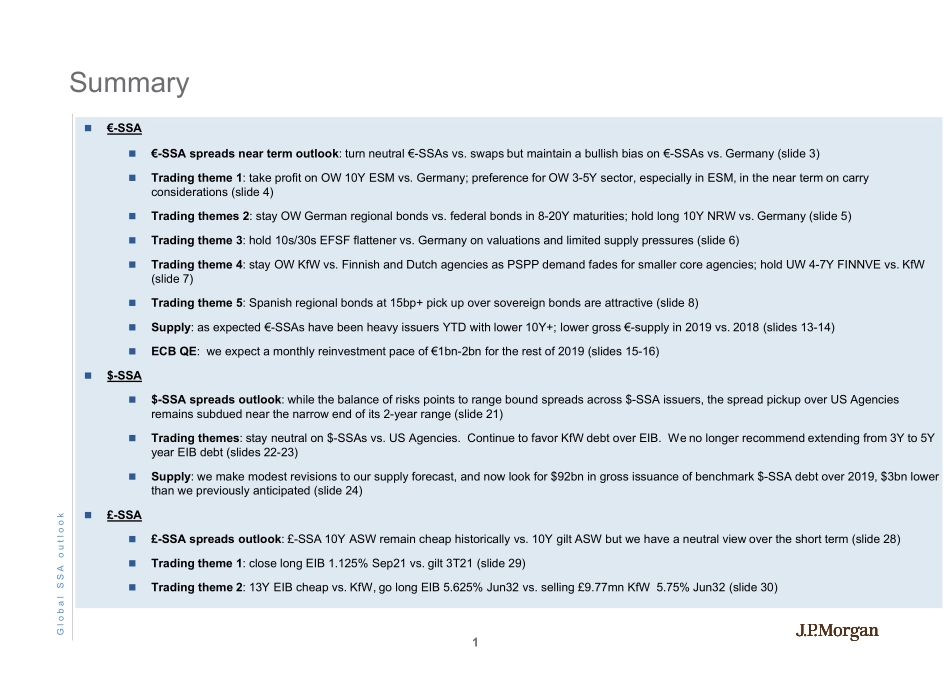

GlobalSSAFeb19outlook:goforcarryin€-SSAvsDEMGlobalRatesStrategy20February2019AdityaChordiaAC(44-20)7134-2132aditya.x.chordia@jpmorgan.comJ.P.MorganSecuritiesplcGianlucaSalford(44-20)7134-1692gianluca.salford@jpmorgan.comJ.P.MorganSecuritiesplcACIndicatescertifyinganalyst.Seelastpageforanalystcertificationandimportantdisclosures.PhoebeWhite(1-212)834-3092phoebe.a.white@jpmorgan.comJ.P.MorganSecuritiesLLCLukeChang(1-212)834-7562luke.chang@jpmorgan.comJ.P.MorganSecuritiesLLCFrancisDiamond(44-20)7134-1504francis.diamond@jpmorgan.comJ.P.MorganSecuritiesplcAntoineGaveau(44-20)7134-2880antoine.gaveau@jpmorgan.comJ.P.MorganSecuritiesplcGlobalSSAoutlook1Summary€-SSA€-SSAspreadsneartermoutlook:turnneutral€-SSAsvs.swapsbutmaintainabullishbiason€-SSAsvs.Germany(slide3)Tradingtheme1:takeprofitonOW10YESMvs.Germany;preferenceforOW3-5Ysector,especiallyinESM,intheneartermoncarryconsiderations(slide4)Tradingthemes2:stayOWGermanregionalbondsvs.federalbondsin8-20Ymaturities;holdlong10YNRWvs.Germany(slide5)Tradingtheme3:hold10s/30sEFSFflattenervs.Germanyonvaluationsandlimitedsupplypressures(slide6)Tradingtheme4:stayOWKfWvs.FinnishandDutchagenciesasPSPPdemandfadesforsmallercoreagencies;holdUW4-7YFINNVEvs.KfW(slide7)Tradingtheme5:Spanishregionalbondsat15bp+pickupoversovereignbondsareattractive(slide8)Supply:asexpected€-SSAshavebeenheavyissuersYTDwithlower10Y+;lowergross€-supplyin2019vs.2018(slides13-14)ECBQE:weexpectamonthlyreinvestmentpaceof€1bn-2bnfortherestof2019(slides15-16)$-SSA$-SSAspreadsoutlook:whilethebalanceofriskspointstorangeboundspreadsacross$-SSAissuers,thespreadpickupoverUSAgenciesremainssubduednearthenarrowendofits2-yearrange(slide21)Tradingthemes:stayneutralon$-SSAsvs.USAgencies.ContinuetofavorKfWdebtoverEIB.Wenolongerrecommendextendingfrom3Yto5YyearEIBdebt(slides22-23)Supply:wemakemodestrevisionstooursupplyforecast,andnowlookfor$92bningrossissuanceofbenchmark$-SSAdebtover2019,$3bnlowerthanwepreviouslyanticipated(slide24)£-SSA£-S...