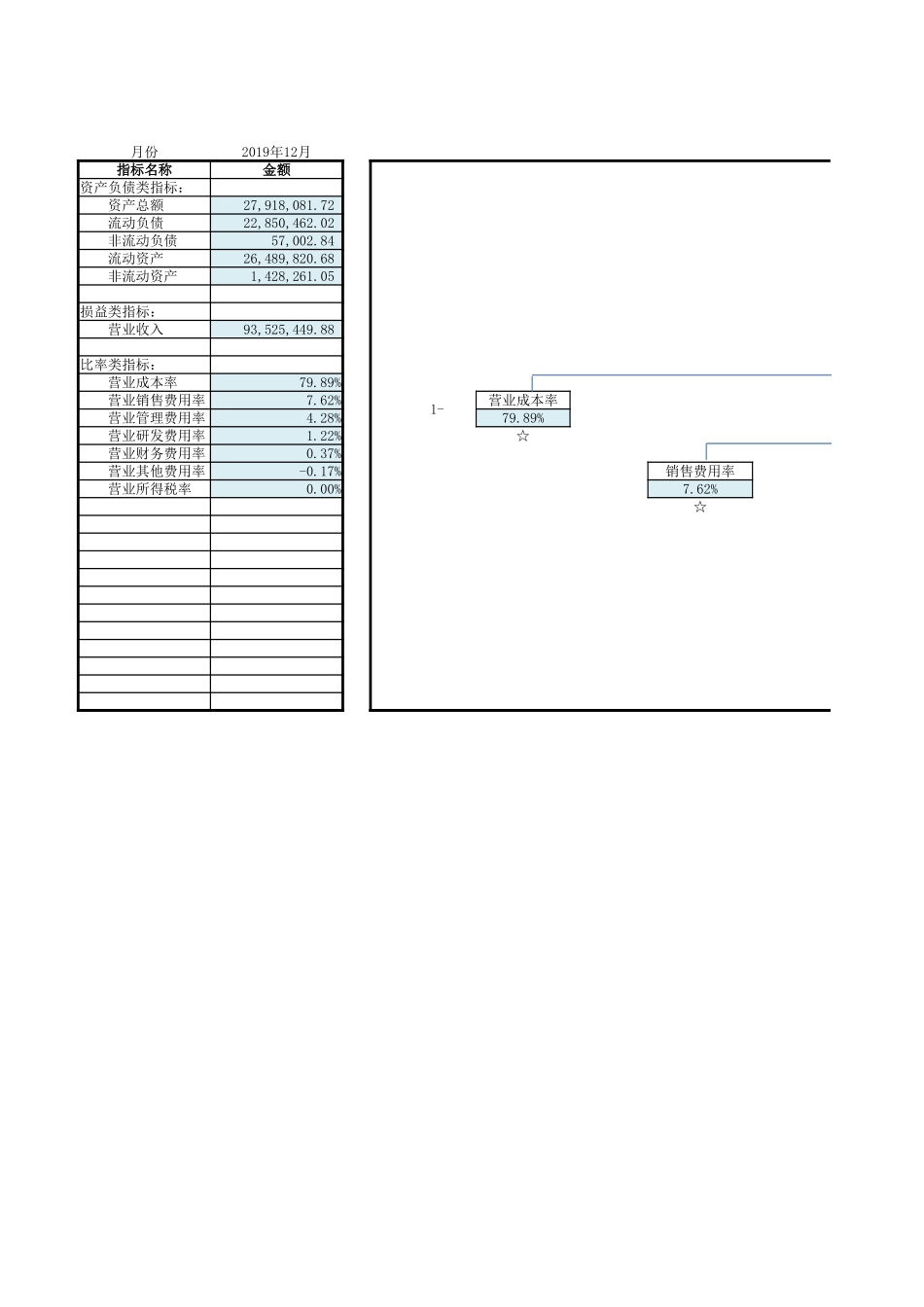

杜邦财务分析体系更多作品❖❖分析结果基础数据体系密码:xdcw888月份指标名称金额资产负债类指标:资产总额27,918,081.72流动负债22,850,462.02非流动负债57,002.84流动资产26,489,820.68非流动资产1,428,261.05损益类指标:营业收入93,525,449.88比率类指标:营业成本率79.89%营业销售费用率7.62%1-营业成本率营业管理费用率4.28%79.89%营业研发费用率1.22%☆营业财务费用率0.37%营业其他费用率-0.17%销售费用率营业所得税率0.00%7.62%☆2019年12月销售净利率6.79%-营业费用率-13.32%管理费用率研发费用率财务费用率其他费用率4.28%1.22%0.37%-0.17%☆☆☆☆杜邦财务分析体系总资产净利率22.75%×总资产周转率3.35所得税率营业收入÷资产总额0.00%93,525,449.8827,918,081.72☆☆☆净资产收益率1.27×权益乘数5.57资产负债率82.05%负债总额÷22,907,464.86流动负债+非流动负债22,850,462.0257,002.84☆☆1÷(1-)资产总额27,918,081.72流动资产+非流动资产26,489,820.681,428,261.05☆☆返回首流动资产:货币资金4,459,078.866,010,581.934,459,078.866,010,581.93交易性金融资产----应收票据----应收账款8,730,583.858,261,106.448,730,583.858,261,106.44预付款项4,565,382.556,505,453.494,565,382.556,505,453.49应收利息----应收股利----其他应收款3,292,611.433,476,891.473,292,611.433,476,891.47存货27,668,025.8724,377,496.1327,668,025.8724,377,496.13一年内到期的非流动资产----其他流动资产1,592,820.13672,425.121,592,820.13672,425.12流动资产合计50,308,502.7049,303,954.5850,308,502.7049,303,954.58非流动资产:可供出售金融资产----持有至到期投资----长期应收款----长期股权投资----投资性房地产----固定资产1,646,757.201,635,988.671,646,757.201,635,988.67在建工程----工程物资----固定资产清理----生产性生物资产----油气资产----无形资产143,062.95140,702.60143,062.95140,702.60开发支出799,025.94854,386.82799,025.94854,386.82商誉----长期待摊费用398,167.57359,529.80398,167.57359,529.80递延所得税资产----其他非流动资产----非流动资产合计2,987,013.652,990,607.892,987,013.652,990,607.89资产总计53,295,516.3552,294,562.4753,295,516.3552,294,562.47项目期末余额-1期末余额-2期末余额-3期末余额-4项目流动负债:短期借款5,900,000.005,900,000.005,900,000.005,900,000.00交易性金融负债----应付...