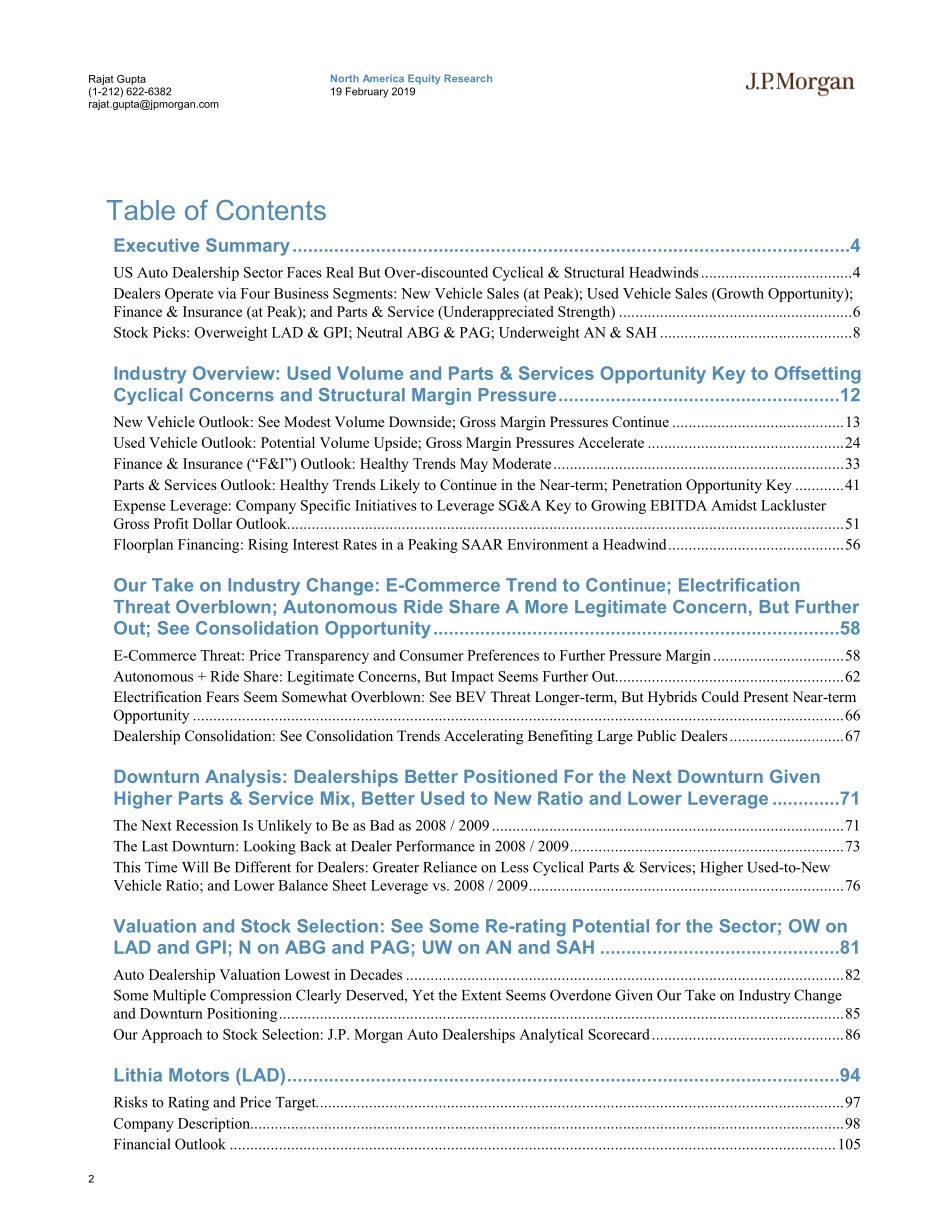

www.jpmorganmarkets.comNorthAmericaEquityResearch19February2019EquityRatingsandPriceTargetsMktCapRatingPriceTargetCompanyTicker($mn)Price($)CurPrevCurEndDatePrevEndDateLithiaMotorsLADUS2,213.1587.97OW—112.00Dec-19——Group1AutomotiveGPIUS1,254.3661.77OW—77.00Dec-19——AsburyAutomotiveABGUS1,495.5271.90N—82.00Dec-19——PenskeAutomotivePAGUS3,796.9044.15N—51.00Dec-19——AutoNationANUS3,622.7239.08UW—40.00Dec-19——SonicAutomotiveSAHUS679.0615.87UW—14.00Dec-19——Source:Companydata,Bloomberg,J.P.Morganestimates.n/c=nochange.Allpricesasof15Feb19.USAutoDealershipsDecade-LowValuationsOver-DiscountIndustryHeadwinds;InitiateLAD&GPIatOW,ABG&PAGatN,andAN&SAHatUWAutos&AutoPartsRajatGuptaAC(1-212)622-6382rajat.gupta@jpmorgan.comRyanBrinkman(1-212)622-6581ryan.j.brinkman@jpmorgan.comDanielJWon(1-212)622-3221daniel.j.won@jpmorgan.comJ.P.MorganSecuritiesLLCSeepage232foranalystcertificationandimportantdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.WeinitiatecoverageontheUSAutoDealershipsectorwithabalancedviewontheindustrybutamoreconstructiveviewonthestocks,acknowledgingvariouscyclicalandstructuralindustryheadwinds,whilebelievingneardecade-lowvaluationssuggestanover-discountingofthesetrendsbyinvestors.WerecommendOverweight-ratedLithiaMotors(LAD)andGroup1Automotive(GPI)tobenefitthemostfromapotentialsectorre-rating.ThelasttimeUSAutoDealershipstockstradednearthislowofarelativeearningsmultiplewasduringthebeginningofthefinancialcrisis,whentheUSeconomyandautoindustrywerebothreeling.Investorconcernstodayseemtwo-fold:(1)fearofapotentialdownturnintheeconomyortheautoindustryfromwhatwouldappeartobe“asgoodasitcanget”levels;and(2)fearofthepotentialthreattodealershipprofitsfromindustrychangeintheareasofe-commerce,vehicleelectrification,andautonomous/ride-...