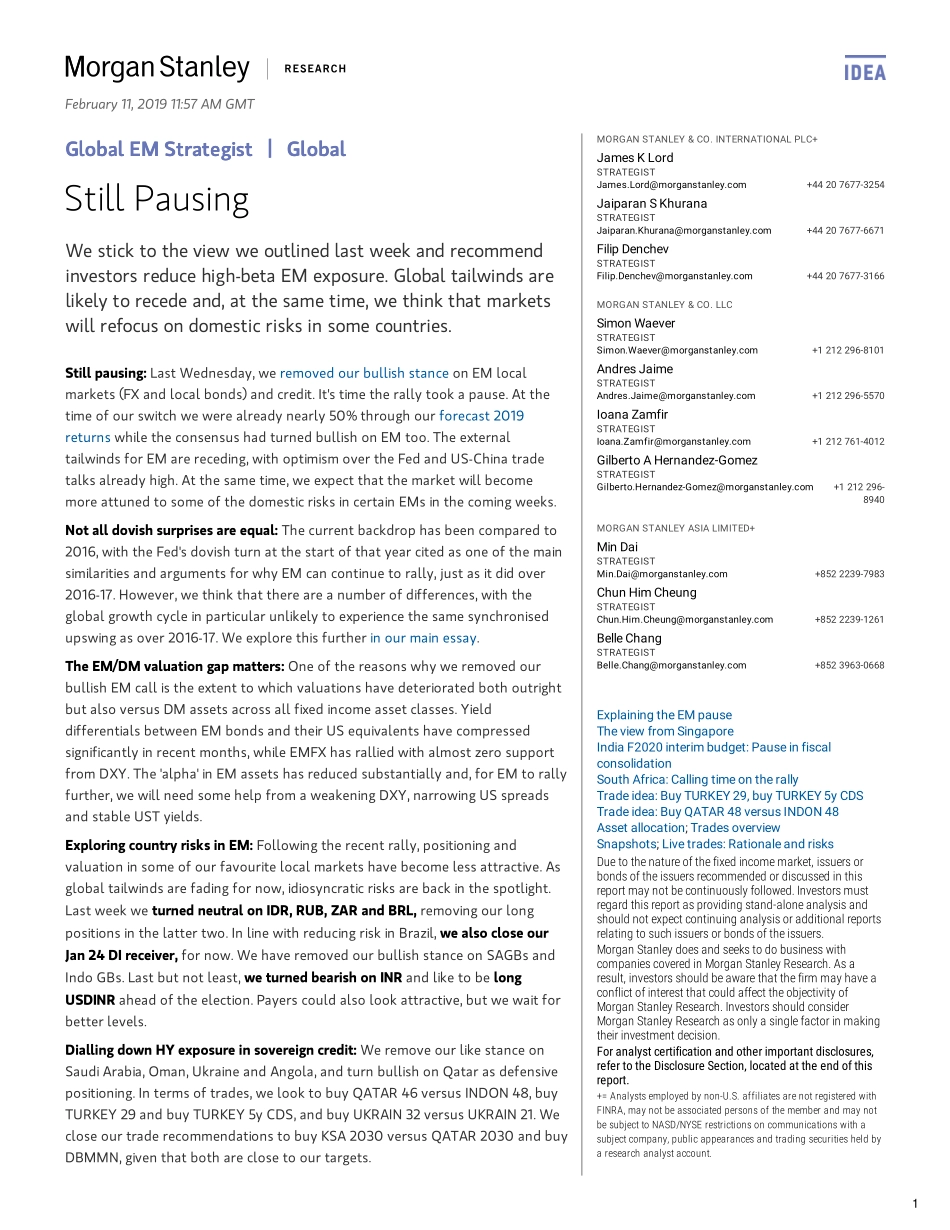

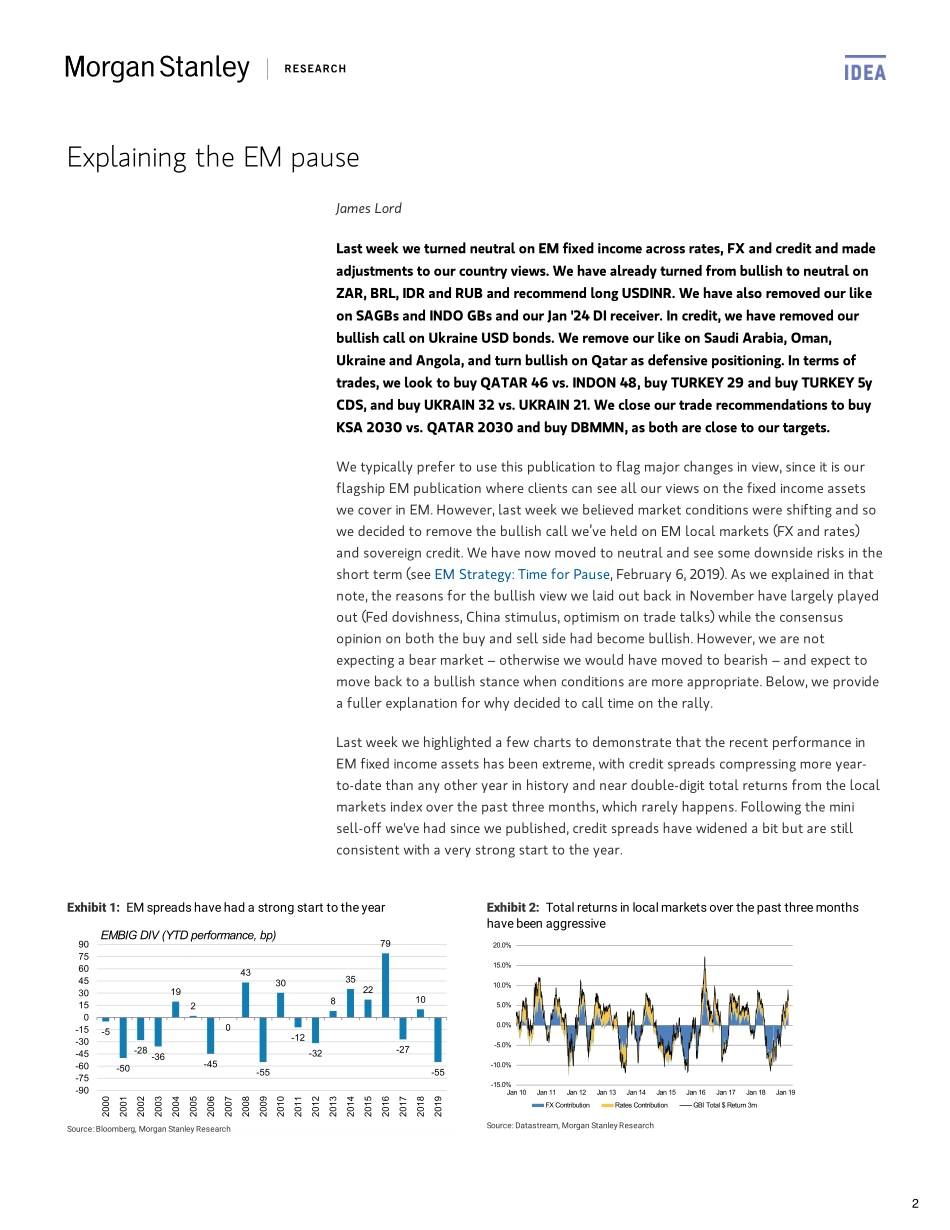

James.Lord@morganstanley.comJaiparan.Khurana@morganstanley.comFilip.Denchev@morganstanley.comSimon.Waever@morganstanley.comAndres.Jaime@morganstanley.comIoana.Zamfir@morganstanley.comGilberto.Hernandez-Gomez@morganstanley.comMin.Dai@morganstanley.comChun.Him.Cheung@morganstanley.comBelle.Chang@morganstanley.comMORGANSTANLEY&CO.INTERNATIONALPLC+JamesKLordSTRATEGIST+44207677-3254JaiparanSKhuranaSTRATEGIST+44207677-6671FilipDenchevSTRATEGIST+44207677-3166MORGANSTANLEY&CO.LLCSimonWaeverSTRATEGIST+1212296-8101AndresJaimeSTRATEGIST+1212296-5570IoanaZamfirSTRATEGIST+1212761-4012GilbertoAHernandez-GomezSTRATEGIST+1212296-8940MORGANSTANLEYASIALIMITED+MinDaiSTRATEGIST+8522239-7983ChunHimCheungSTRATEGIST+8522239-1261BelleChangSTRATEGIST+8523963-0668ExplainingtheEMpauseTheviewfromSingaporeIndiaF2020interimbudget:PauseinfiscalconsolidationSouthAfrica:CallingtimeontherallyTradeidea:BuyTURKEY29,buyTURKEY5yCDSTradeidea:BuyQATAR48versusINDON48Assetallocation;TradesoverviewSnapshots;Livetrades:RationaleandrisksGlobalEMStrategistGlobalEMStrategist||GlobalGlobalStillPausingWesticktotheviewweoutlinedlastweekandrecommendinvestorsreducehigh-betaEMexposure.Globaltailwindsarelikelytorecedeand,atthesametime,wethinkthatmarketswillrefocusondomesticrisksinsomecountries.Stillpausing:LastWednesday,weremovedourbullishstanceonEMlocalmarkets(FXandlocalbonds)andcredit.It'stimetherallytookapause.Atthetimeofourswitchwewerealreadynearly50%throughourforecast2019returnswhiletheconsensushadturnedbullishonEMtoo.TheexternaltailwindsforEMarereceding,withoptimismovertheFedandUS-Chinatradetalksalreadyhigh.Atthesametime,weexpectthatthemarketwillbecomemoreattunedtosomeofthedomesticrisksincertainEMsinthecomingweeks.Notalldovishsurprisesareequal:Thecurrentbackdrophasbeencomparedto2016,withtheFed'sdovishturnatthestartofthatyearcitedasoneofthemainsimilaritiesandargumentsforwhyEMcancontinuetorally,justasitdidover2016-17.However,wethinkthatthereareanumberofdifferences,withtheglobalgrowthcycleinparticularunlikelytoex...