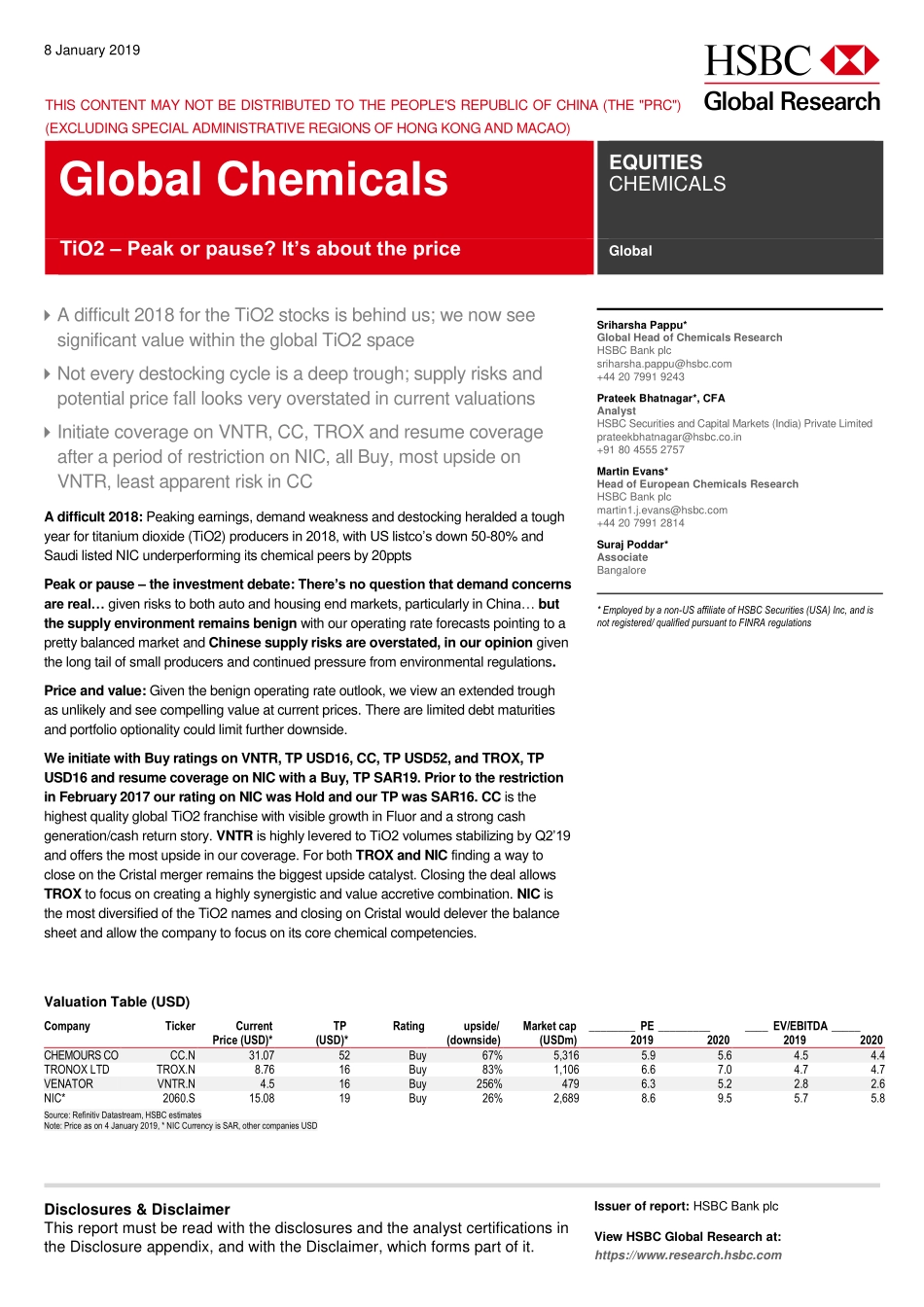

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:HSBCBankplcViewHSBCGlobalResearchat:https://www.research.hsbc.comTHISCONTENTMAYNOTBEDISTRIBUTEDTOTHEPEOPLE'SREPUBLICOFCHINA(THE"PRC")(EXCLUDINGSPECIALADMINISTRATIVEREGIONSOFHONGKONGANDMACAO)Adifficult2018fortheTiO2stocksisbehindus;wenowseesignificantvaluewithintheglobalTiO2spaceNoteverydestockingcycleisadeeptrough;supplyrisksandpotentialpricefalllooksveryoverstatedincurrentvaluationsInitiatecoverageonVNTR,CC,TROXandresumecoverageafteraperiodofrestrictiononNIC,allBuy,mostupsideonVNTR,leastapparentriskinCCAdifficult2018:Peakingearnings,demandweaknessanddestockingheraldedatoughyearfortitaniumdioxide(TiO2)producersin2018,withUSlistco’sdown50-80%andSaudilistedNICunderperformingitschemicalpeersby20pptsPeakorpause–theinvestmentdebate:There’snoquestionthatdemandconcernsarereal…givenriskstobothautoandhousingendmarkets,particularlyinChina…butthesupplyenvironmentremainsbenignwithouroperatingrateforecastspointingtoaprettybalancedmarketandChinesesupplyrisksareoverstated,inouropiniongiventhelongtailofsmallproducersandcontinuedpressurefromenvironmentalregulations.Priceandvalue:Giventhebenignoperatingrateoutlook,weviewanextendedtroughasunlikelyandseecompellingvalueatcurrentprices.Therearelimiteddebtmaturitiesandportfoliooptionalitycouldlimitfurtherdownside.WeinitiatewithBuyratingsonVNTR,TPUSD16,CC,TPUSD52,andTROX,TPUSD16andresumecoverageonNICwithaBuy,TPSAR19.PriortotherestrictioninFebruary2017ourratingonNICwasHoldandourTPwasSAR16.CCisthehighestqualityglobalTiO2franchisewithvisiblegrowthinFluorandastrongcashgeneration/cashreturnstory.VNTRishighlyleveredtoTiO2volumesstabilizingbyQ2’19andoffersthemostupsideinourcoverage.ForbothTROXandNICfindingawaytocloseontheCristalmergerremainsthebiggestupsidecatalyst.ClosingthedealallowsTROXtofocusoncreatingahighlysynergisticandvalueaccretivecombination.NICisth...