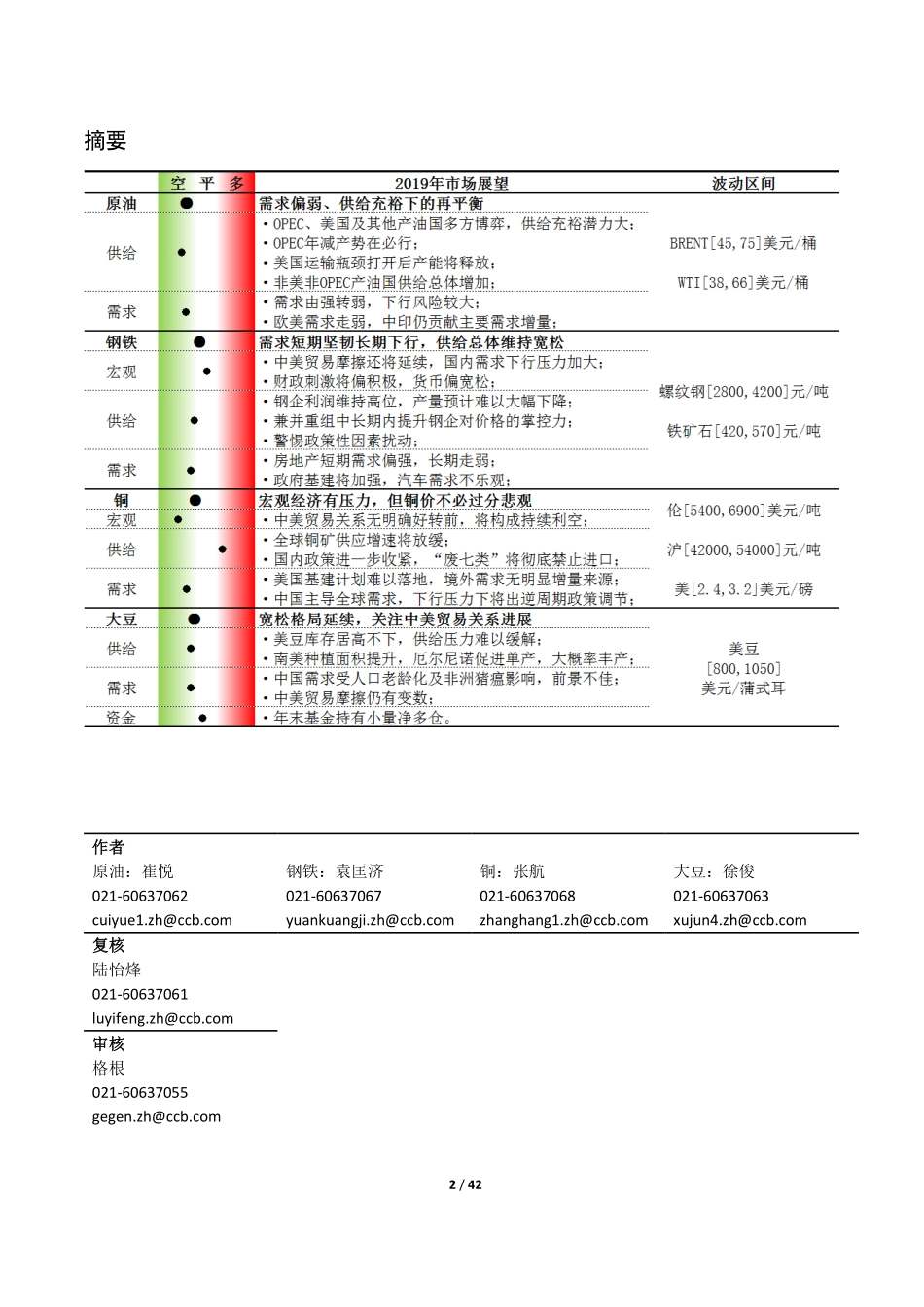

1/42fa概览建行商品指数整体上行,年内开于1889.24,收于1954.31,涨幅达3.44%。各板块中,黑色板块上涨8.56%,有色板块下跌14.44%,农产品板块下跌6.10%,贵金属板块微涨0.07%。数据来源:Wind、CCB内外盘商品价格走势数据来源:Wind、CCB金融市场交易中心2018年回顾暨2019年展望大宗商品市场CommoditiesMarket2/42摘要作者原油:崔悦钢铁:袁匡济铜:张航大豆:徐俊021-60637062021-60637067021-60637068021-60637063cuiyue1.zh@ccb.comyuankuangji.zh@ccb.comzhanghang1.zh@ccb.comxujun4.zh@ccb.com复核陆怡烽021-60637061luyifeng.zh@ccb.com审核格根021-60637055gegen.zh@ccb.com3/42目录原油.................................................................................................................................................................4一、全年行情回顾:油价冲高回落,呈现倒V型.....................................................................................4二、供给方面:三足鼎立局势显,供给充裕潜力大.................................................................................5三、需求方面:由强转弱,2019下行风险较大......................................................................................10四、后市展望:需求偏弱、供给充裕下再平衡.......................................................................................13钢铁...............................................................................................................................................................15一、全年行情回顾:主导因素反复切换,行情走势一波三折...............................................................15二、宏观影响:国际环境演变整体影响国内行业政策...........................................................................16三、终端需求:房地产需求成中流砥柱,后继乏力成隐忧...................................................................16四、钢铁产量:环保限产政策密集支撑钢价,去产能完成产量回升...................................................19五、钢铁库存:年初创新高,年底创新低...............................................................................................22...