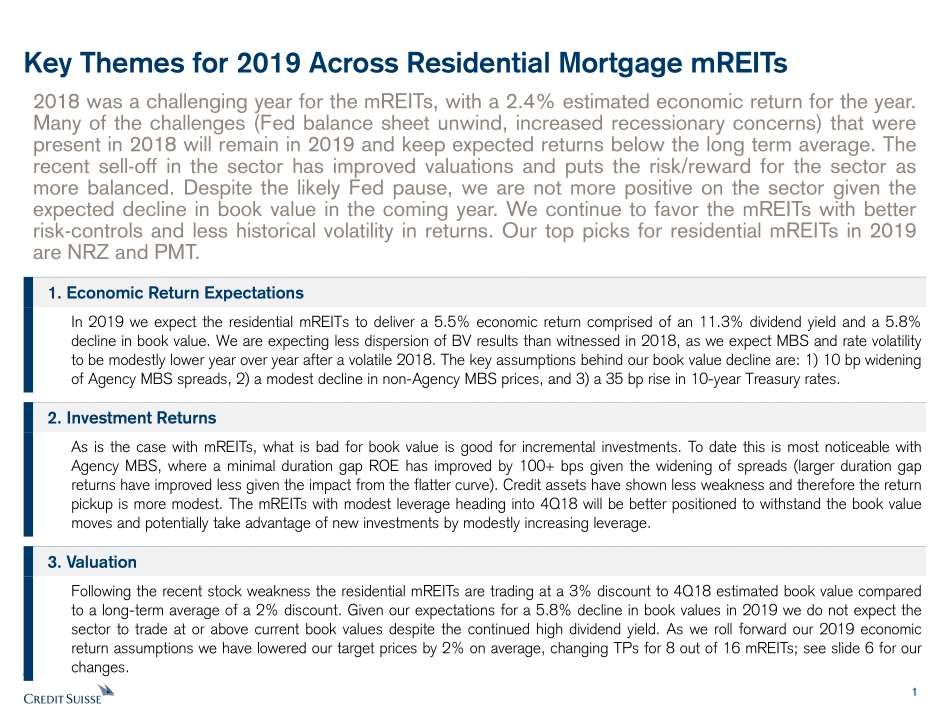

CreditSuisseEquityResearchAmericas/UnitedStatesResidentialMortgageREIT2019Outlook:ReturnstoImproveFromLastYear,butStillBelowAverage;NRZ,PMTTopPicksJanuary4,2019RESEARCHTEAMDouglasHarter,CFAResearchAnalyst(212)538-5983douglas.harter@credit-suisse.comSamChoe,CFAResearchAssociate(212)325-5957samuel.choe@credit-suisse.comJoshBolton,CFAResearchAssociate(212)325-8963joshua.bolton@credit-suisse.comDISCLOSUREAPPENDIXATTHEBACKOFTHISREPORTCONTAINSIMPORTANTDISCLOSURES,ANALYSTCERTIFICATIONS,LEGALENTITYDISCLOSUREANDTHESTATUSOFNON-USANALYSTS.USDisclosure:CreditSuissedoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethattheFirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision1KeyThemesfor2019AcrossResidentialMortgagemREITs1.EconomicReturnExpectationsIn2019weexpecttheresidentialmREITstodelivera5.5%economicreturncomprisedofan11.3%dividendyieldanda5.8%declineinbookvalue.WeareexpectinglessdispersionofBVresultsthanwitnessedin2018,asweexpectMBSandratevolatilitytobemodestlyloweryearoveryearafteravolatile2018.Thekeyassumptionsbehindourbookvaluedeclineare:1)10bpwideningofAgencyMBSspreads,2)amodestdeclineinnon-AgencyMBSprices,and3)a35bprisein10-yearTreasuryrates.2.InvestmentReturnsAsisthecasewithmREITs,whatisbadforbookvalueisgoodforincrementalinvestments.TodatethisismostnoticeablewithAgencyMBS,whereaminimaldurationgapROEhasimprovedby100+bpsgiventhewideningofspreads(largerdurationgapreturnshaveimprovedlessgiventheimpactfromtheflattercurve).Creditassetshaveshownlessweaknessandthereforethereturnpickupismoremodest.ThemREITswithmodestleverageheadinginto4Q18willbebetterpositionedtowithstandthebookvaluemovesandpotentiallytakeadvantageofnewinvestmentsbymodestlyincreasingleverage.3.ValuationFollowingtherecentstockweaknesstheresidentialmREITsaretradingata3%discountto4Q18estimatedbookvaluecomparedtoalong-termaverageofa2%discount.Givenourexpectationsfor...