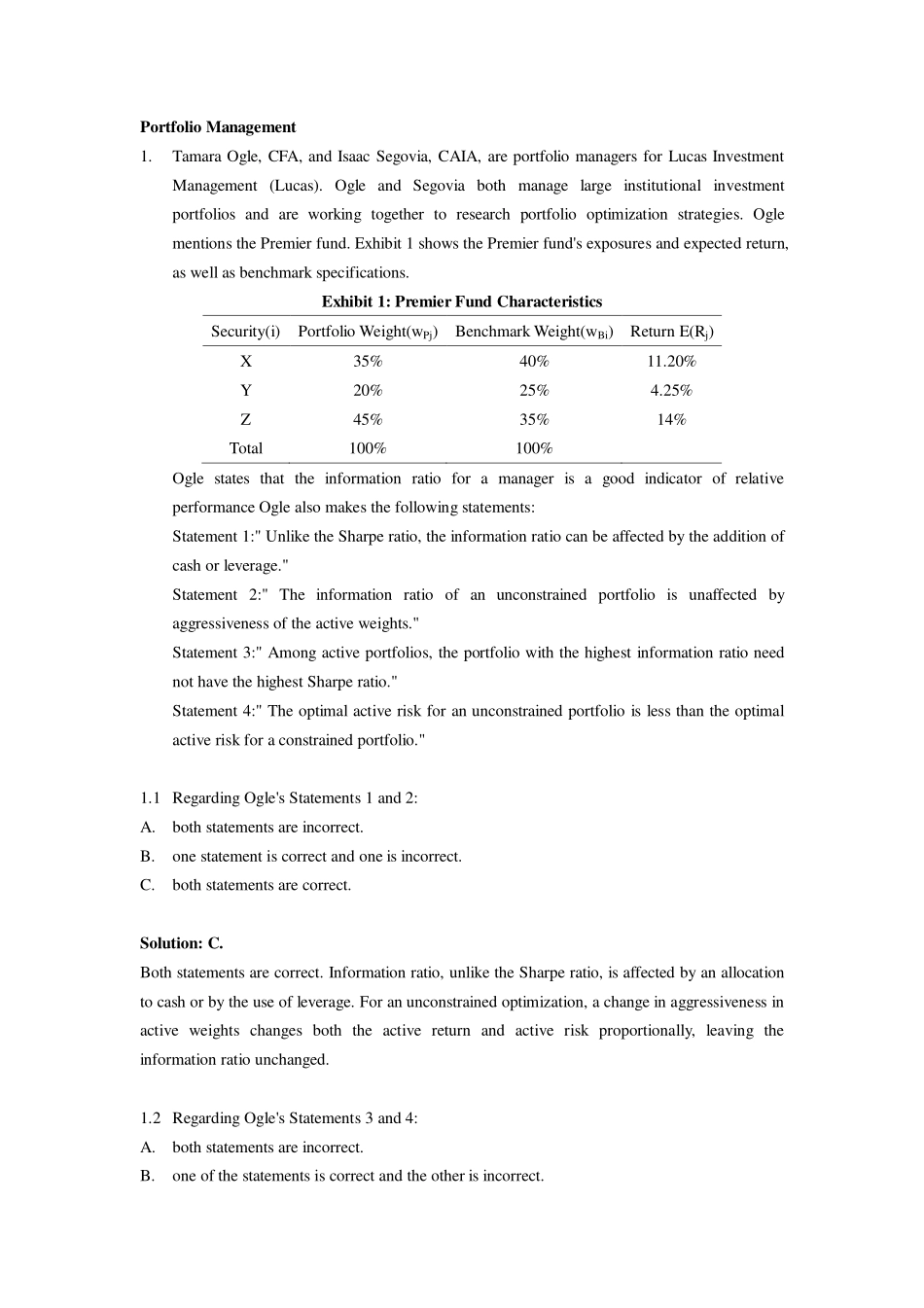

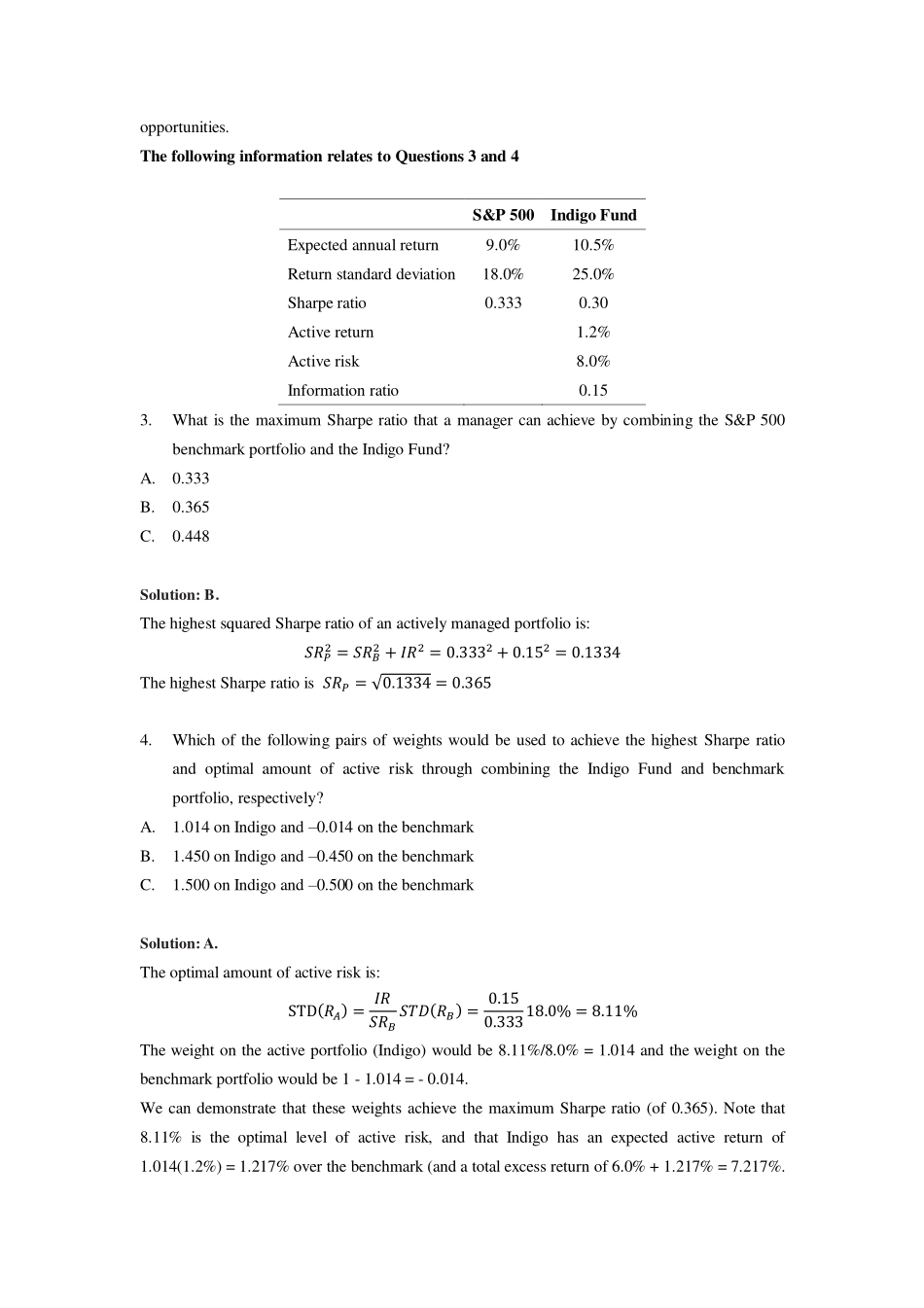

PortfolioManagement1.TamaraOgle,CFA,andIsaacSegovia,CAIA,areportfoliomanagersforLucasInvestmentManagement(Lucas).OgleandSegoviabothmanagelargeinstitutionalinvestmentportfoliosandareworkingtogethertoresearchportfoliooptimizationstrategies.OglementionsthePremierfund.Exhibit1showsthePremierfund'sexposuresandexpectedreturn,aswellasbenchmarkspecifications.Exhibit1:PremierFundCharacteristicsSecurity(i)PortfolioWeight(wPj)BenchmarkWeight(wBi)ReturnE(Rj)X35%40%11.20%Y20%25%4.25%Z45%35%14%Total100%100%OglestatesthattheinformationratioforamanagerisagoodindicatorofrelativeperformanceOglealsomakesthefollowingstatements:Statement1:"UnliketheSharperatio,theinformationratiocanbeaffectedbytheadditionofcashorleverage."Statement2:"Theinformationratioofanunconstrainedportfolioisunaffectedbyaggressivenessoftheactiveweights."Statement3:"Amongactiveportfolios,theportfoliowiththehighestinformationrationeednothavethehighestSharperatio."Statement4:"Theoptimalactiveriskforanunconstrainedportfolioislessthantheoptimalactiveriskforaconstrainedportfolio."1.1RegardingOgle'sStatements1and2:A.bothstatementsareincorrect.B.onestatementiscorrectandoneisincorrect.C.bothstatementsarecorrect.Solution:C.Bothstatementsarecorrect.Informationratio,unliketheSharperatio,isaffectedbyanallocationtocashorbytheuseofleverage.Foranunconstrainedoptimization,achangeinaggressivenessinactiveweightschangesboththeactivereturnandactiveriskproportionally,leavingtheinformationratiounchanged.1.2RegardingOgle'sStatements3and4:A.bothstatementsareincorrect.B.oneofthestatementsiscorrectandtheotherisincorrect.C.bothstatementsarecorrect.Solution:A.Bothstatementsareincorrect.TheportfoliowiththehighestinformationratiowillhavethehighestSharperatio.RecallthattheSharperatiooftheportfolioiscomputedasSRp2=SRB2+IRp2.GiventhatbenchmarkSharperatio(SRB)isthesameforallsimilaractiveportfolios,theactiveportfoliowiththehighestinformationratiowillalsobetheportfoliowiththehighestSharperatio.Theoptimalactiveriskforaconstrainedportfolio=TC*optimal...