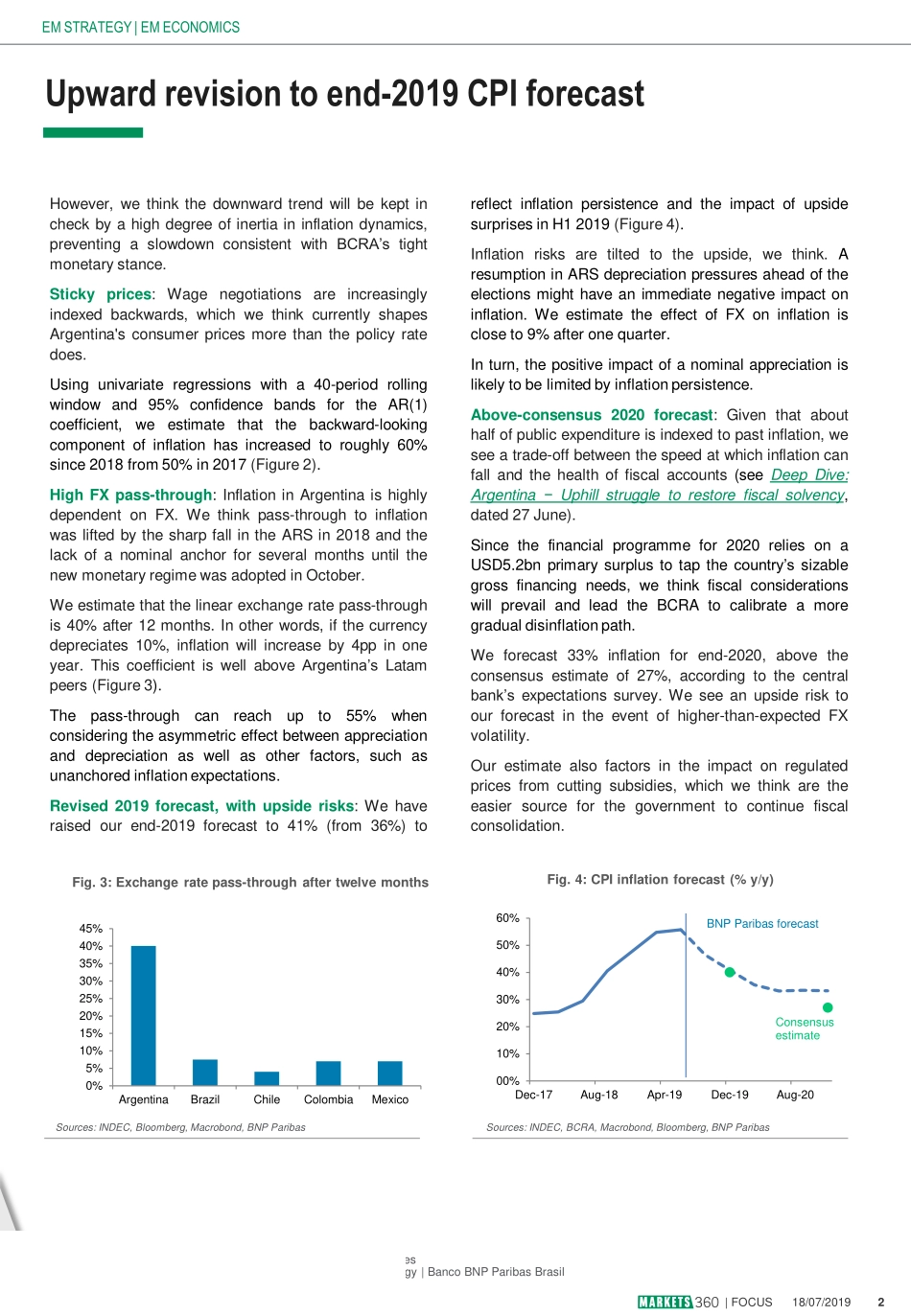

|FOCUS18/07/20191Shouldmoneydemandnotpickupthewayauthoritiesproject,thecurrentgrowthpaceofremuneratedliabilities(Leliqs)issuedbytheBCRAisasourceofrepressedinflation,inourview,togetherwithARSappreciationandthefreezeoftariffhikes.Sincethepesoisatransactionaltoolforlocalsratherthanareserveofvalue,andthefiscalconsolidationremainsfarfromdone,weexpectthecurrencytoremainunderpressure,despiteperiodicstabilisationandthecarryonoffer.WearebearishARSwithatacticalshortpositionagainstUSD(seeArgentina:Capitalflighttotheupside,3July).Weprefertobeonthesidelinesoncreditforthetimebeing..MARKETVIEWFOCUS|LATINAMERICA18July2019Argentina–SlowerpathtolowerinflationKEYMESSAGESWeexpectArgentina’sinflationtokeepmoderatinginH22019,butwehaveraisedouryear-endforecastby5ppto41%.Althoughthecentralbank’smonetarystancewouldimplysubstantialdisinflation,wethinkitwillbecurbedbyhighinflationinertia.Forend-2020,weexpectinflationof33%,abovetheconsensusestimateof27%.RelianceonARSappreciationtotameconsumerpricesposesupsideriskstoourforecasts.Junewasthethirdconsecutivemonthofdecelerationinconsumerpriceinflation,witharateof2.7%m/mafterthe4.7%m/mpeakreachedinMarch.High-frequencyprivategaugessuggestthatinflationhascontinueditsdownwardpathinJuly,likelydecliningto2.3%m/m(Figure1).Waningimpactofregulatedprices:Weexpectthistrendtocontinueuntiltheendoftheyear,thankstoacombinationoflowerregulatedpricesandmorecontainedinflationexpectations.AuthoritieshavedecidedtoconcentrateutilitytariffhikesinthefirstpartoftheyearwiththelikelyaimofkeepingthemasfaraspossiblefromOctober’sgeneralelection.Weestimateregulatedpriceswilladdabout3.2pp.toinflationinH22019,wellbelowthe5.4pp.seeninH1.PleaserefertoimportantinformationattheendofthisreportFig.1:CPIinflation(%m/m)Sources:INDEC,Macrobond,BNPParibasSources:INDEC,Macrobond,Bloomberg,BNPParibasEMSTRATEGY|EMECONOMICSFelipeKlein,Economist|BNPParibasSucursalBuenosAiresGabrielGersztein,GlobalHeadofEmergingMarketsStrategy|BancoBNPParibasBrasilFig.2:Inflationinertia0%20%40%60%80%100%1...