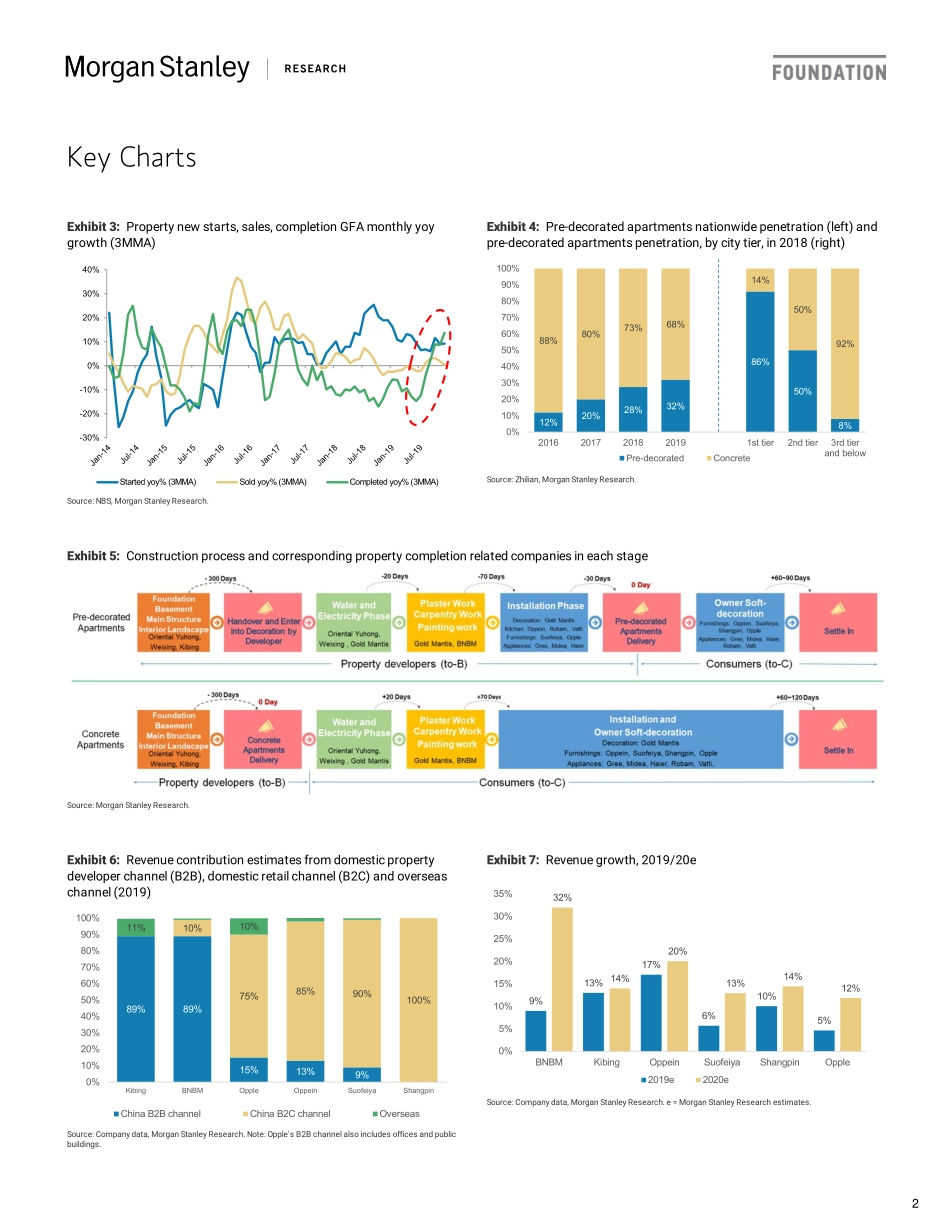

Hangjie.Chen@morganstanley.comKevin.Luo@morganstanley.comRachel.Zhang@morganstanley.comHanli.Fan@morganstanley.comLillian.Lou@morganstanley.comIn-LineMORGANSTANLEYASIALIMITED+HangjieChenEQUITYANALYST+8522848-7168KevinLuo,CFAEQUITYANALYST+8522239-1527RachelLZhangEQUITYANALYST+8522239-1520HanliFan,CFAEQUITYANALYST+8523963-1017LillianLouEQUITYANALYST+8522848-6502MorganStanleyappreciatesyoursupportinthe2020InstitutionalInvestorAll-AsiaResearchTeamSurvey.Requestyourballothere.ChinaIndustrialsAsiaPacificIndustryViewIndustrynote:PotentialWinnersfromPropertyCompletionsChinaIndustrialsChinaIndustrials||AsiaPacificAsiaPacificPotentialWinnersfromPropertyCompletions-InitiatingonTwoIndustrialsStocksChinapropertycompletionsareheadingintoanupcycle.IntheChinaIndustrialsspace,weinitiateontwostocksthatcanbenefitfromthistrend.OWBNBMandKibing.WearebullishontheChinapropertycompletionupcycle.China'sNationalBureauofStatistics(NBS)recorded16%yoygrowthinpropertycompletionsin4Q19,after28monthsofdatainnegativeterritory.Webelievethat4Q19wastheinflectionpoint,andtheupturnwillcontinuein2020.Theupcycleisevidencedbyhighergrowthintotalpropertydevelopmentfunds,accelerationinleadingindicators,and20-25%yoyrevenuegrowthforecastsforpropertydevelopersin2019-21,accordingtoourChinapropertyteam.Weexpectasurgeinpropertycompletionstoactastheprimarysharepricecatalystforrelatedcompaniesin2020.Fundamentalimpactsvarybycompanyproductofferings.Wesplitthepropertycompletionrelatedcompanies'businessmodelsintoB2B(sellstopropertydevelopers)andB2C(sellstoconsumers)businesses.Wealsoconsiderthefactthatpre-decoratedapartmentsaretakingsharefromconcreteapartments.ForB2Bbusiness,fundamentalshaveimprovedfrom3Q19,aheadofpropertycompletions.Webelievethatthefundamentalupturnwillcontinuein2020,supportedbyasurgeinconstructionactivities.ForB2C,weexpecttheweakdemandof2019toturnaroundin2Q/3Q20,giventhatconsumersshouldstartpurchasinghomedurablesafterobtainingproperty.Marketsharedynamicsandexpansionintoothercategoriesarecompanydiffere...