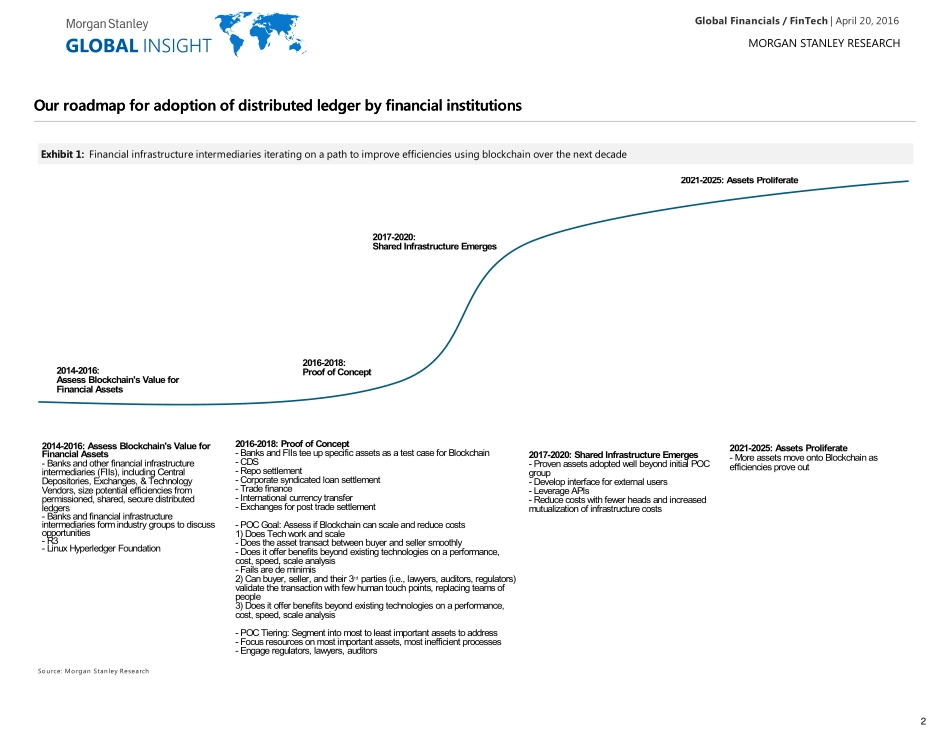

摩根史丹利发布了区块链研究报告,31页的文章里细数了区块链成为银行实际应用之前要克服的10大障碍,并指出区块链技术优势很清晰,但短期对银行业绩没有影响。2016-2018年是区块链试错的时间段,各种POC(概念产品)会不断出现,2025年会是什么样子的?这10大障碍是:1.应用场景的性价比很高吗?2.谁来支付/共同承担升级现有系统的成本?3.利益不均4.形成行业标准尚需时日5.可扩展性/性能问题6.政府管制7.监管问题8.法律风险9.加密学/安全性10.简单/跨平台可操作性(本文仅翻译摘要部分,欢迎大家指正miner@8btc.com)Huw.vanSteenis@morganstanley.comBetsy.Graseck@morganstanley.comFiona.Simpson@morganstanley.comJames.Faucette@morganstanley.comAttractiveIn-LineMORGANSTANLEY&CO.INTERNATIONALPLC+HuwVanSteenis+44207425-9747MORGANSTANLEY&CO.LLCBetsyL.Graseck,CFA+1212761-8473MORGANSTANLEY&CO.INTERNATIONALPLC+FionaSimpson,CFA+44207425-5593MORGANSTANLEY&CO.LLCJamesEFaucette+1212296-5771Banking-LargeCapBanksNorthAmericaIndustryViewBanksEuropeIndustryViewGlobalFinancials/FinTechGlobalFinancials/FinTechApril20,2016GlobalInsight:BlockchaininBanking:DisruptiveThreatorTool?Blockchainscouldhavewidespreadpotentialtodisruptfinancialintermediaries.Ourin-depthstudysuggestsseveralmisconceptions&identifies10hurdlestoovercometomakeblockchainarealityinbanking.Theopportunityisclearbuttheblueskyistoofarofftoimpactour2017/18e.Thepotofgold?Higherefficiencies.It'searlydays,butindustryheavyweightsaresponsoringawiderangeofblockchainusecasessupportedbyindustryconsortiums.AsNIMfadesandcapitalbuilds,globalbankmanagementspressharderforastepdownincosts.Costmutualisationthroughblockchainarchitectedfinancialsystemutilitiescouldprovidesomeearningsboostaftertherelatedmulti-yearinvestmentspendplateaus.Butblockchainscouldbeadouble-edgedswordanddisruptfinancials.Blockchainswon'tjustchangetheFinancialServices'ITarchitecture.Theycouldalsochangeaccessibleprofitpools.Alotwilldependonthegovernanceandhowquicklyincumbentsmove.ThefirmsholdingthekeystothedataandtheITarchitecturecoulddrivemoreprofitpooltowardsthemselves.Soit'snowonderthatthecustodianslikeJP...