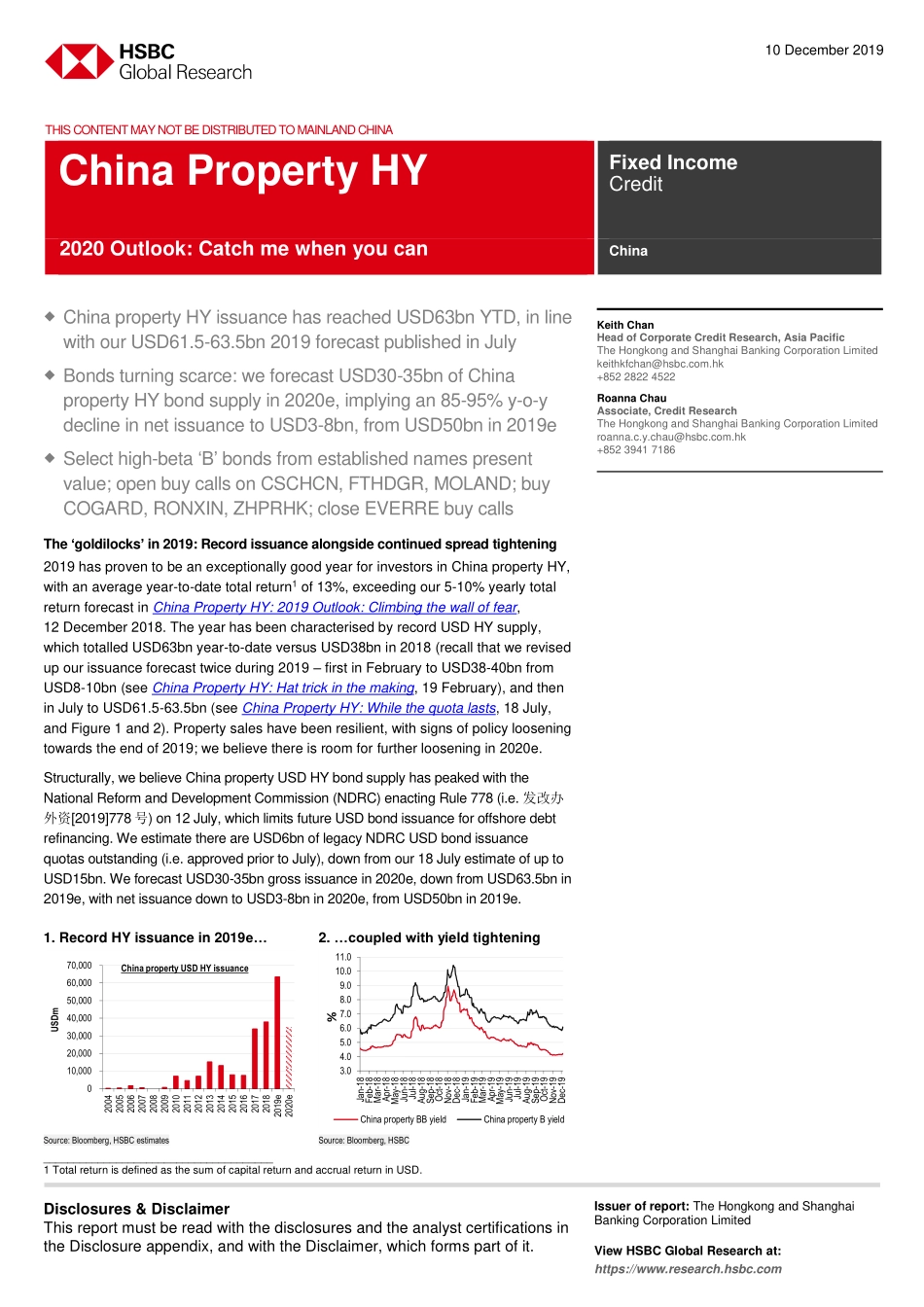

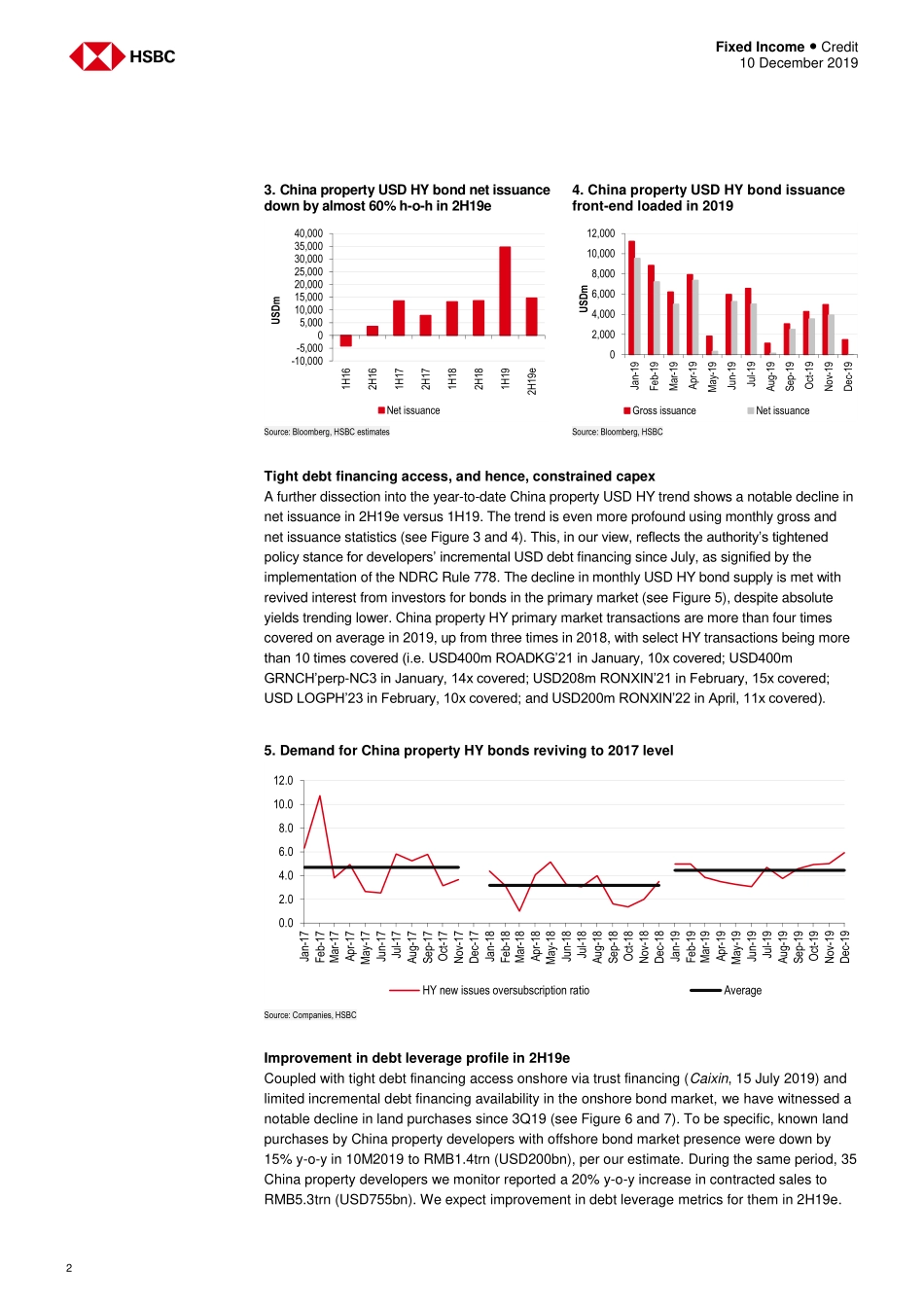

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:TheHongkongandShanghaiBankingCorporationLimitedViewHSBCGlobalResearchat:https://www.research.hsbc.comTHISCONTENTMAYNOTBEDISTRIBUTEDTOMAINLANDCHINAChinapropertyHYissuancehasreachedUSD63bnYTD,inlinewithourUSD61.5-63.5bn2019forecastpublishedinJulyBondsturningscarce:weforecastUSD30-35bnofChinapropertyHYbondsupplyin2020e,implyingan85-95%y-o-ydeclineinnetissuancetoUSD3-8bn,fromUSD50bnin2019eSelecthigh-beta‘B’bondsfromestablishednamespresentvalue;openbuycallsonCSCHCN,FTHDGR,MOLAND;buyCOGARD,RONXIN,ZHPRHK;closeEVERREbuycallsThe‘goldilocks’in2019:Recordissuancealongsidecontinuedspreadtightening2019hasproventobeanexceptionallygoodyearforinvestorsinChinapropertyHY,withanaverageyear-to-datetotalreturn1of13%,exceedingour5-10%yearlytotalreturnforecastinChinaPropertyHY:2019Outlook:Climbingthewalloffear,12December2018.TheyearhasbeencharacterisedbyrecordUSDHYsupply,whichtotalledUSD63bnyear-to-dateversusUSD38bnin2018(recallthatwerevisedupourissuanceforecasttwiceduring2019–firstinFebruarytoUSD38-40bnfromUSD8-10bn(seeChinaPropertyHY:Hattrickinthemaking,19February),andtheninJulytoUSD61.5-63.5bn(seeChinaPropertyHY:Whilethequotalasts,18July,andFigure1and2).Propertysaleshavebeenresilient,withsignsofpolicylooseningtowardstheendof2019;webelievethereisroomforfurtherlooseningin2020e.Structurally,webelieveChinapropertyUSDHYbondsupplyhaspeakedwiththeNationalReformandDevelopmentCommission(NDRC)enactingRule778(i.e.发改办外资[2019]778号)on12July,whichlimitsfutureUSDbondissuanceforoffshoredebtrefinancing.WeestimatethereareUSD6bnoflegacyNDRCUSDbondissuancequotasoutstanding(i.e.approvedpriortoJuly),downfromour18JulyestimateofuptoUSD15bn.WeforecastUSD30-35bngrossissuancein2020e,downfromUSD63.5bnin2019e,withnetissuancedowntoUSD3-8bnin2020e,fromUSD50bnin2019e.______________________________________1Totalreturnisdefinedasthesumof...