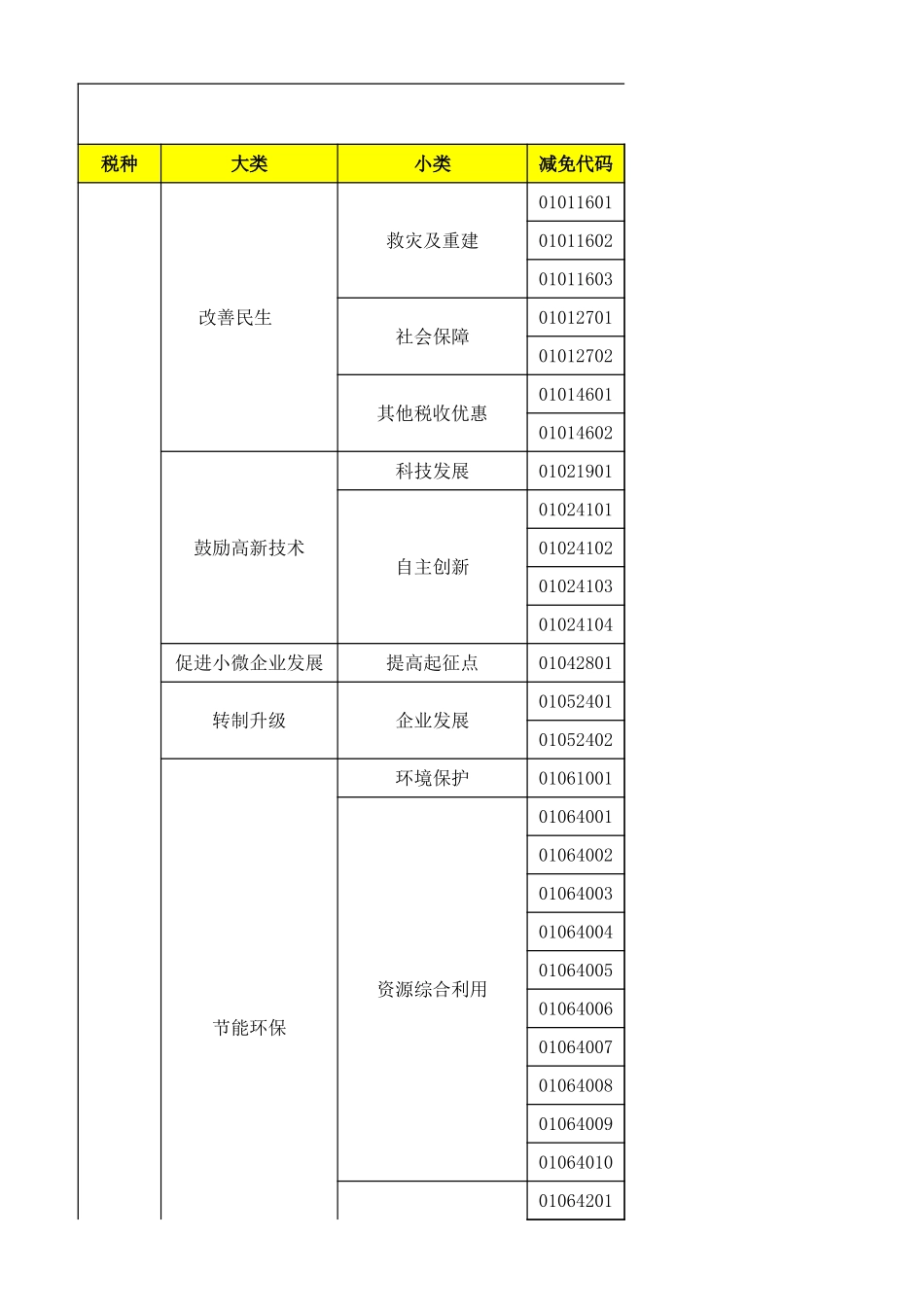

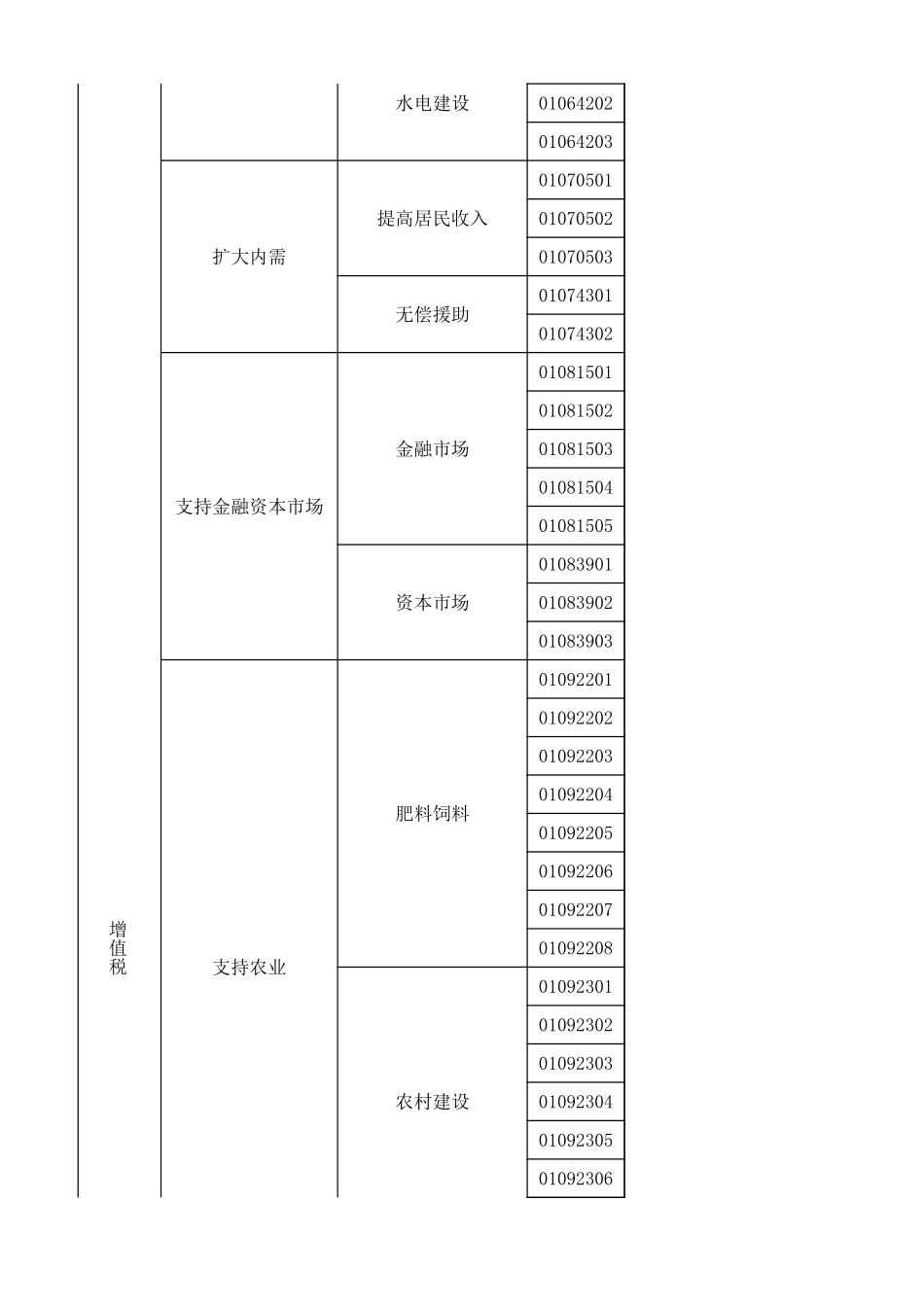

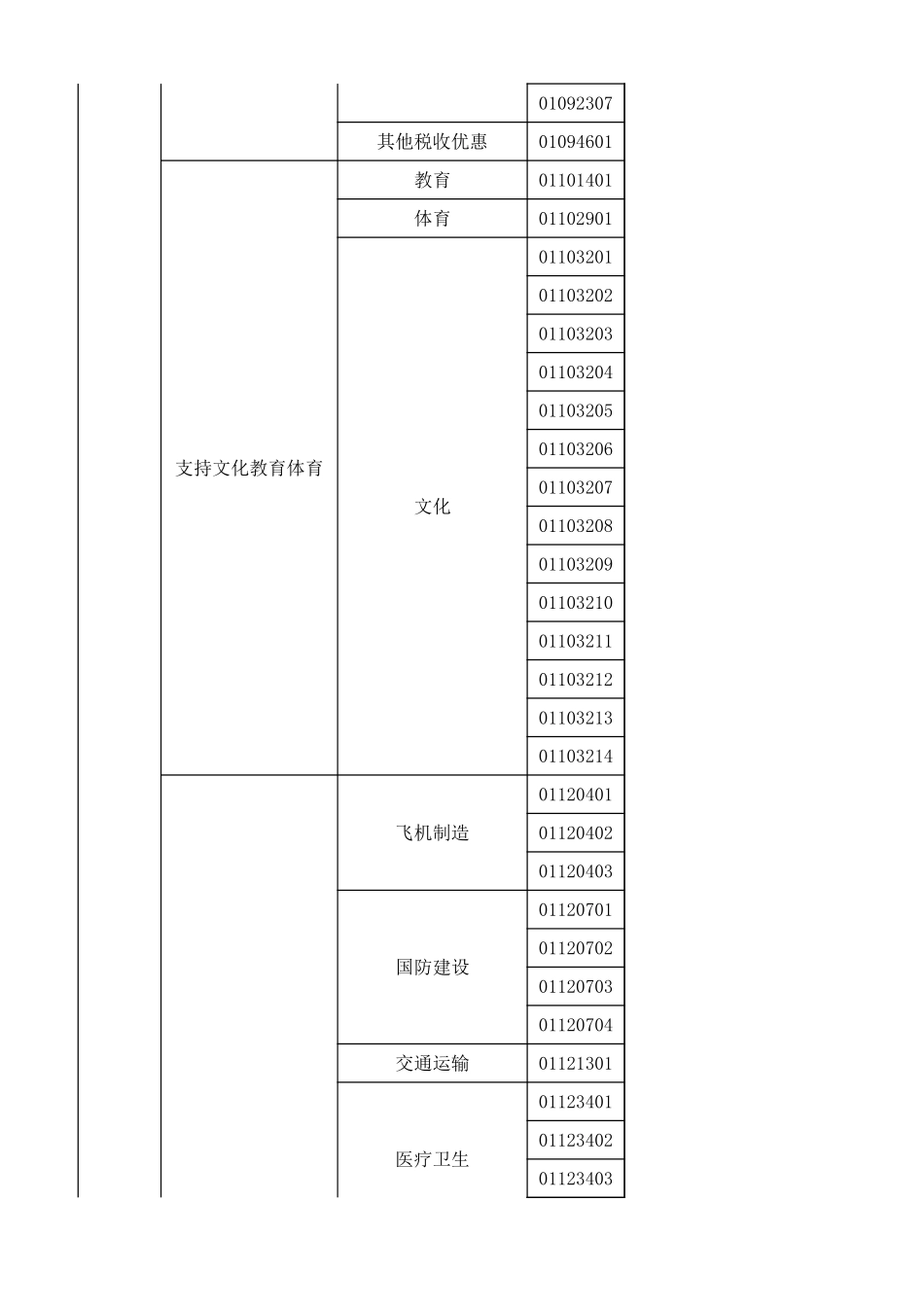

减免税分类及税种大类小类减免代码改善民生救灾及重建010116010101160201011603社会保障0101270101012702其他税收优惠0101460101014602鼓励高新技术科技发展01021901自主创新01024101010241020102410301024104促进小微企业发展提高起征点01042801转制升级企业发展0105240101052402节能环保环境保护01061001资源综合利用01064001010640020106400301064004010640050106400601064007010640080106400901064010水电建设01064201水电建设0106420201064203扩大内需提高居民收入010705010107050201070503无偿援助0107430101074302支持金融资本市场金融市场0108150101081502010815030108150401081505资本市场010839010108390201083903支持农业肥料饲料0109220101092202010922030109220401092205010922060109220701092208农村建设010923010109230201092303010923040109230501092306增值税01092307其他税收优惠01094601支持文化教育体育教育01101401体育01102901文化0110320101103202011032030110320401103205011032060110320701103208011032090110321001103211011032120110321301103214支持其他各项事业飞机制造011204010112040201120403国防建设01120701011207020112070301120704交通运输01121301医疗卫生011234010112340201123403支持其他各项事业医疗卫生01123405其他税收优惠01124601011246020112460301124604011246050112460601124607011246080112460901124610011246110112461201124613节能环保环境保护02061001其他税收优惠02064601支持文化教育体育文化02103201支持其他各项事业交通运输02121301其他税收优惠0212460102124602021246030212460402124605021246060212460702124609彩票03010101救灾及重建0301160103011602消费税改善民生救灾及重建03011603居民住房03011701030117020301170303011704030117050301170603011707军转择业03011801030118020301180303011804社会保障0301270103012702再就业扶持030136010301360203013603其他税收优惠03014601鼓励高新技术技术转让0302120103021202科技发展03021901030219020302190303021904外包服务0302300103023002高新技术030244010302440203024403促进区域发展东部发展030303010303030203030303两岸交流030321010303210203032103西部开发03033301促进小微企业发展其他税收优惠0304460103044602转制升级邮政03053501节能环保资源综合利用03064001支持金融资本市场金融市场03081501030815020308150303081504030...