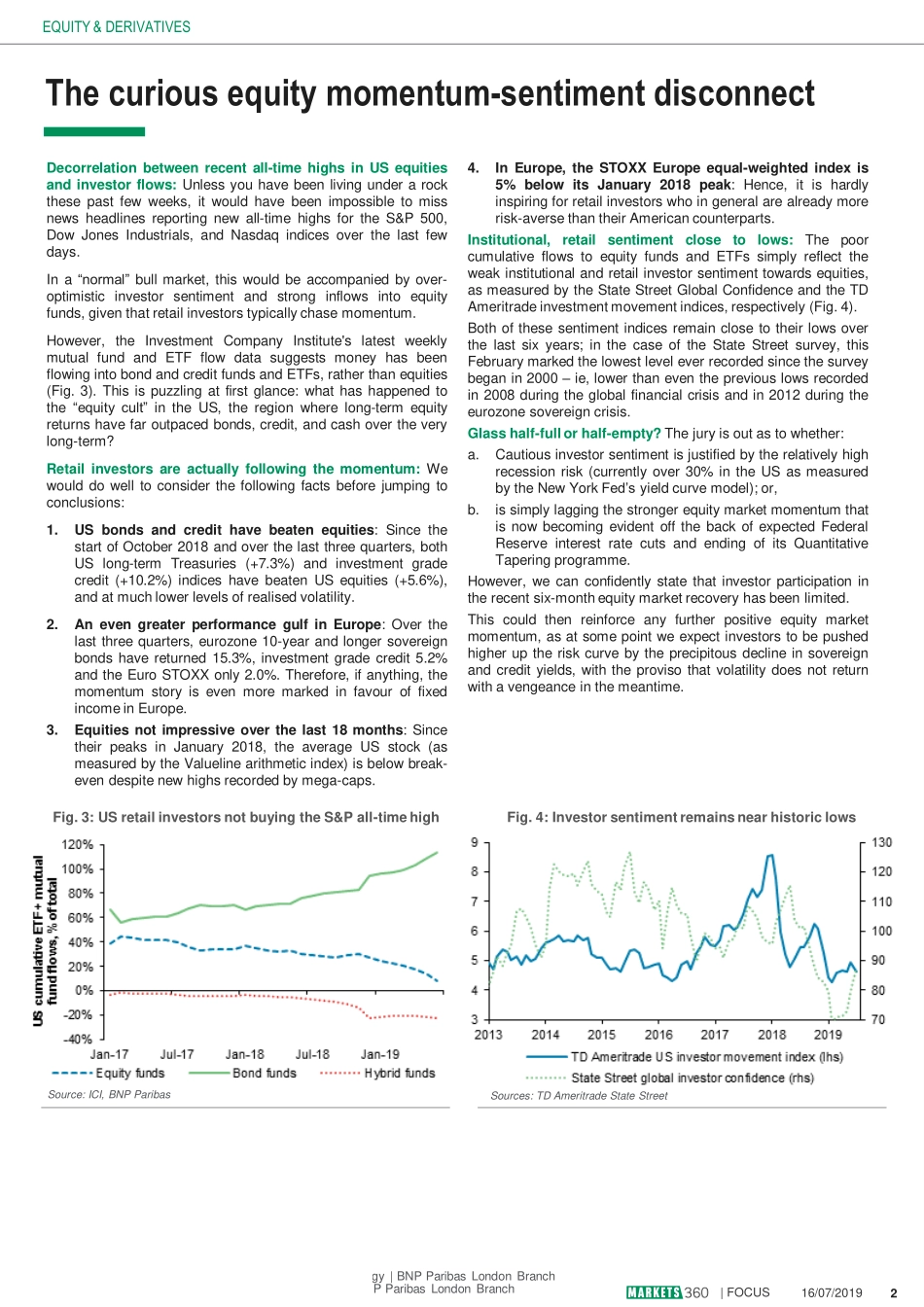

Everyonelikesbonds:EvenastheS&P500surpassed3000overthepastweek,mostfundsflowdatacontinuetosuggestinvestorpreferenceforbondsoverequities.Sincethebeginningof2019,cumulativefundsflowintofixedincomeETFshasbeenfourtimesmorethanintoequities(asapercentofAUM).Bothintheshort-term(four-weeks)andlong-term(26-weeks),flowsintoequitieshaveunderperformedbonds.Whoisbuyingequities?Thebetaofglobalmacrohedgefunds/CTAstoequitiessuggeststhatsystematicstrategieshaveincreasedtheirallocationinequities.Therecentdeclineinequity-realizedvolatilitytosingledigitshasdriveninflowsfromvolatility-controlledfundsintoequities.Corporates,bywayofbuybacks,seemtobethesecondlargebuyersofequities.Eurozoneflowsdecoupleeconomicsurprises:Flowsintoequitiestightlyfollowtheeconomicsurpriseindexinmostregions.However,EZflowsasanexceptionfallbehindbettereconomicsurprisesintheeuroarea.Sectorbiastodefensives.Evenwiththerecentreboundinequities,investorspreferdefensivesliketelecom,consumerstaples,andutilities–thetopthreesectorsintermsoffour-weekcumulativeflows.Infact,thetelecomsector,whichhasunderperformedthemostinEuropesincethestartof2019,haveactuallyseenthehighestcumulativeflows.1FOCUS|EUROPE16July2019KEYMESSAGESMutualfundsandETFsflowdatasuggestinvestorshavebeenbuyingfixedincomeattheexpenseofequitiessincethestartoftheyear.Thelargestbuyersofequitiesappeartobesystematicstrategieslikevolatility-controlledfunds,andcorporatesthemselvesbywayofbuybacks.ETFinvestorsseemtopreferbondsensitivedefensivesectorstocyclicalsintheequityspace.Fundsflowdatacontinuetoshowlate-cycledynamicsbeingplayedoutininvestors'portfolios.Investorswhoagreewithourviewthatwehavejustenteredalongendcyclemayconsiderourlatecyclelong/shortbasket(seeEQDEurope:Lateinthegame).EQUITY&DERIVATIVESContentsPage2:Thecuriousequitymomentum-sentimentdisconnectPage3:ETFflowslandscapePage4:EquityETFs–RegionaloverviewPage5:FixedIncomeETFs–RegionaloverviewPage6:EquityETFs–FlowvssentimentPage7:EquityETFs–Style&sizePage8-10:EquityETFs–SectorsPage11-12:FixedIncomeETF...