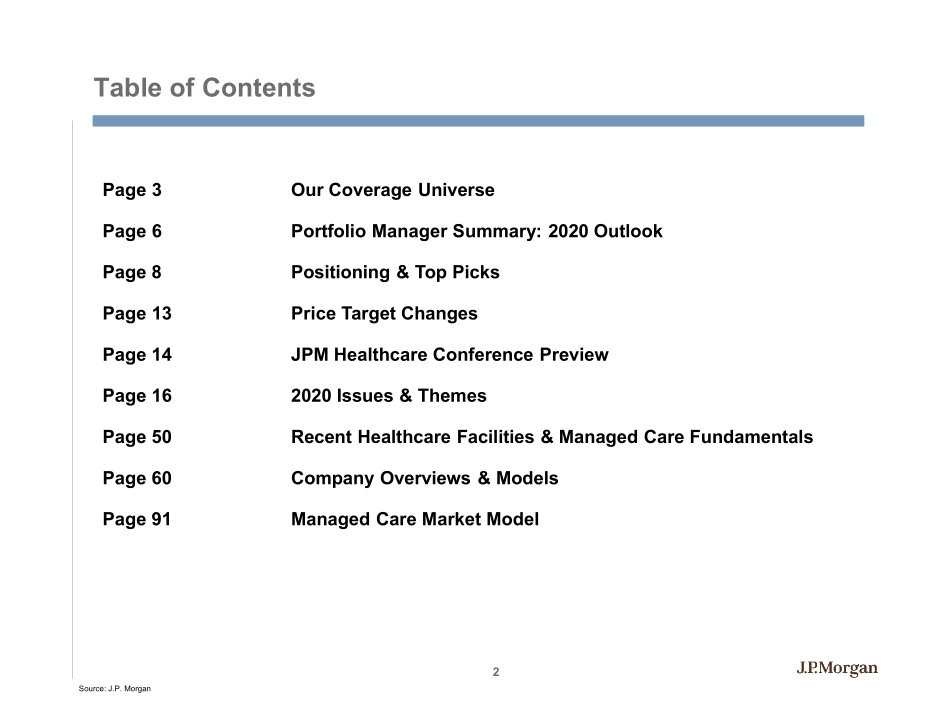

1NorthAmericaEquityResearchDecember20,2019HealthcareFacilities&ManagedCareGaryTaylorAC212-622-6600gary.taylor@jpmorgan.comJ.P.MorganSecuritiesLLCHEALTHCAREFACILITIES&MANAGEDCAREBullish2020OutlookDiversifiedHMOs|GovnHMOs|AcuteCare|Sub-Acute|Outpatient|OutsourcedServicesAnthonyMakdessi212-622-3682anthony.makdessi@jpmorgan.comJ.P.MorganSecuritiesLLCSeetheendpagesofthispresentationforanalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.ClientConferencecallFridayDecember20,201910amEasternTimeContactusfordial-indetails.MichaelHa212-622-9009michael.ha@jpmorgan.comJ.P.MorganSecuritiesLLC**CorrectedVersion–Wehavecorrectedslides20,66,74and82.**2TableofContentsSource:J.P.MorganPage3OurCoverageUniversePage6PortfolioManagerSummary:2020OutlookPage8Positioning&TopPicksPage13PriceTargetChangesPage14JPMHealthcareConferencePreviewPage162020Issues&ThemesPage50RecentHealthcareFacilities&ManagedCareFundamentalsPage60CompanyOverviews&ModelsPage91ManagedCareMarketModel3OurCoverageUniverseSource:J.P.Morgan12/18/2019JPMEPSGrowthP/EEV/EBITDACompany/SubsectorTickerPriceTargetMktCapRatingC'19EC'20EC'21EC'19EC'20EC'21EC'19EC'20EC'21EAcuteCareHospitalsCommunityHealthCYH$3.04na$347UW(2%)19%(5%)------8.5x8.5x8.3xHCAHCA$144.08$186$50,068OW13%12%11%13.8x12.3x11.2x9.1x8.6x8.1xTenetHealthcareTHC$37.98$31$3,988UW45%(10%)3%14.2x15.8x15.4x8.1x8.1x8.0xTotalMarketCap$54,402Median:5%9%(1%)14.0x14.1x13.3x8.5x8.5x8.1xSub-AcuteCareAcadiaHealthcareACHC$33.33$35$2,928N(15%)7%9%16.8x15.8x14.6x10.3x9.8x9.2xUniversalHealthServicesUHS$141.65$164$12,515N5%5%5%14.4x13.7x13.0x9.1x8.8x8.6xTotalMarketCap$15,444Median:(5%)6%7%15.6x14.8x13.8x9.7x9.3x8.9xOutpatientCareDavitaIncDVA$73.45$75$9,835N57%3%24%13.9x13.4x10.8x7.8x8.7x8.1x...