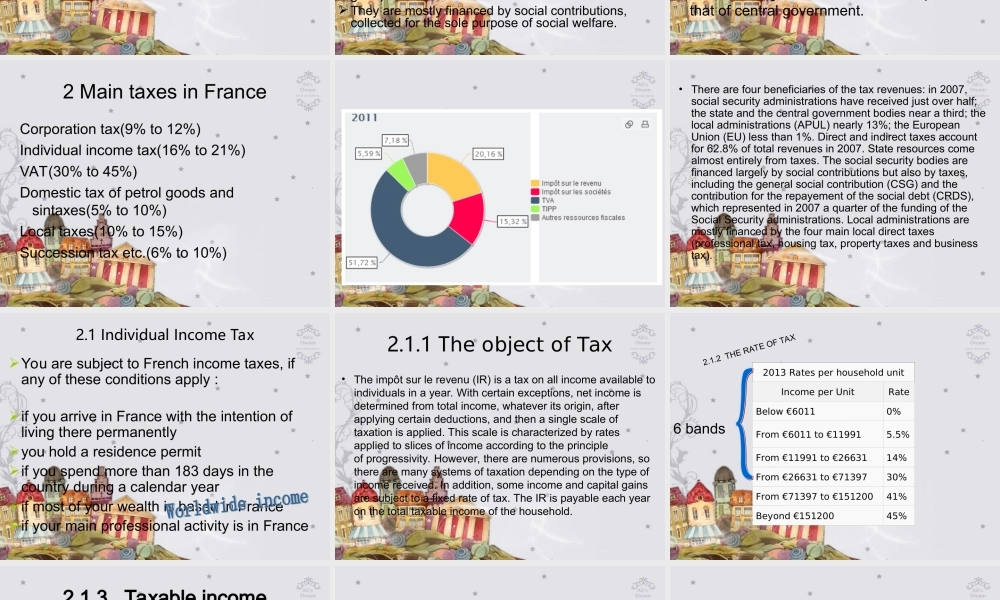

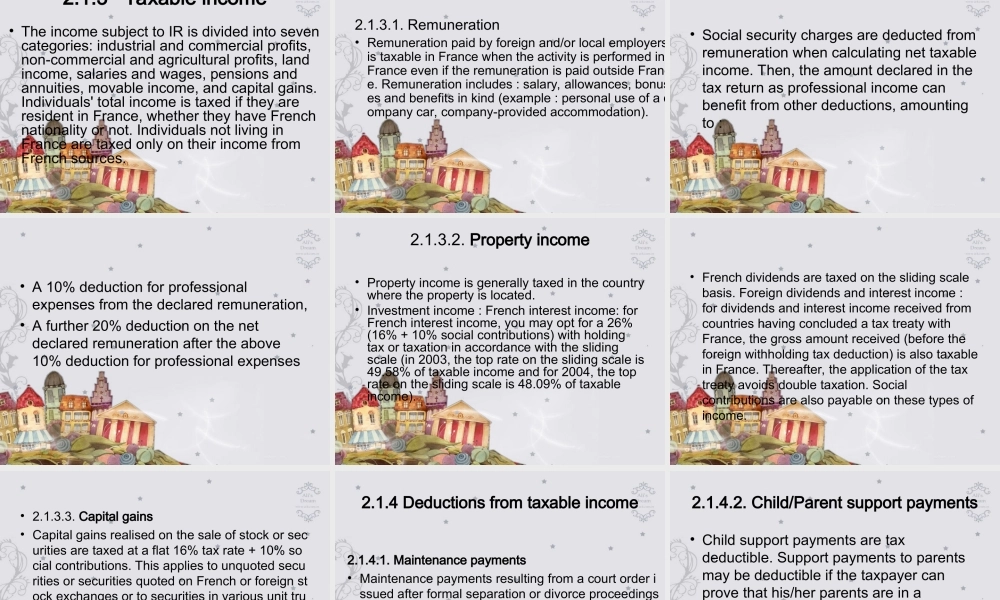

France-----AromanticcountryTheEiffelTowerChapterVITaxationinFrance•Overview•Individualincometax•Localtaxes•Wealthtax•Inheritancetax•VATtax•Compliance•Recenttaxreform1.OverviewTheFrenchtaxsystemcanbecharacterizedbyitscomplexity,highmarginalratesandhighadministrativecosts.TaxationinFranceisdeterminedbytheyearlybudgetvotebytheFrenchParliament,whichdetermineswhichkindsoftaxes(orquasi-taxes)canbeleviedandwhichratescanbeapplied.•InFrance,taxesareleviedbythegovernement,andcollectedbythepublicadministrations.French"publicadministrations"aremadeupofthreedifferentinstitutions:1.1Thecentralgovernment,i.e.thenationalgovernmentorthestate("l'État")striclyspeaking,plusvariouscentralgovernmentbodies.Ithasaseparatebudget(generalbudget,specialTreasuryaccounts,specialbudgets).Itcollectsmostofthetaxes.1.2Socialsecurityassociation(ASSO),isprivateorganizationsendowedwithamissionofpublicservice(eventhoughtheybehavetoalargeextentlikepublicadministrations).Theirbudgetismadeupofallmandatorysocialsecurityfunds(generalscheme,unemploymentinsuranceschemes,complementaryretirementfundsandwelfarebenefitfunds,fundsfortheliberalprofessionsandagriculturalfunds,specialemployeeschemes)andtheagenciesfinancedbysuchfunds(socialworks,publicandprivatesectorhospitalscontributingtopublichospitalservicesandfinancedfromanaggregateoperatinggrant).Theyaremostlyfinancedbysocialcontributions,collectedforthesolepurposeofsocialwelfare.1.3localgovernments,whichincludeagencieswithlimitedterritorialjurisdiction,suchaslocalauthorities,localpublicestablishments,chambersofcommerceandallpublicorquasi-publicbodiesfinancedprimarilybylocalgovernments.Theycollectmanytaxes,buttheirweightisratherlimitedcomparedtothatofcentralgovernment.2MaintaxesinFranceCorporationtax(9%to12%)Individualincometax(16%to21%)VAT(30%to45%)Domestictaxofpetrolgoodsandsintaxes(5%to10%)Localtaxes(10%to15%)Successiontaxetc.(6%to10%)•Therearefourbeneficiariesofthetaxrevenues:in2007,socialsecurityadministrationshavereceivedjustoverhalf;the...