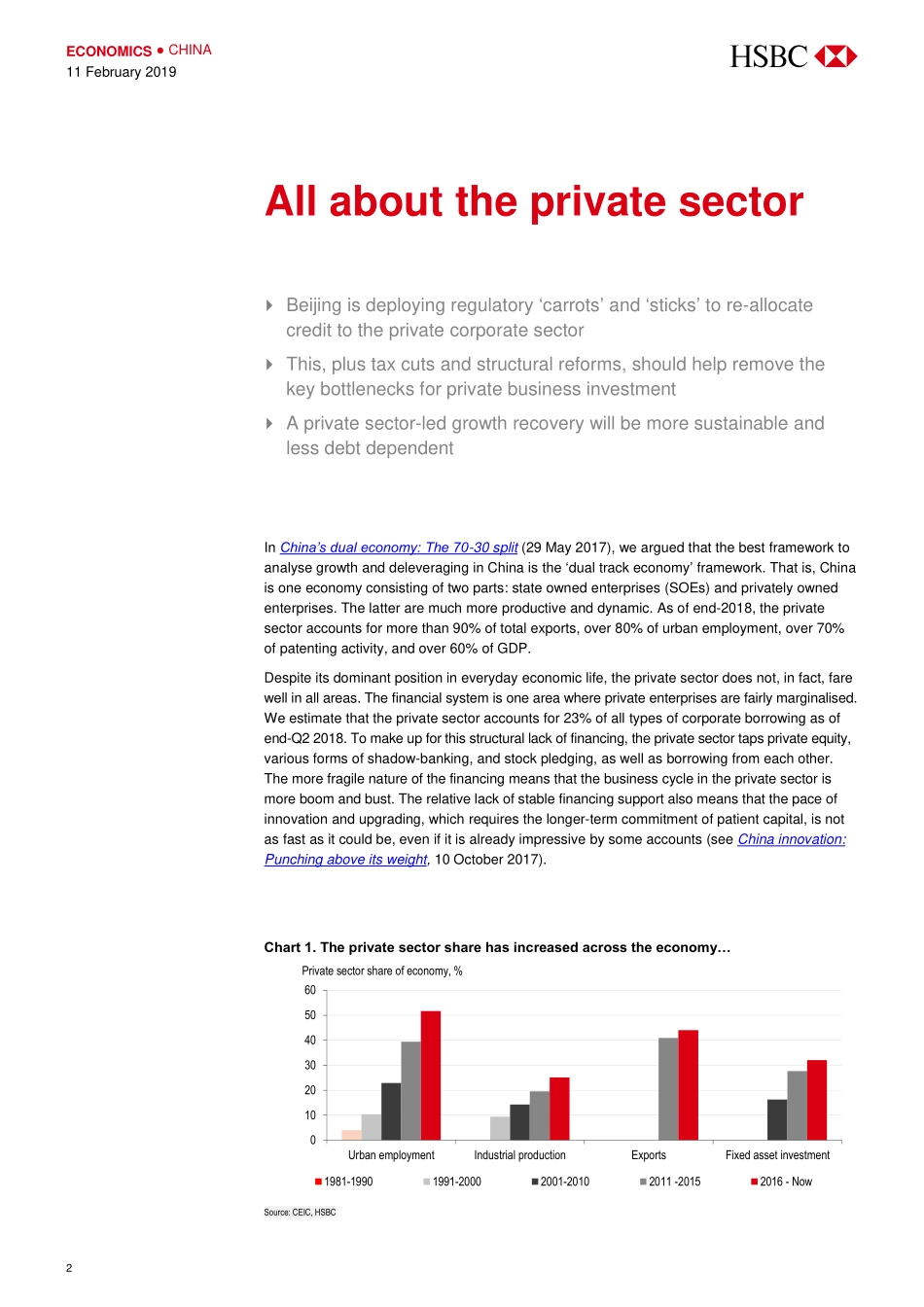

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:TheHongkongandShanghaiBankingCorporationLimitedViewHSBCGlobalResearchat:https://www.research.hsbc.comHSBCChinaConference201915-17May,ShenzhenRegisternowPolicyeasingthistimetargetsmainlytheprivatecorporatesectorratherthanSOEsandthepropertymarketCombinedwithreformsaimingatlevellingtheplayfield,theeasingalleviatesmajorconstraintsonprivate-sectorbusinessinvestment,benefitingmorethan80%ofurbanworkersItalsore-allocatescapitaltomoreefficientsectors–thekeytodeleveragingBeijinghasalreadykick-startedpolicyeasingtooffsettheheadwindsthatareslowingChina’seconomicgrowth.ThisisthefourthroundofeasingsincetheGlobalFinancialCrisis.Webelieveitwillworktomakegrowthsustainable.Yet,onequestionclientskeepaskingiswhetherthiswillbeareplayofthedebt-fuelledreboundinpropertyandconstructionthatwesawinpreviouscycles,whichnotonlywereshortlivedbutalsoworsenedthedebtproblem.Webelievethistimeisdifferent.First,unlikepreviousroundsofeasing,themonetaryandfiscalstimulusnowistargetingmainlytheprivatecorporatesector,notthehighlyleveragedpropertyandstate-ownedenterprises(SOEs).ThePBoCwillcontinuetoinjectliquidityintothebankingsystem.AlthoughbankstraditionallyprefertolendtoSOEsandbigprojects,authoritiesthistimearedeployingamixofregulatory‘carrots’and‘sticks’toguidebanks’loanallocationtoprivateenterprises.Weestimatethat,ifpolicymakersachievetheir‘softtarget’,newloanstotheprivatebusinesssectorcouldrisetoRMB6.1trnin2019(fromRMB4.6trn).Therearealsocreditenhancementtoolsandtargetedliquidityassistancetoincentivisebankstolendmore.Second,althoughBeijinghasgivenlocalgovernmentsmoreroomtoissuebondstoselectivelyfinanceinfrastructureprojects,corporatetaxcutsarenowthemainfocusoffiscalstimulus.Afterloweringpersonalincometaxeslastyear,weexpectBeijingtoannounceapackageofVATandsocialsecuritytaxcutsinthecomingmonths,tototalaroundRMB1.3...