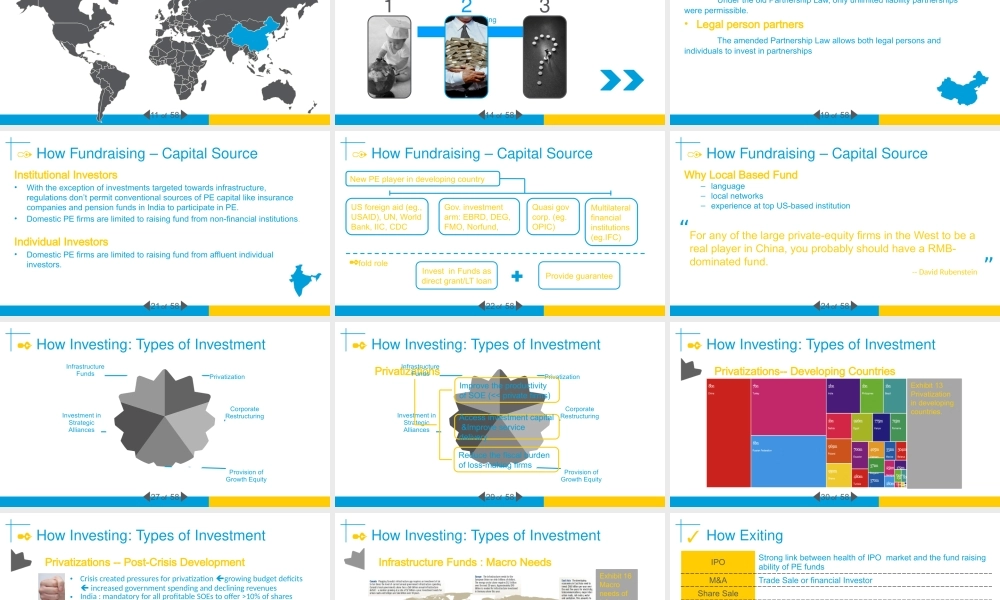

of58PrivateEquityinDevelopingCountries小丸子小新PresentByContent123of58WHYHOWWHATof1of58LoadingWHYPrivateEquityDevelopingCountriesChina&India123of2of58WhyPrivateEquityAttractiveReturnMitigateRiskBusinessUncertaintyHard-to-valueAssetsInfoAsymmetriesof13Exhibit1of58WhyDevelopingCountries“Economicgrowthremainstheprimarydriverofincreasingemergingmarketprivateequitycommitments.Source:www.empea.net”2Exhibit2•Highergrowth•Lowerleverage•Highrateofjobcreation•Supportforsmallercompany4of58WhyDevelopingCountriesEU36%26%Asia/Oceania27%15%2Exhibit3For2010&2011,Asia/Oceania'sshareishigherthanboththeEU15andtheUSA5of58WhyDevelopingCountriesEmergingmarketsincreaseUSoneofcountriesthatdeclinedfastest2Exhibit4&5Theindexmeasures:sizeofgov,expenditures,taxes,enterprises,legalstructureandsecurityofpropertyrights,accesstosoundmoneyfreedomtotradeinternationallyregulationofcredit,labor,andbusiness6of58WhyDevelopingCountriesExhibit6&7BoththeBreadthandtheQualityoftheEmergingMarketPrivateEquityOpportunityhaveImprovedSince2000.27of58WhyDevelopingCountriesAttractivenessofDevelopingCountriesEconomicProgressEconomicReformPlannedCapitalist1989BradyPlan•Restructureexternaldebt•Boosteconomichealth•IncreaseinvestorconfidenceTaxReform•LowertaxoncapitalgainsRelaxRestrictionofForeignInvestment•Encourageequityinvestment&stockmarketgrowthImproveAccounting&DisclosureStandards•Lowerinvestingcosts•Diminishinfoasymmetriesof28of58WhyChina&IndiaEmergingAsianmarketsNO.1attractivedestinationsforglobalinvestorsChinaNo.1investmenttargetfor9consecutiveyearsIndiaNo.2investmenttargetRisingMiddleClassUrbanMigrationIncreasingMarketDemand310of58WhyChina&India311of58LoadingHOWFundraisingInvestingExiting12314of58HowFundraising–FundStructure•LimitedliabilitypartnershipUndertheoldPartnershipLaw,onlyunlimitedliabilitypartnershipswerepermissible.•LegalpersonpartnersTheamendedPartnershipLawallowsbothlegalpersonsandindividualstoinvestinpartnerships119of58HowFundraising–CapitalSourceInstitutionalInvestors•Wit...