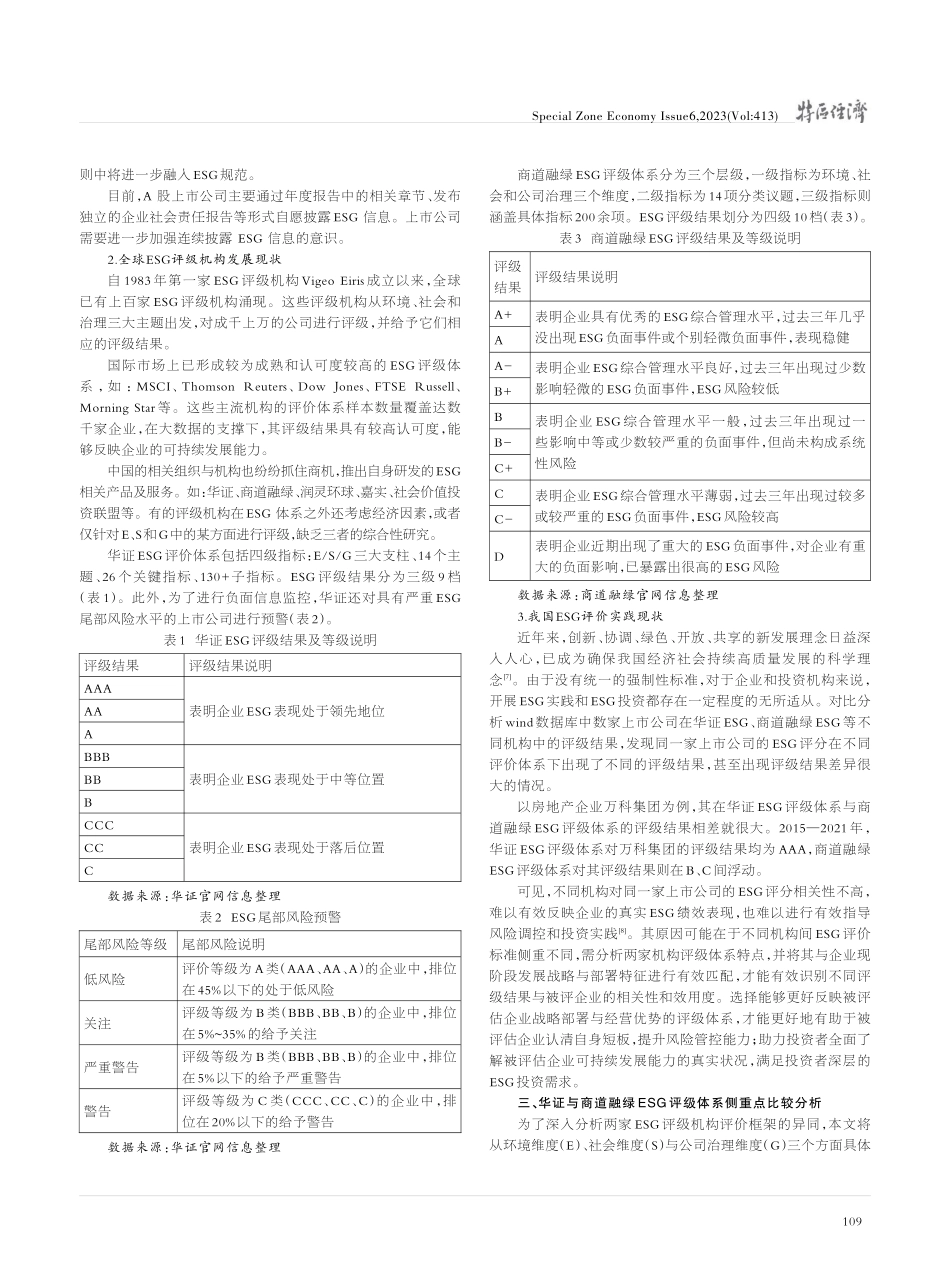

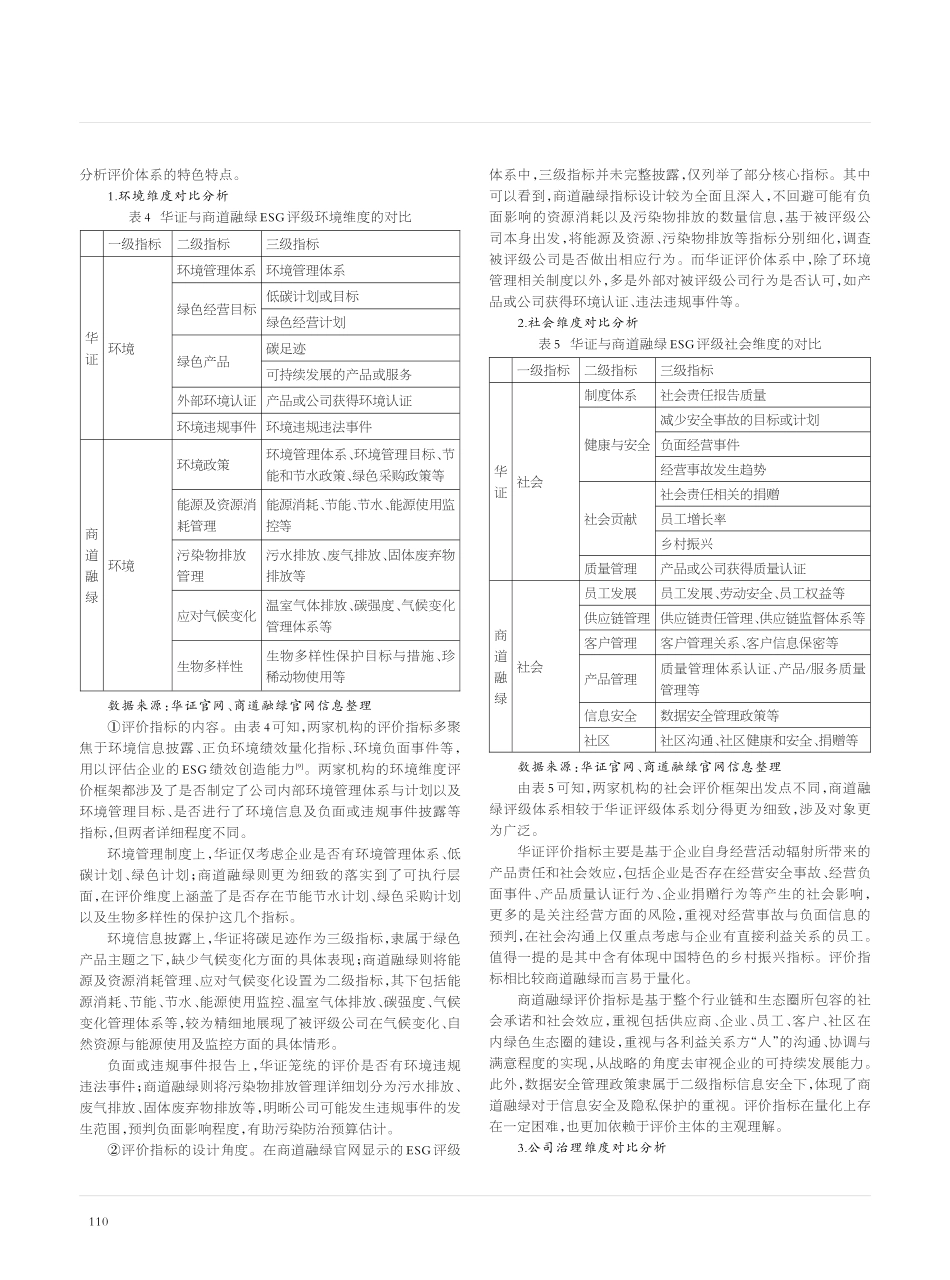

基于选择性研究的ESG评级□周频,钱晨(湖北工业大学,湖北武汉430068)摘要:随着“3060”目标的提出,中国ESG发展亦进入快车道。ESG评级机构大量涌现,却时常发生同一家上市公司在不同机构的评级结果相差较大的情况。由万科集团在华证ESG评级体系与商道融绿ESG评级体系下的不同评级结果,引发进一步分析两家机构评级体系的结构与特点,发现二者成熟度不同,适用的阶段也不尽相同。结合房地产行业的发展趋势,认为有助于全面认识万科集团的是商道融绿ESG信息评估体系。将机构评级体系的特征与企业发展战略等进行结合评价,不仅有助于企业认识自我可持续发展能力,还有助于投资者甄别选择合适的投资标的,满足自身的ESG投资需求。关键词:万科集团;ESG评级;可持续发展中图分类号:F272文献标识码:A文章编号:1004-0714(2023)006-0108-05ESGRatingsBasedonSelectiveResearch——TakingVankeasanExampleZHOUPin1,QIANChen2(HubeiUniversityofTechnology,430068,Wuhan,China)Abstract:Withtheintroductionofthe“3060”goal,China’sESGdevelopmenthasalsoenteredthefastlane.ESGratingagencieshaveemergedinlargenumbers,butitoftenhappensthattheratingresultsofthesamelistedcompanyindifferentagenciesarequitedifferent.ThedifferentratingresultsofVankeundertheChinaSecuritiesESGratingsystemandSynTaoGreenFinanceESGratingsystemledtofurtheranalysisofthestructureandcharacteristicsoftheratingsystemsofthetwoinstitutions,andfoundthattheyhavediffer⁃entmaturitylevelsanddifferentapplicablestages.Combinedwiththedevelopmenttrendoftherealestateindustry,itisbelievedthattheSynTaoGreenFinancingESGInformationEvaluationSystemishelpfulforacomprehensiveunderstandingofVanke.Combiningthecharacteristicsoftheinstitutionalratingsystemwiththecorporatedevelopmentstrategywillnotonlyhelpcompaniesunderstandtheirownsustainabledevelop⁃mentcapabilities,butalsohelpinvestorsidentifyandselectsuitableinvestmenttargetstomeettheirESGinvestmentneeds.Keywords:Vanke;ESGRating;SustainableDevelopment——以万科集团为例一、ESG概述ESG是企业非财务信息披露框架,是从环境、社会以及公司治理三个维度来评价企业可持续发展能力的一种全新理念[1-2]。环境责任(E),要求公司在生产经营活动中提升环境绩效,降低单...