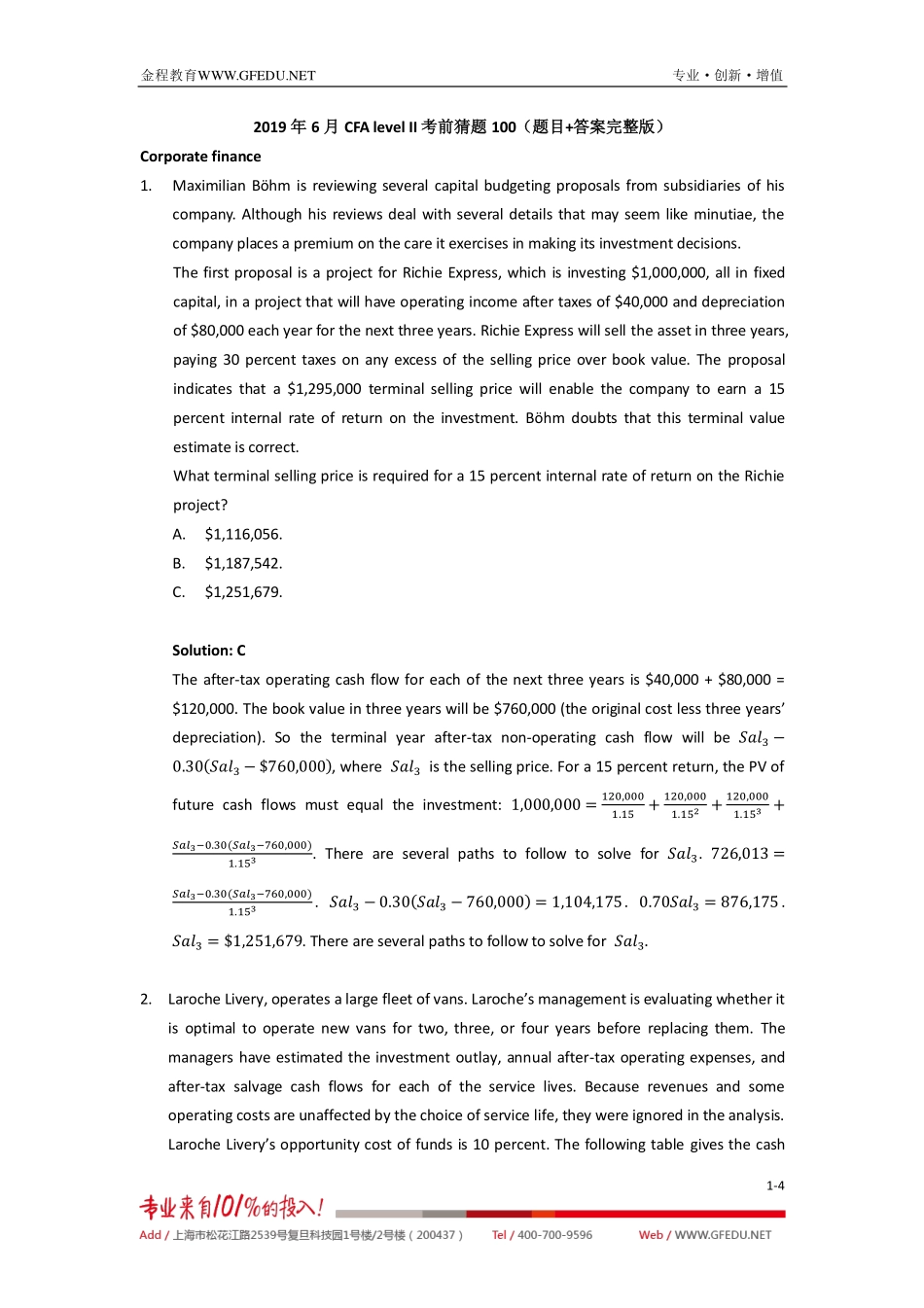

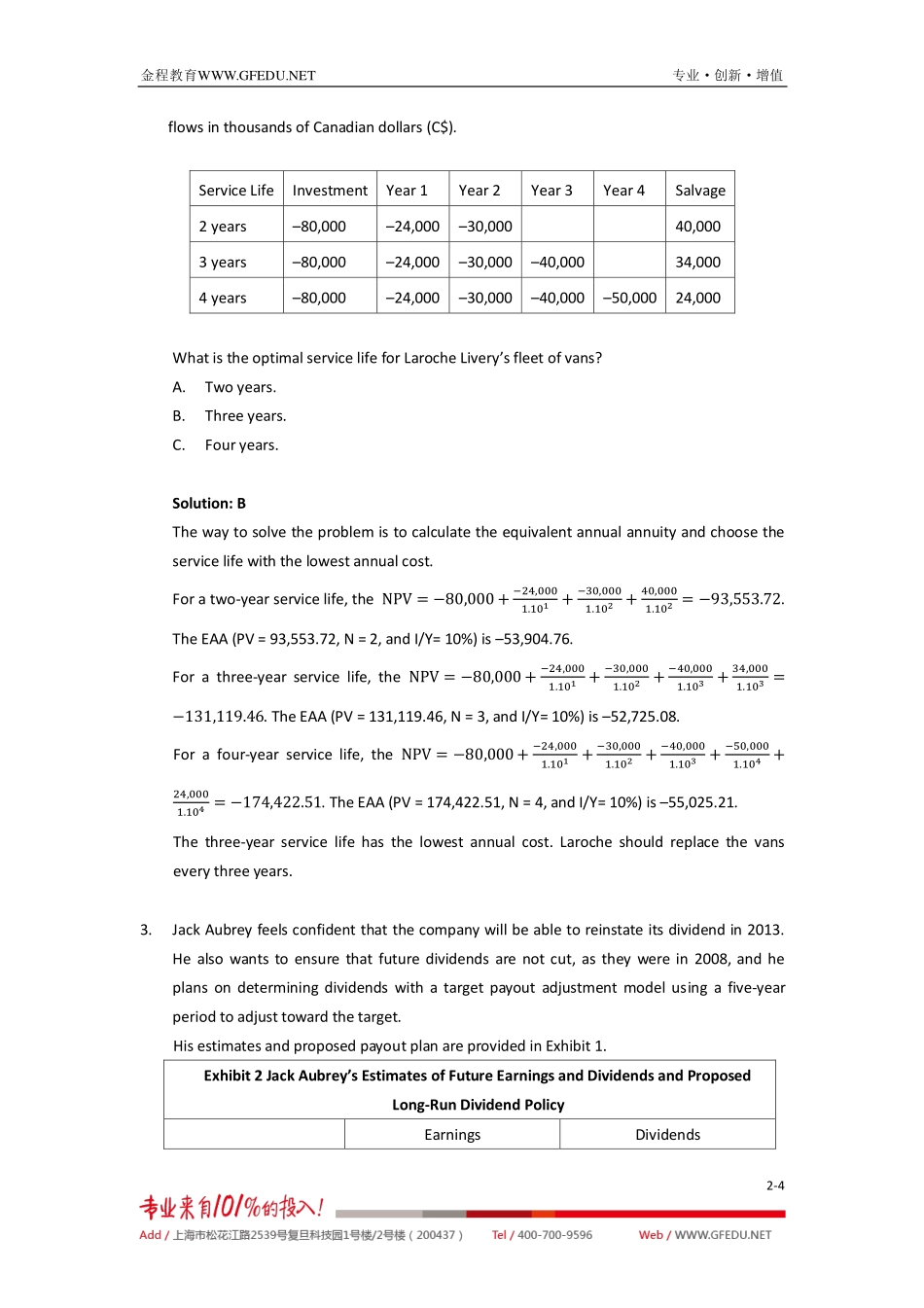

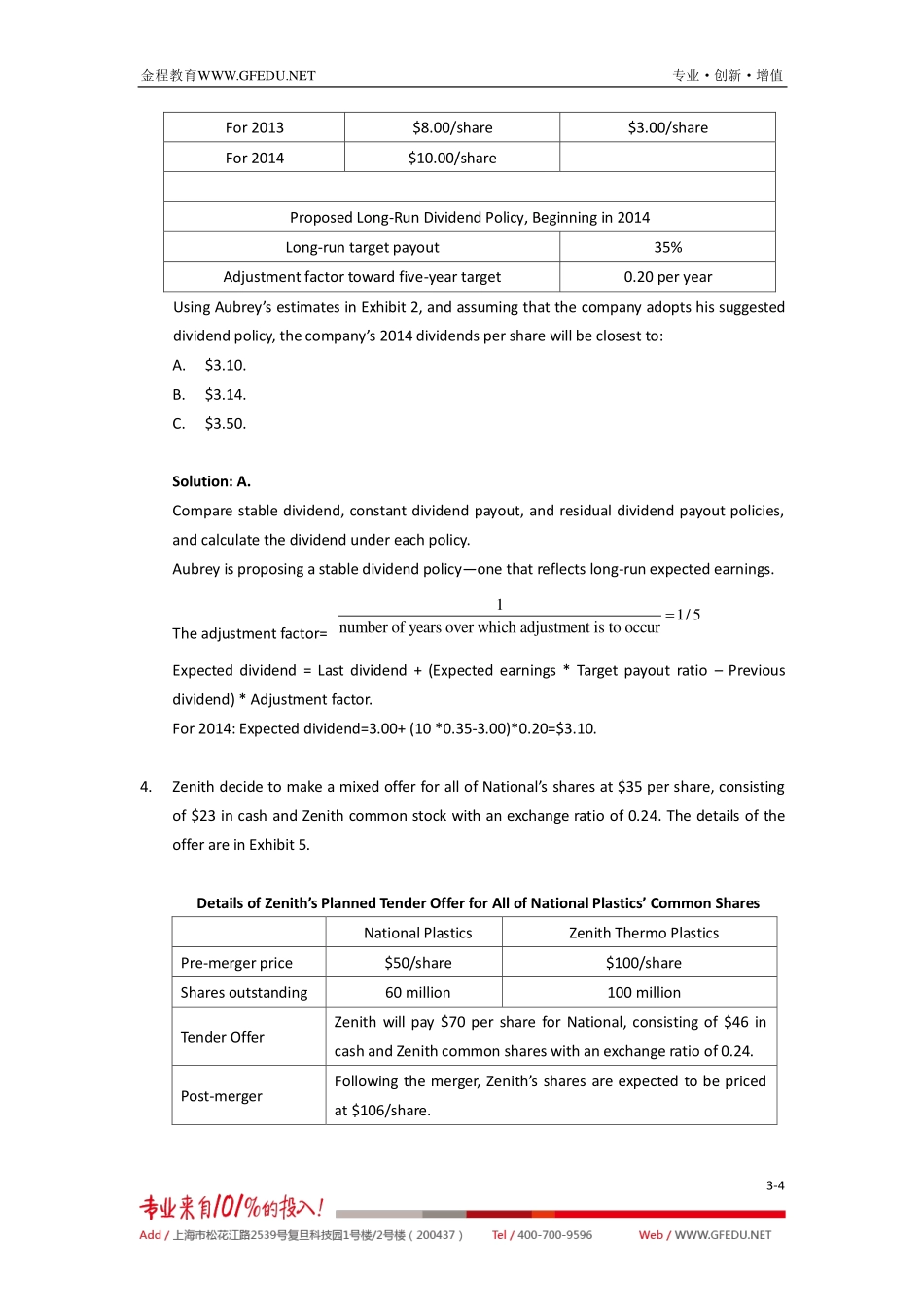

金程教育WWW.GFEDU.NET专业·创新·增值1-42019年6月CFAlevelII考前猜题100(题目+答案完整版)Corporatefinance1.MaximilianBöhmisreviewingseveralcapitalbudgetingproposalsfromsubsidiariesofhiscompany.Althoughhisreviewsdealwithseveraldetailsthatmayseemlikeminutiae,thecompanyplacesapremiumonthecareitexercisesinmakingitsinvestmentdecisions.ThefirstproposalisaprojectforRichieExpress,whichisinvesting$1,000,000,allinfixedcapital,inaprojectthatwillhaveoperatingincomeaftertaxesof$40,000anddepreciationof$80,000eachyearforthenextthreeyears.RichieExpresswillselltheassetinthreeyears,paying30percenttaxesonanyexcessofthesellingpriceoverbookvalue.Theproposalindicatesthata$1,295,000terminalsellingpricewillenablethecompanytoearna15percentinternalrateofreturnontheinvestment.Böhmdoubtsthatthisterminalvalueestimateiscorrect.Whatterminalsellingpriceisrequiredfora15percentinternalrateofreturnontheRichieproject?A.$1,116,056.B.$1,187,542.C.$1,251,679.Solution:CTheafter-taxoperatingcashflowforeachofthenextthreeyearsis$40,000+$80,000=$120,000.Thebookvalueinthreeyearswillbe$760,000(theoriginalcostlessthreeyears’depreciation).Sotheterminalyearafter-taxnon-operatingcashflowwillbe𝑆𝑎𝑙3−0.30(𝑆𝑎𝑙3−$760,000),where𝑆𝑎𝑙3isthesellingprice.Fora15percentreturn,thePVoffuturecashflowsmustequaltheinvestment:1,000,000=120,0001.15+120,0001.152+120,0001.153+𝑆𝑎𝑙3−0.30(𝑆𝑎𝑙3−760,000)1.153.Thereareseveralpathstofollowtosolvefor𝑆𝑎𝑙3.726,013=𝑆𝑎𝑙3−0.30(𝑆𝑎𝑙3−760,000)1.153.𝑆𝑎𝑙3−0.30(𝑆𝑎𝑙3−760,000)=1,104,175.0.70𝑆𝑎𝑙3=876,175.𝑆𝑎𝑙3=$1,251,679.Thereareseveralpathstofollowtosolvefor𝑆𝑎𝑙3.2.LarocheLivery,operatesalargefleetofvans.Laroche’smanagementisevaluatingwhetheritisoptimaltooperatenewvansfortwo,three,orfouryearsbeforereplacingthem.Themanagershaveestimatedtheinvestmentoutlay,annualafter-taxoperatingexpenses,andafter-taxsalvagecashflowsforeachoftheservicelives.Becauserevenuesandsomeoperatingcostsareunaffectedbythechoiceofservicelife,theywereignoredintheanalysis.LarocheLivery’s...