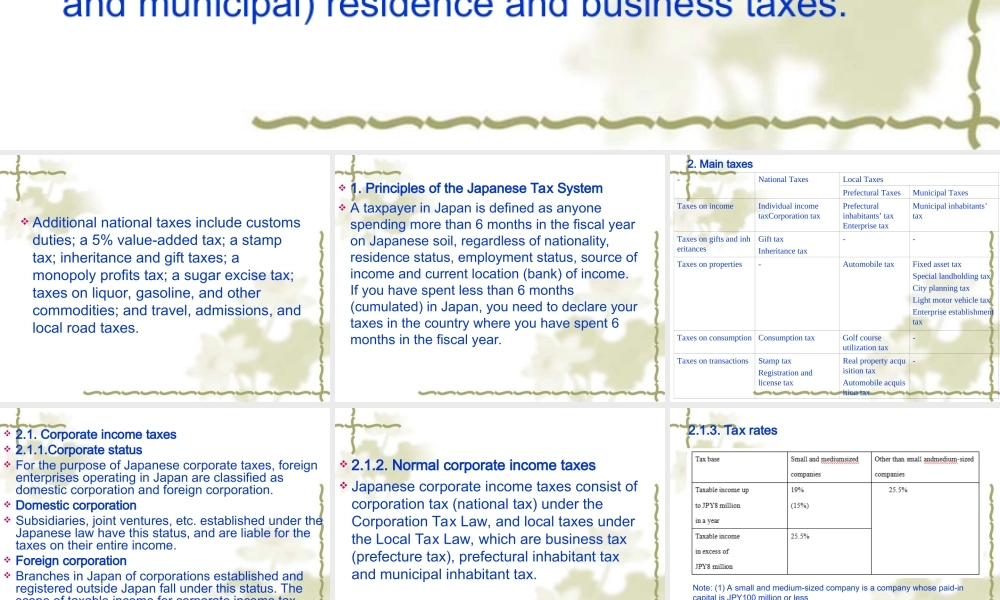

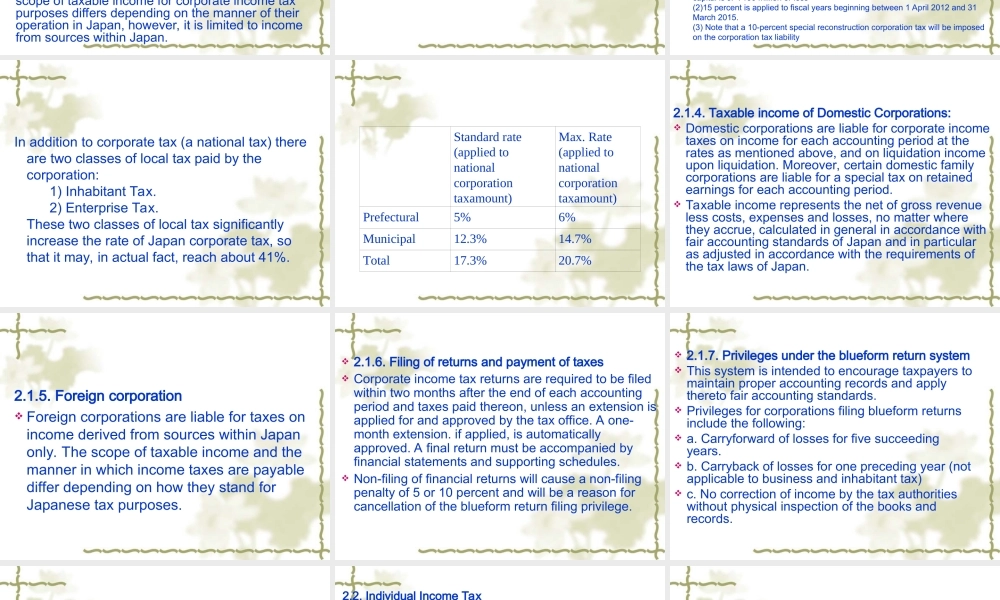

ChapterVIITaxationinJapanAfterWorldWarII,Japanadoptedataxsystemrelyingmainlyondirecttaxes,likethoseintheUnitedStatesandtheUnitedKingdom.Themostimportantofthesearetheincometaxandcorporationtax.TheNationalTaxAdministrationAgency,abranchoftheMinistryofFinance,administersincomeandcorporationtaxlaws.Inaddition,theTaxSystemCouncilfilesrecommendationsforrevisionofthesystemeverythreeyears.Individualsaresubjecttoanationalincometaxaswellaslocal(prefecturalandmunicipal)residenceandbusinesstaxes.Additionalnationaltaxesincludecustomsduties;a5%value-addedtax;astamptax;inheritanceandgifttaxes;amonopolyprofitstax;asugarexcisetax;taxesonliquor,gasoline,andothercommodities;andtravel,admissions,andlocalroadtaxes.1.PrinciplesoftheJapaneseTaxSystemAtaxpayerinJapanisdefinedasanyonespendingmorethan6monthsinthefiscalyearonJapanesesoil,regardlessofnationality,residencestatus,employmentstatus,sourceofincomeandcurrentlocation(bank)ofincome.Ifyouhavespentlessthan6months(cumulated)inJapan,youneedtodeclareyourtaxesinthecountrywhereyouhavespent6monthsinthefiscalyear.-NationalTaxesLocalTaxesPrefecturalTaxesMunicipalTaxesTaxesonincomeIndividualincometaxCorporationtaxPrefecturalinhabitants’taxEnterprisetaxMunicipalinhabitants’taxTaxesongiftsandinheritancesGifttaxInheritancetax--Taxesonproperties-AutomobiletaxFixedassettaxSpeciallandholdingtaxCityplanningtaxLightmotorvehicletaxEnterpriseestablishmenttaxTaxesonconsumptionConsumptiontaxGolfcourseutilizationtax-TaxesontransactionsStamptaxRegistrationandlicensetaxRealpropertyacquisitiontaxAutomobileacquisitiontax-2.Maintaxes2.1.Corporateincometaxes2.1.1.CorporatestatusForthepurposeofJapanesecorporatetaxes,foreignenterprisesoperatinginJapanareclassifiedasdomesticcorporationandforeigncorporation.DomesticcorporationSubsidiaries,jointventures,etc.establishedundertheJapaneselawhavethisstatus,andareliableforthetaxesontheirentireincome.ForeigncorporationBranchesinJapanofcorporationsestablishedandregisteredoutsideJapanfallunderthisst...