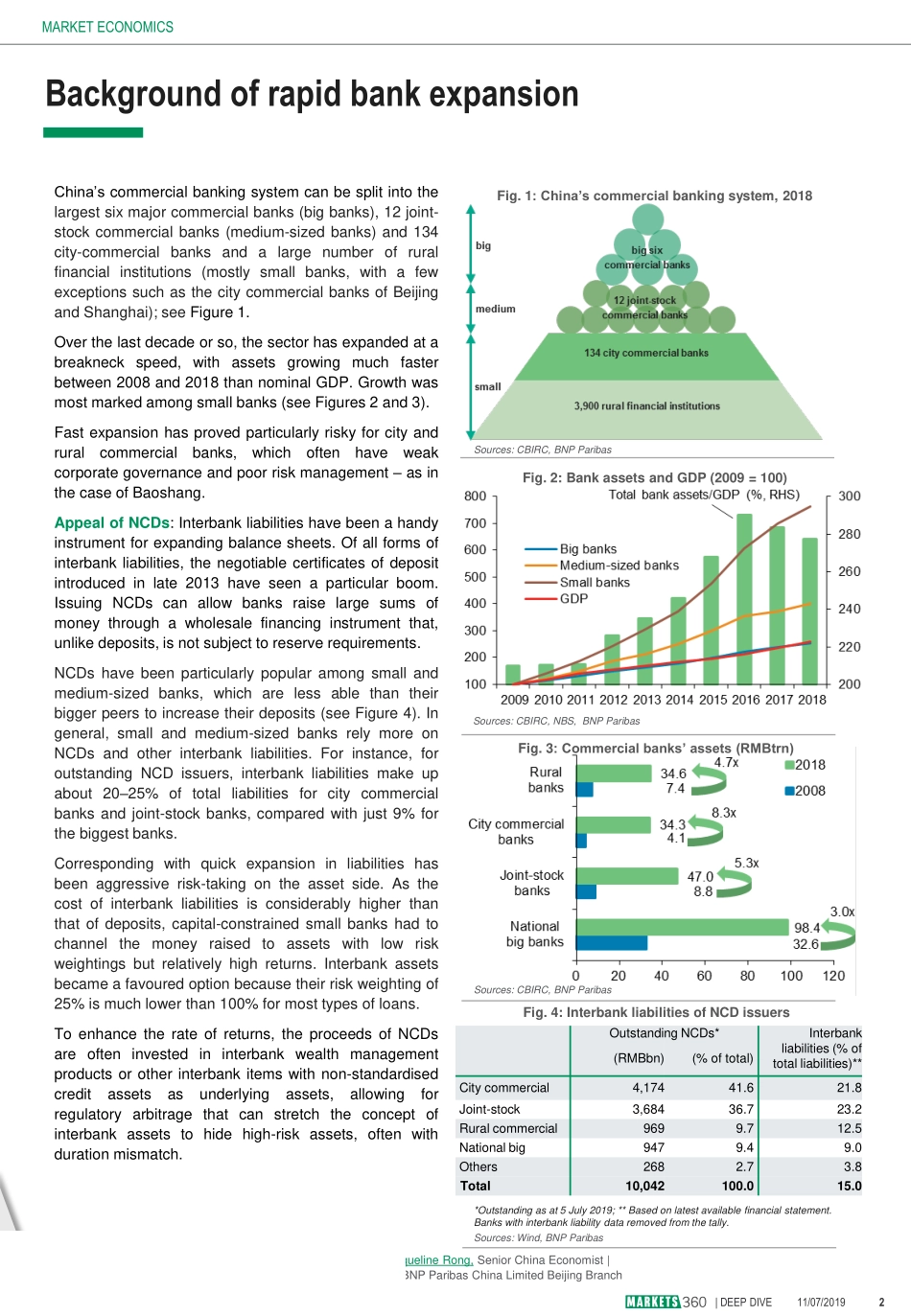

|DEEPDIVE11/07/20191DEEPDIVE|CHINA11July2019China–SharpeningcreditriskdifferentiationKEYMESSAGESThefailureofBaoshangBankhashadaprofoundimpactontheoperationandliquidityofChina’sfinancialsector,inourview.Theinitialmarketreactionsuggestshighfinancialrisksandmarketvulnerabilities,whichweexpectauthoritiestoaddressintheshortterm.Onbalance,wethinktheimplicationsarepositive.Theauthoritieshavestartedtotackletheimplicitguaranteeproblemandarisk-basedpricingmechanismhasbeguntowork.PleaserefertoimportantinformationattheendofthisreportMARKETECONOMICS|EMSTRATEGYXDChen,ChiefChinaEconomist|JacquelineRong,SeniorChinaEconomist|TianheJi,HeadofFXLMStrategyforGlobalMarkets,China|JiaxiuJiang,JuniorChinaEconomist|BNPParibasChinaLimitedBeijingBranchTheregulators’takeoverofanInnerMongolianbankstrugglingwithhighcreditrisktriggeredmarketjittersovertheChineseauthorities’commitmenttostructuraldeleveraging.Othersmallcommercialbanksandnon-bankfinancialinstitutionsimmediatelyhaddifficultiesaccessingliquidity.MaterialisingcounterpartyriskssawlendersturnmorediscerningaboutbondsandcreditsusedascollateralbysmallcommercialbanksandNBFIs.ThefailureofBaoshangBankpointedtobroadervulnerabilities.Tocalmuneaseandrestoreconfidence,therefore,theauthoritieshavereassuredthemarketthatBaoshangwasanindividualcaseratherthanpartofasystematicresolutionforallsmallandmedium-sizedbanksthathaveaccumulatedhighfinancialrisks.InadditiontoprotectingBaoshang’sinvestorsandcreditorsupto99.98%,theauthoritieshavetakensystem-widemeasures.ThePeople’sBankofChinaandtheChinaSecuritiesRegulatoryCommissionareincreasingliquiditysupplythroughopenmarketoperationsandtargetedliquiditysupportforsmallbanksandNBFIs.Asaresult,financialjittershavelargelyabatedandliquiditysupplyisample.WethinktheBaoshangcasehashadanumberofpositiveimpacts.Theso-calledimplicitguaranteeofbankshasbeenbroken,albeitnotasadeliberatepolicyaction.China’sdebtdefaultratioisartificiallylow,inourview,comparedwithdevelopedmarketsorevenemergingmarkets.Wethinkthefunctionin...