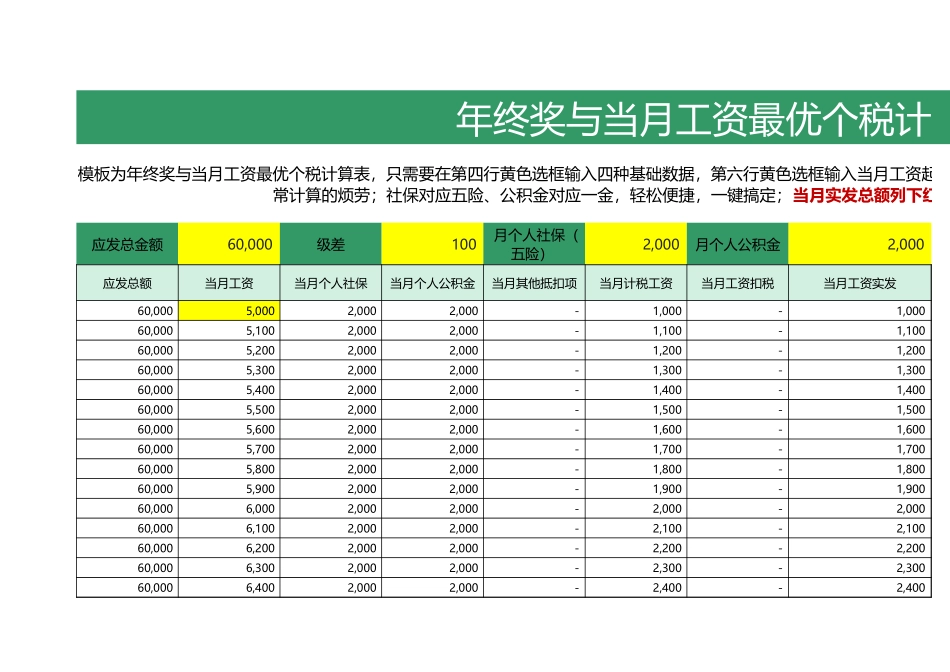

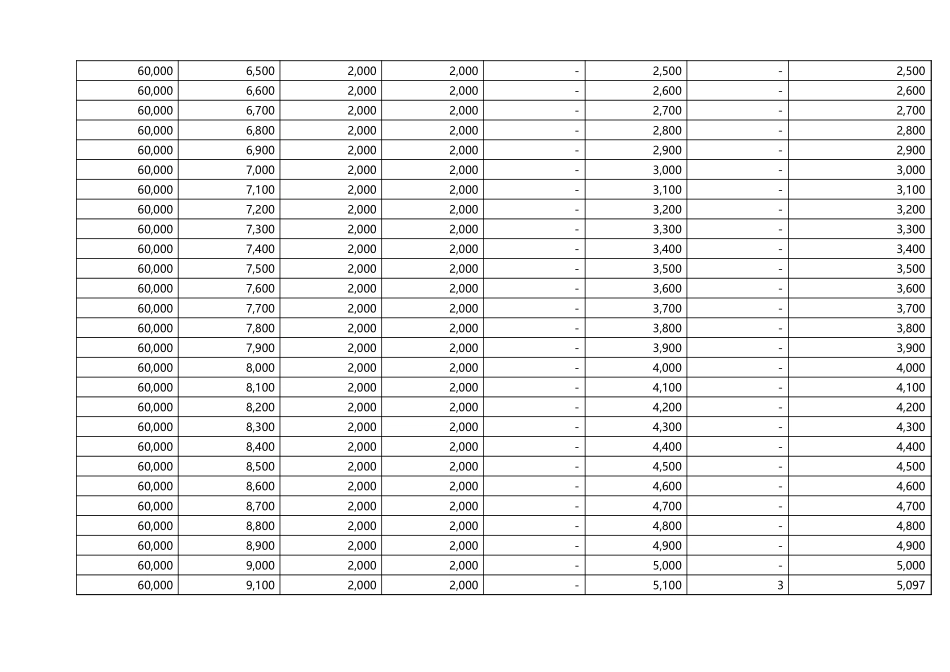

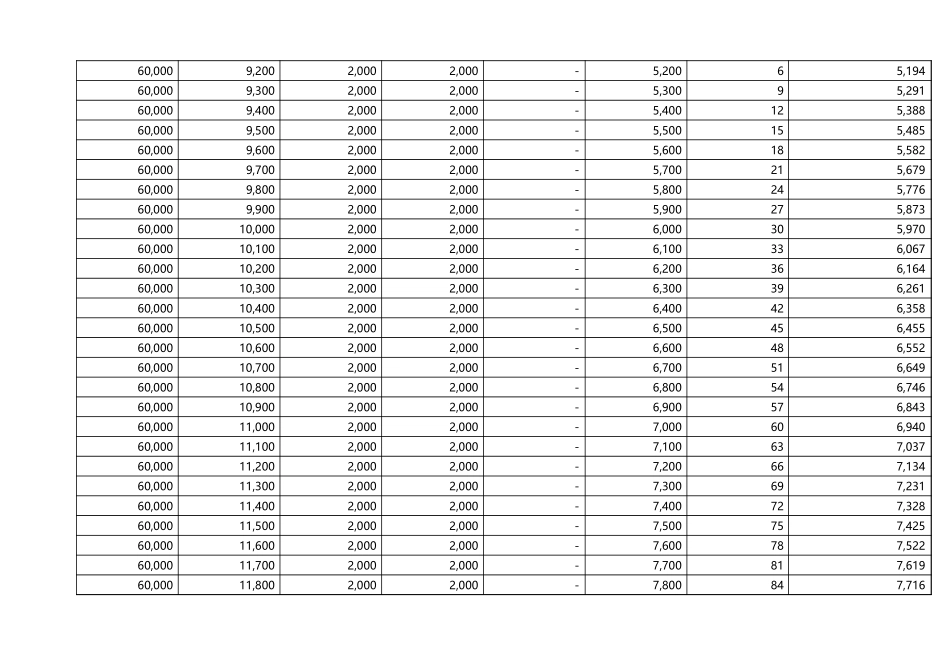

应发总金额60,000级差1002,000月个人公积金2,000应发总额当月工资当月个人社保当月个人公积金当月其他抵扣项当月计税工资当月工资扣税当月工资实发60,0005,0002,0002,000-1,000-1,00060,0005,1002,0002,000-1,100-1,10060,0005,2002,0002,000-1,200-1,20060,0005,3002,0002,000-1,300-1,30060,0005,4002,0002,000-1,400-1,40060,0005,5002,0002,000-1,500-1,50060,0005,6002,0002,000-1,600-1,60060,0005,7002,0002,000-1,700-1,70060,0005,8002,0002,000-1,800-1,80060,0005,9002,0002,000-1,900-1,90060,0006,0002,0002,000-2,000-2,00060,0006,1002,0002,000-2,100-2,10060,0006,2002,0002,000-2,200-2,20060,0006,3002,0002,000-2,300-2,30060,0006,4002,0002,000-2,400-2,400年终奖与当月工资最优个税计算模板为年终奖与当月工资最优个税计算表,只需要在第四行黄色选框输入四种基础数据,第六行黄色选框输入当月工资起始常计算的烦劳;社保对应五险、公积金对应一金,轻松便捷,一键搞定;当月实发总额列下红色月个人社保(五险)60,0006,5002,0002,000-2,500-2,50060,0006,6002,0002,000-2,600-2,60060,0006,7002,0002,000-2,700-2,70060,0006,8002,0002,000-2,800-2,80060,0006,9002,0002,000-2,900-2,90060,0007,0002,0002,000-3,000-3,00060,0007,1002,0002,000-3,100-3,10060,0007,2002,0002,000-3,200-3,20060,0007,3002,0002,000-3,300-3,30060,0007,4002,0002,000-3,400-3,40060,0007,5002,0002,000-3,500-3,50060,0007,6002,0002,000-3,600-3,60060,0007,7002,0002,000-3,700-3,70060,0007,8002,0002,000-3,800-3,80060,0007,9002,0002,000-3,900-3,90060,0008,0002,0002,000-4,000-4,00060,0008,1002,0002,000-4,100-4,10060,0008,2002,0002,000-4,200-4,20060,0008,3002,0002,000-4,300-4,30060,0008,4002,0002,000-4,400-4,40060,0008,5002,0002,000-4,500-4,50060,0008,6002,0002,000-4,600-4,60060,0008,7002,0002,000-4,700-4,70060,0008,8002,0002,000-4,800-4,80060,0008,9002,0002,000-4,900-4,90060,0009,0002,0002,000-5,000-5,00060,0009,1002,0002,000-5,10035,09760,0009,2002,0002,000-5,20065,19460,0009,3002,0002,000-5,30095,29160,0009,4002,0002,000-5,400125,38860,0009,5002,0002,000-5,500155,48560,0009,6002,0002,000-5,600185,58260,0009,7002,0002,000-5,700215,67960,0009,8002,0002,000-5,800245,776...