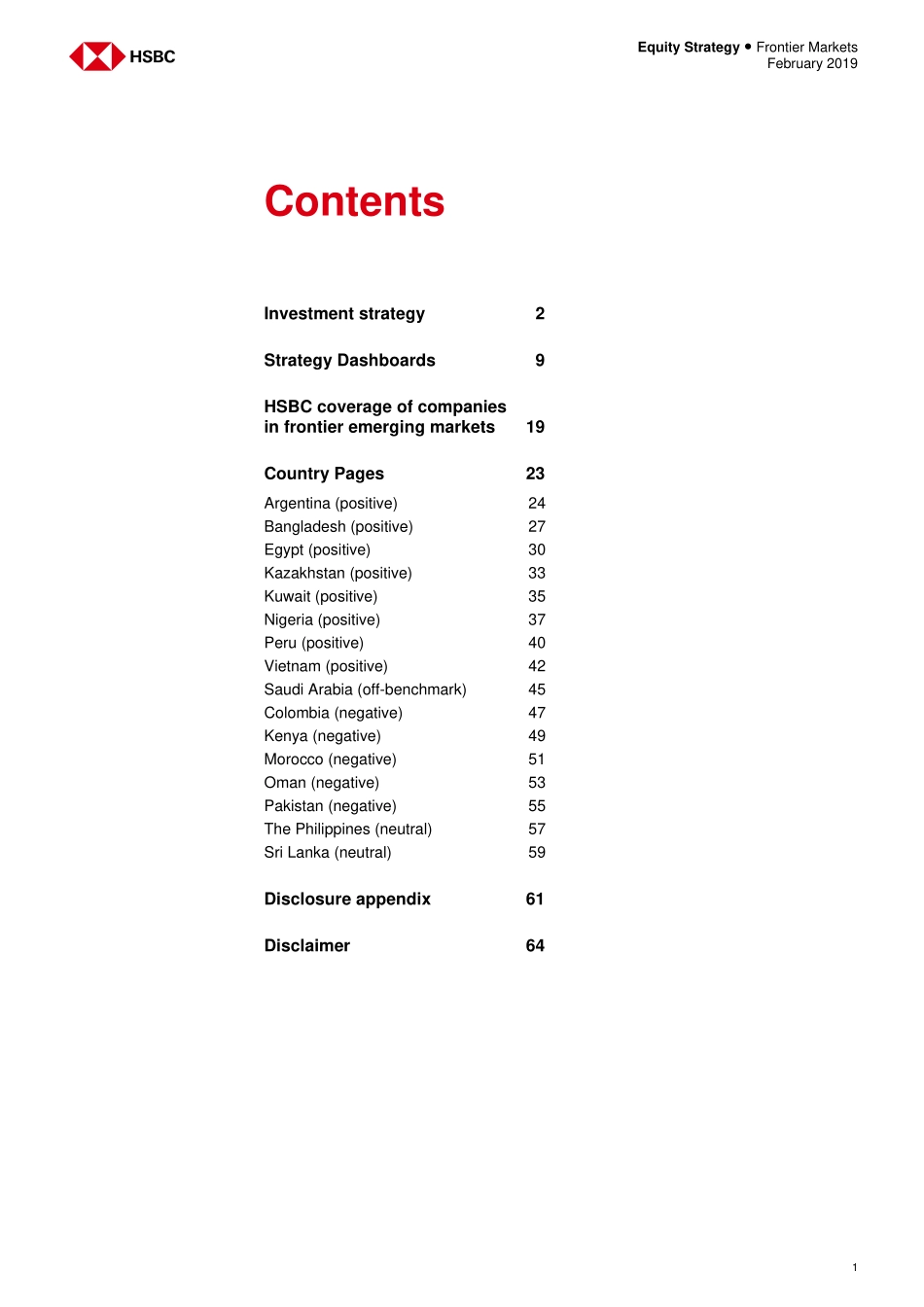

www.research.hsbc.comDisclosures&Disclaimer:ThisreportmustbereadwiththedisclosuresandtheanalystcertificationsintheDisclosureappendix,andwiththeDisclaimer,whichformspartofit.EquityStrategyFrontierMarketsFebruary2019By:JohnLomax,FranciscoSchumacher,DevendraJoshiandHeraldvanderLindeFrontierEmergingMarketsEquityStrategyOil-pricestickinesspersistsPerformanceofFEMmarketsremainshighlydependentonoilpricesPaceofgovernmenteffortstodiversifyoil-focusedeconomiesisslowingValuationshavecorrectedsharplybutearningsgrowthandROEsremainweak1EquityStrategy●FrontierMarketsFebruary2019Investmentstrategy2StrategyDashboards9HSBCcoverageofcompaniesinfrontieremergingmarkets19CountryPages23Argentina(positive)24Bangladesh(positive)27Egypt(positive)30Kazakhstan(positive)33Kuwait(positive)35Nigeria(positive)37Peru(positive)40Vietnam(positive)42SaudiArabia(off-benchmark)45Colombia(negative)47Kenya(negative)49Morocco(negative)51Oman(negative)53Pakistan(negative)55ThePhilippines(neutral)57SriLanka(neutral)59Disclosureappendix61Disclaimer64ContentsEquityStrategy●FrontierMarketsFebruary20192MarketoutlookOilcontinuestobeakeydriverofFEMmarketswhichincludesomeoftheworld’slargestoilexporters.InourlatestGEMSEquityStrategyQuarterly(9January2019)wecutouroff-benchmarkexposuretofrontiermarketsowingtotheloweroilprice.WiththeriseofshaleproductionintheUSandtheslowingglobaleconomy,HSBChaslowereditsoilpriceassumptionsfor2019eand2020etoUSD64/bfromUSD80/b,andtoUSD70/bfromUSD85/b,respectively(see:Rangebound:OPECcutmeetsUSshaleglut,GordonGrayetal,13January2019).Withtheoilpricehavingfallen,ouroutlookforoil-producingnationsoverallhasdiminished.Wearestillpositive,althoughlesssothanwewerebefore,onKuwait,SaudiArabia,NigeriaandKazakhstanwearenegativeonColombiaandOman.ThefinancialsectorpresentsopportunityinNigeria,SaudiArabiaandEgypt.ElectionsareimpactingAsiancountries;aftertheelectionsweareturningpositiveonBangladesh,butwearecautiousonSriLankaaselectionshavetobeheldsometimebefore1December2020.InvestmentstrategyPerfo...