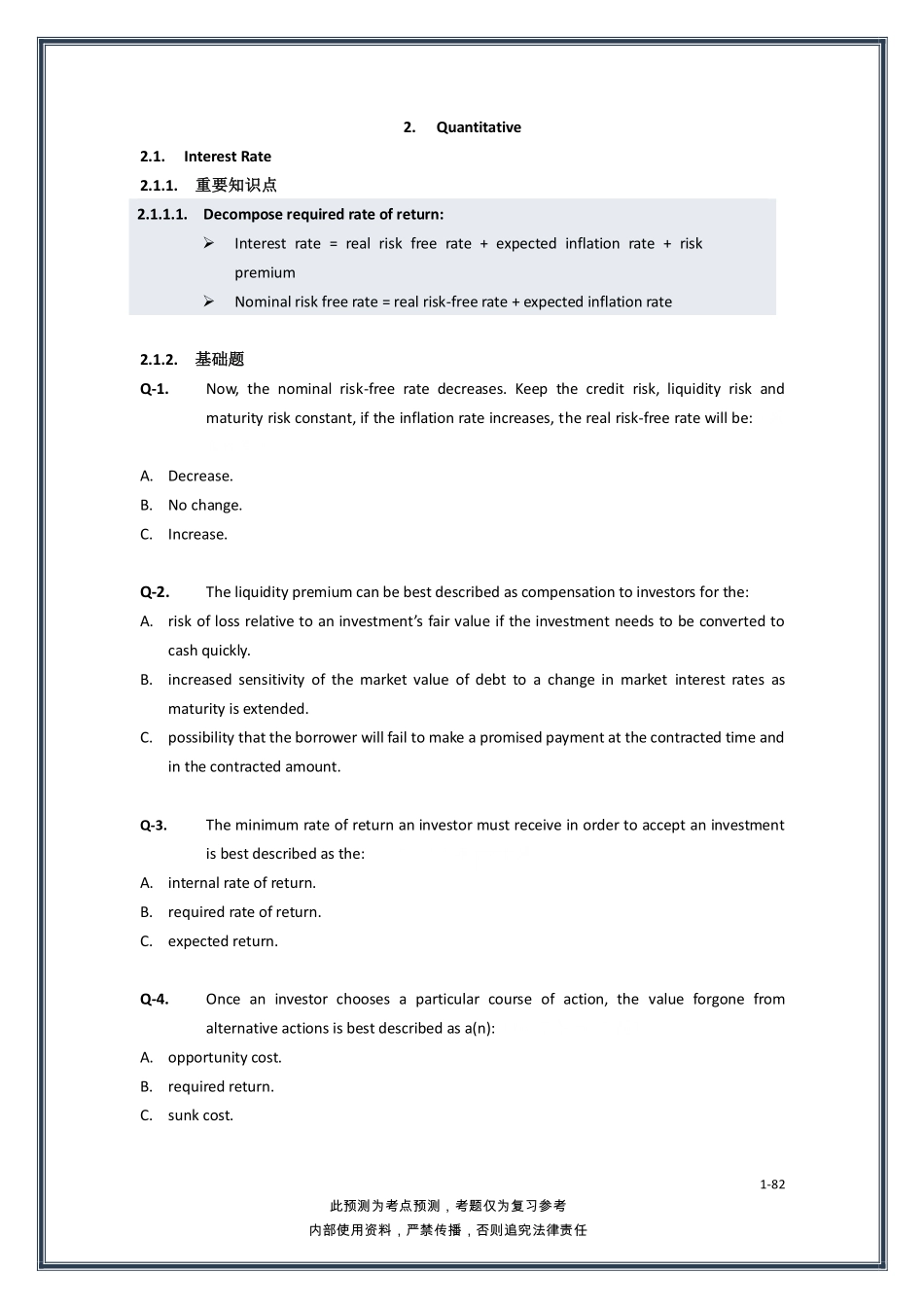

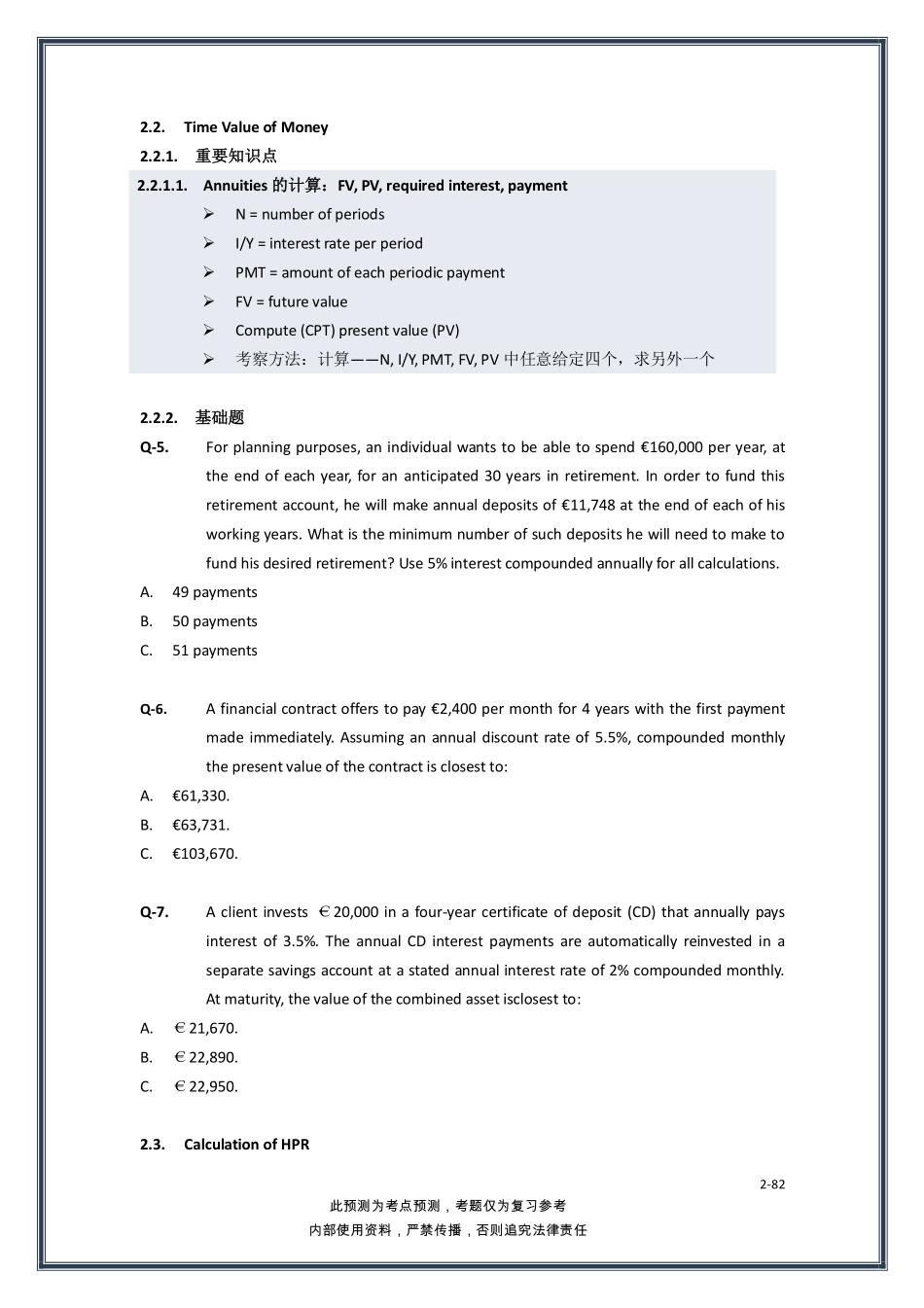

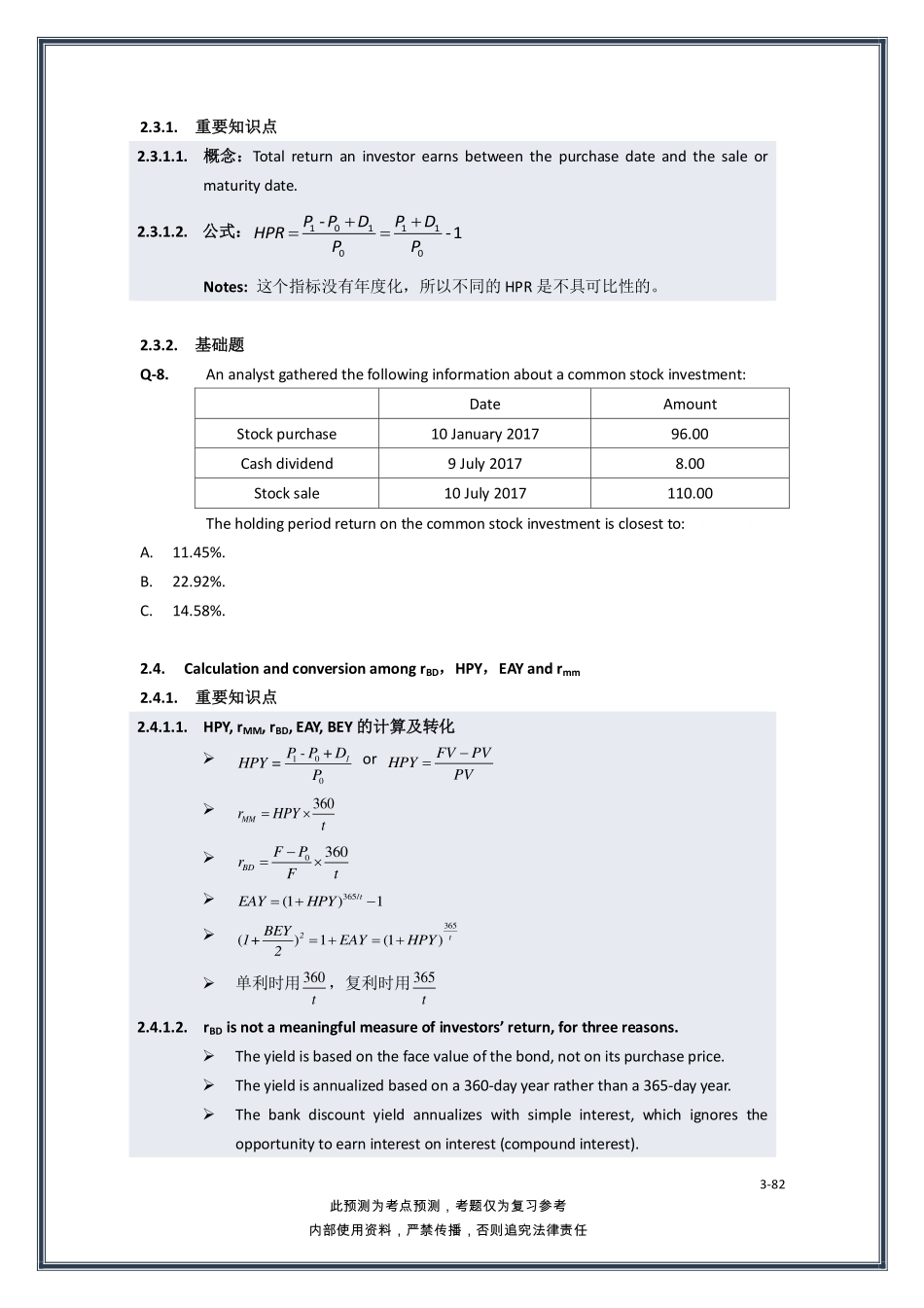

1-82此预测为考点预测,考题仅为复习参考内部使用资料,严禁传播,否则追究法律责任2.Quantitative2.1.InterestRate2.1.1.重要知识点2.1.1.1.Decomposerequiredrateofreturn:Interestrate=realriskfreerate+expectedinflationrate+riskpremiumNominalriskfreerate=realrisk-freerate+expectedinflationrate2.1.2.基础题Q-1.Now,thenominalrisk-freeratedecreases.Keepthecreditrisk,liquidityriskandmaturityriskconstant,iftheinflationrateincreases,therealrisk-freeratewillbe:(疑似改写)A.Decrease.B.Nochange.C.Increase.Q-2.Theliquiditypremiumcanbebestdescribedascompensationtoinvestorsforthe:A.riskoflossrelativetoaninvestment’sfairvalueiftheinvestmentneedstobeconvertedtocashquickly.B.increasedsensitivityofthemarketvalueofdebttoachangeinmarketinterestratesasmaturityisextended.C.possibilitythattheborrowerwillfailtomakeapromisedpaymentatthecontractedtimeandinthecontractedamount.Q-3.Theminimumrateofreturnaninvestormustreceiveinordertoacceptaninvestmentisbestdescribedasthe:(15、18A年mock题)A.internalrateofreturn.B.requiredrateofreturn.C.expectedreturn.Q-4.Onceaninvestorchoosesaparticularcourseofaction,thevalueforgonefromalternativeactionsisbestdescribedasa(n):(16/17年mock题)A.opportunitycost.B.requiredreturn.C.sunkcost.2-82此预测为考点预测,考题仅为复习参考内部使用资料,严禁传播,否则追究法律责任2.2.TimeValueofMoney2.2.1.重要知识点2.2.1.1.Annuities的计算:FV,PV,requiredinterest,paymentN=numberofperiodsI/Y=interestrateperperiodPMT=amountofeachperiodicpaymentFV=futurevalueCompute(CPT)presentvalue(PV)考察方法:计算——N,I/Y,PMT,FV,PV中任意给定四个,求另外一个2.2.2.基础题Q-5.Forplanningpurposes,anindividualwantstobeabletospend€160,000peryear,attheendofeachyear,forananticipated30yearsinretirement.Inordertofundthisretirementaccount,hewillmakeannualdepositsof€11,748attheendofeachofhisworkingyears.Whatistheminimumnumberofsuchdepositshewillneedtomaketofundhisdesiredretirement?Use5%interestcompoundedannuallyforallcalculations.A.49paymentsB.50paymentsC.51paymentsQ-6.Afinancialcontractoffer...