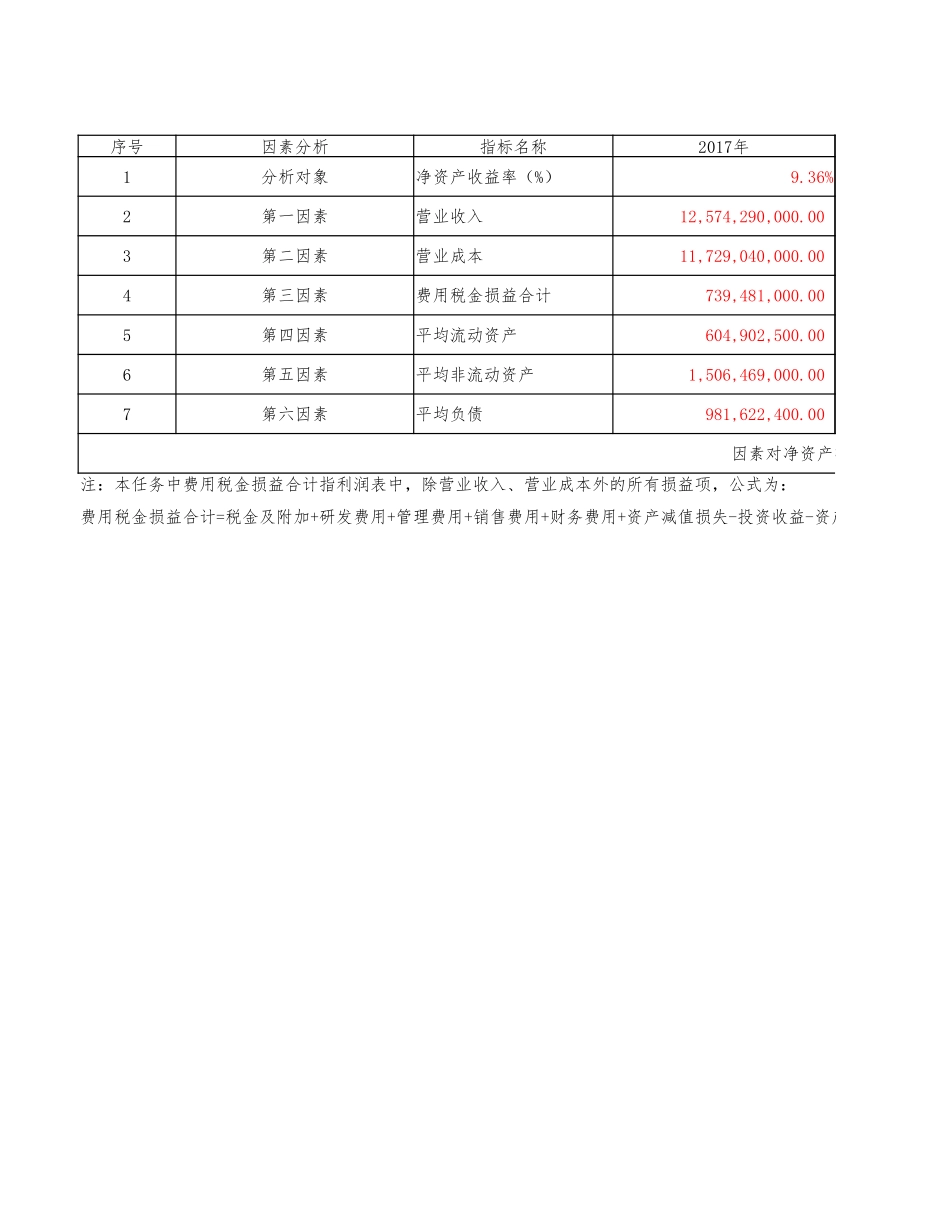

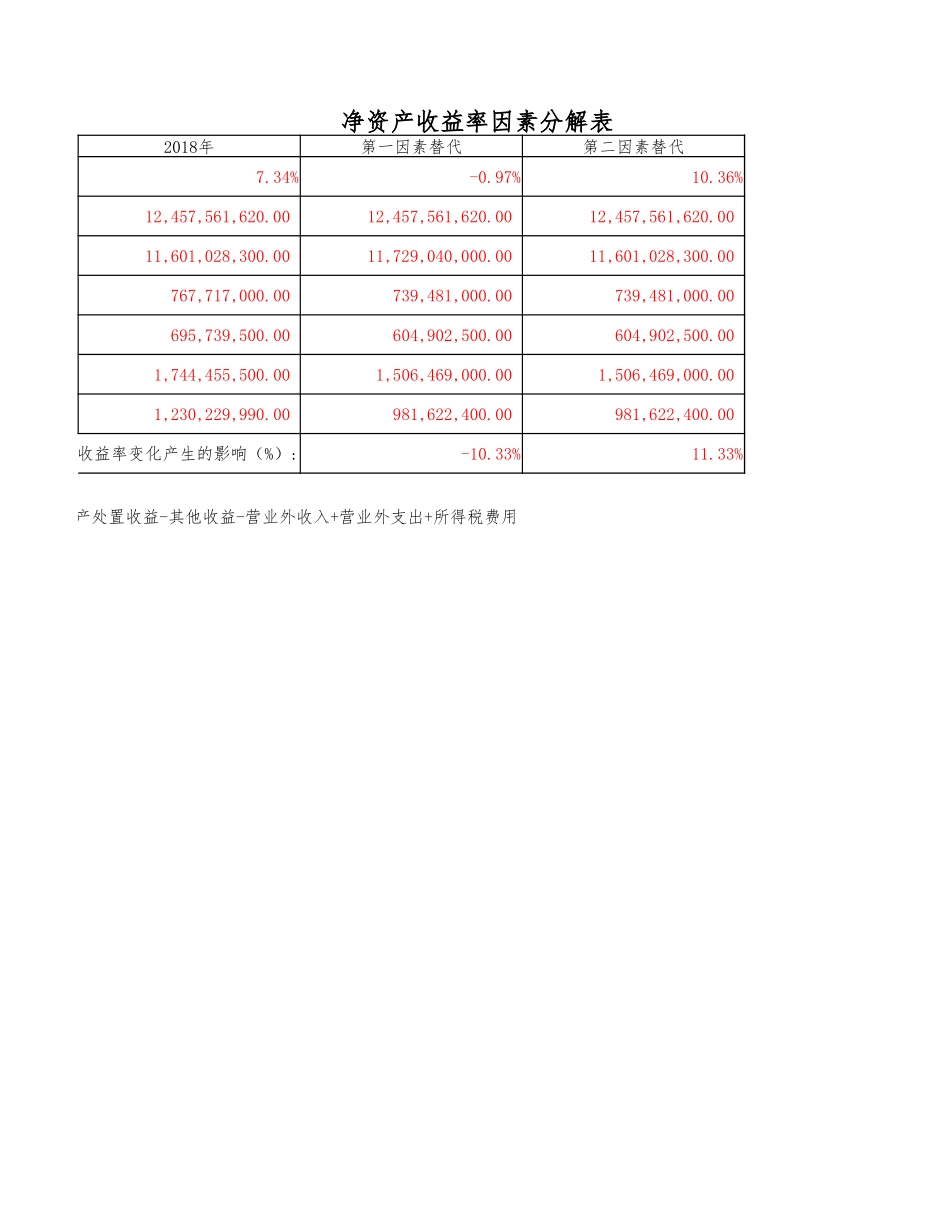

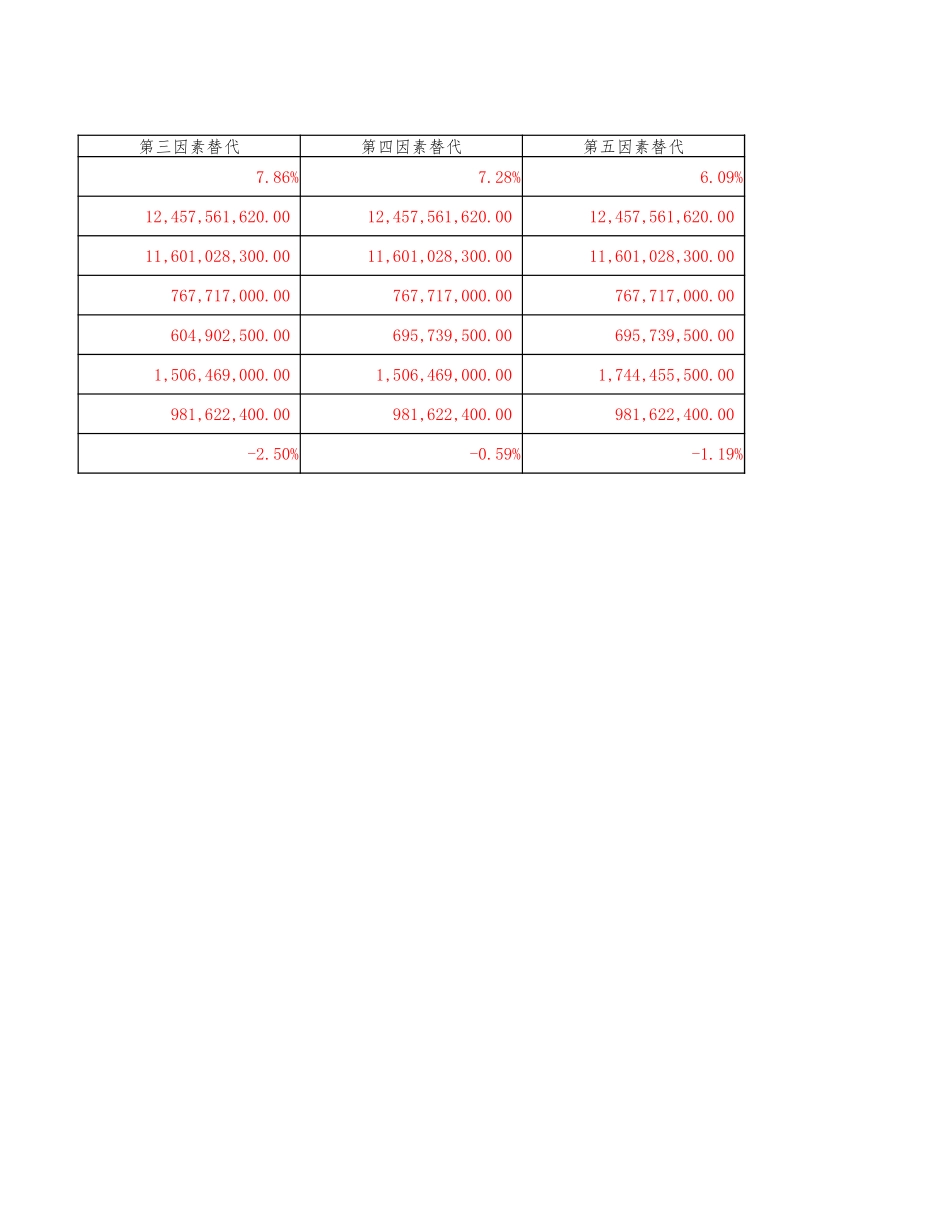

序号因素分析指标名称1分析对象9.36%2第一因素营业收入12,574,290,000.003第二因素营业成本11,729,040,000.004第三因素费用税金损益合计739,481,000.005第四因素平均流动资产604,902,500.006第五因素平均非流动资产1,506,469,000.007第六因素平均负债981,622,400.00注:本任务中费用税金损益合计指利润表中,除营业收入、营业成本外的所有损益项,公式为:2017年净资产收益率(%)因素对净资产收益率变化产生费用税金损益合计=税金及附加+研发费用+管理费用+销售费用+财务费用+资产减值损失-投资收益-资产处置收益-其他净资产收益率因素分解表第一因素替代第二因素替代7.34%-0.97%10.36%12,457,561,620.0012,457,561,620.0012,457,561,620.0011,601,028,300.0011,729,040,000.0011,601,028,300.00767,717,000.00739,481,000.00739,481,000.00695,739,500.00604,902,500.00604,902,500.001,744,455,500.001,506,469,000.001,506,469,000.001,230,229,990.00981,622,400.00981,622,400.00-10.33%11.33%式为:2018年素对净资产收益率变化产生的影响(%):资收益-资产处置收益-其他收益-营业外收入+营业外支出+所得税费用第三因素替代第四因素替代第五因素替代7.86%7.28%6.09%12,457,561,620.0012,457,561,620.0012,457,561,620.0011,601,028,300.0011,601,028,300.0011,601,028,300.00767,717,000.00767,717,000.00767,717,000.00604,902,500.00695,739,500.00695,739,500.001,506,469,000.001,506,469,000.001,744,455,500.00981,622,400.00981,622,400.00981,622,400.00-2.50%-0.59%-1.19%第六因素替代7.34%12,457,561,620.0011,601,028,300.00767,717,000.00695,739,500.001,744,455,500.001,230,229,990.001.25%