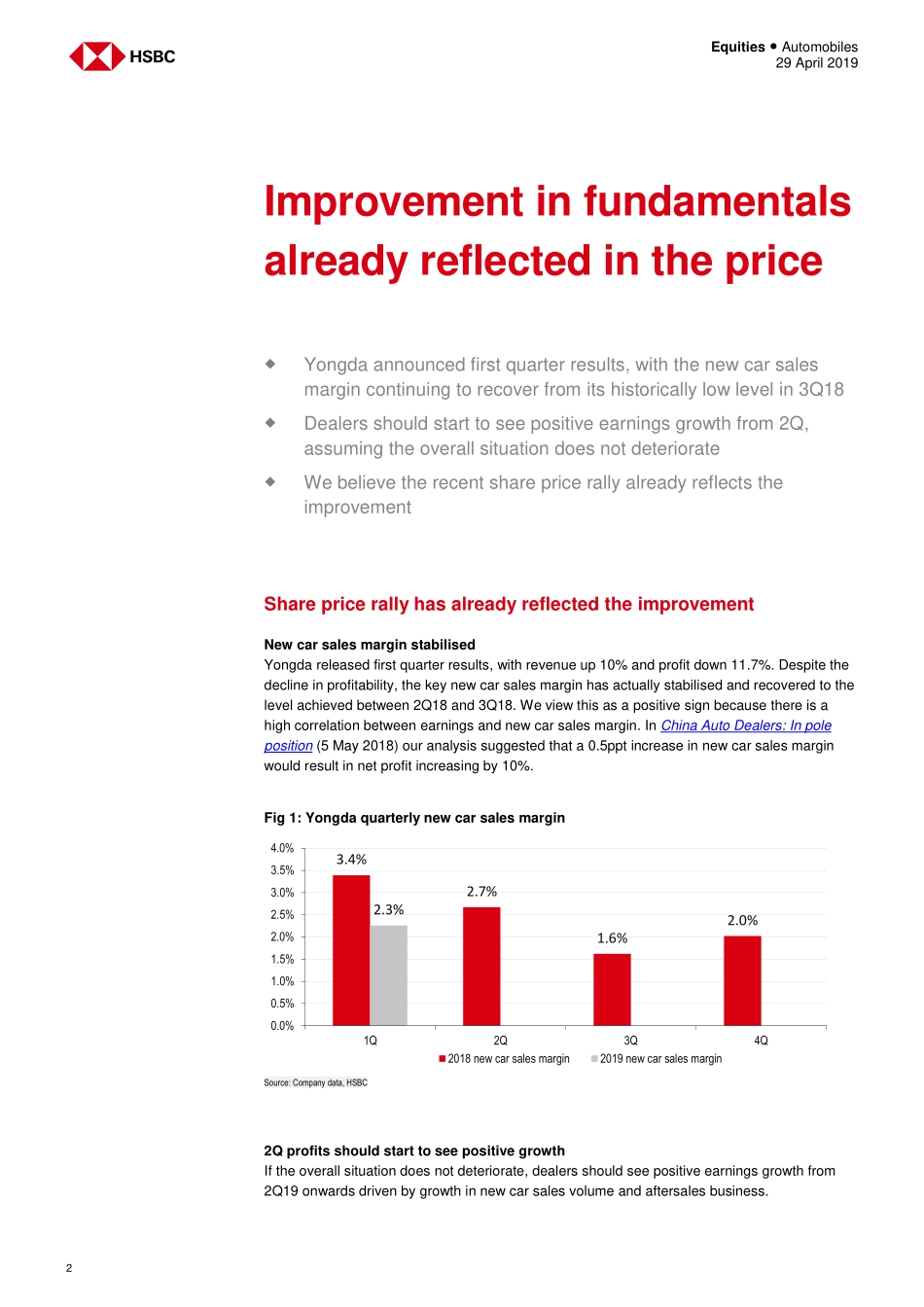

Disclosures&DisclaimerThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.Issuerofreport:TheHongkongandShanghaiBankingCorporationLimitedViewHSBCGlobalResearchat:https://www.research.hsbc.comHSBCChinaConference201915-17May,ShenzhenRegisternowTHISCONTENTMAYNOTBEDISTRIBUTEDTOTHEPEOPLE'SREPUBLICOFCHINA(THE"PRC")(EXCLUDINGSPECIALADMINISTRATIVEREGIONSOFHONGKONGANDMACAO)Dealersexperiencedarecoveryin1Q19,drivenbyrobustgrowthinluxuryautosalesandapickupinthenewcarsalesmarginWebelievethattheyear-to-datesharepricerallyhaspricedintheimprovementsinfundamentalsWemaintainourtargetpricesforYongdaandZhongshenganddowngradebothcompaniesonvaluationSofar,sogood:Luxuryautosalesgrew7%inMarch.Salesofdomesticallyproducedmodelsgrewby15%.Overallluxuryretailsalesremainedrobust,withthepenetrationratefurtherincreasingto13%in1Q19(12.7%by2018year-end).YongdaAuto(3669HK)releasedselective1Qfinancialresults.Althoughnetprofitdeclinedc12%in1Q,thenewcarsalesmargincontinuedtoimprovefromthebottomin3Q18.Yongdashouldseepositivegrowthinnetprofitsfrom2Q19aslongasitsmarginaremaintainedatcurrentlevels.However,webelievethisisalreadyinprice:SharepricesforYongdaandZhongshenghaverisenby54%and35%YTD,respectively.Webelievethemarkethasalreadypricedintherecoveryinfundamentalssofar.Weexpectthenewcarsalesmarginwilllikelytostayat1QlevelsaswethinkarecoveryinmarginsispartiallytheresultofextrarebatesfromOEMs.Thecurrentmarketdiscountrateisstillatahighlevel.Commentsaboutrecentpolicystimulusandautofinanceservicefees:Weanalysethepotentialrelaxationoftheplaterestrictionpolicy.Luxurysalesarehighlyskewedinplate-restrictedareasforthedealersunderourcoverage.Salesexposurerangesfrom23%to50%.TheimpactoftherecentincidentonchargingautofinanceservicefeesappearslimitedascommissionsfromsellingautofinanceproductsaremostlyreceivedfromOEMs’autofinancecompaniesinsteadofcarbuyers.Waitforthenextcatalyst:WedowngradebothYongdaandZhongshengtoHoldfromBuyaswebelieveth...