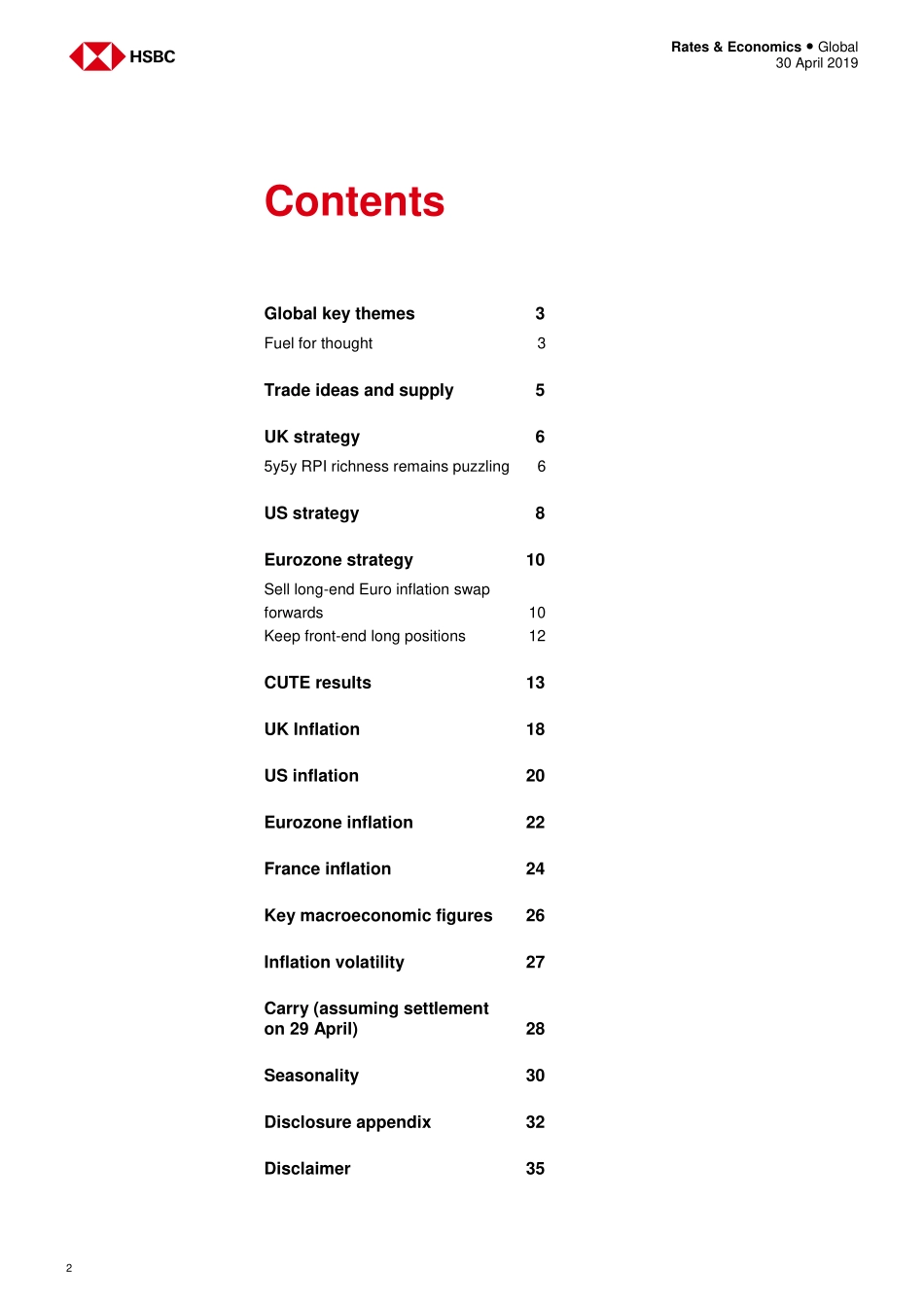

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:HSBCBankplcViewHSBCGlobalResearchat:https://www.research.hsbc.comAsoilslipsoffitspeak,weassesstheextenttowhichmovesinoilpricesinfluenceglobalinflationbreakevensItseemsinevitablethatlong-endEuroinflationforwardswillfallfromtheECB’starget,especiallywithoutDutchpensionbuyingThepersistentrichnessof5y5yRPIispuzzling,butitmaybearesultofinsuranceandpension-relatedactivityFuelforthoughtOilpriceshaveretreatedofftheirsixmonthhighs,andfurtherweaknesscouldbeahead.USbreakevensaremostsensitivetochangesinoilprices,butweshouldnotoverplaytheirimportancefor10-yearTIPSvaluationswherewemaintainamildlybullishview.Selllong-endEuroinflationforwardsFacedwithastructurallylowinflationoutlook,itseemsimprobablethatlong-endinflationswapforwardswillsustaintheircurrentlevelswhicharestillneartheECB’stargetofcloseto2%.WeaddtoourstructurallybearishEuroinflationexposurebyselling20y10yHICPxT.Furthermore,onthedemandside,thereisnowloweractivityinthe10-year+sectoroftheHICPxTcurvefromDutchpensioninvestors.Thisshowsnosignofchanginganytimesoonasfundinglevelsremaintoolow.Infact,fouroutofthelargestfivepensionfundsrecentlywarnedthatthelikelihoodoffuturecutstopensionrightsandbenefitshadincreased.5y5yRPIdefiesgravityAtthetimeofwriting,theUKinflationmarketisstillawaitingthegovernment’sresponsetotheHouseofLordsreportonRPIreformwhichwassupposedtobeforthcominginApril.Asuncertaintylingerson,thepersistentrichnessof5y5yRPIcontinuestopuzzlemarketparticipants.Weagreethatfromapurelymacroeconomicperspective,intermediateRPIforwardslookexpensive.However,wethinkvaluationsmayhavebeendistortedbyachangeininvestordemand.LDIhedgingflowsandinsurancebuyingmaybericheningthe10-yearpoint.Butincreasedbuy-outactivitycouldofferrelativelymoresupportforthelonger-endoftheRPIcurve.30April2019DanielaRussellHeadofUKRatesStrategyHSBCBankplcdaniela.russell@hsbcib.com+4420...