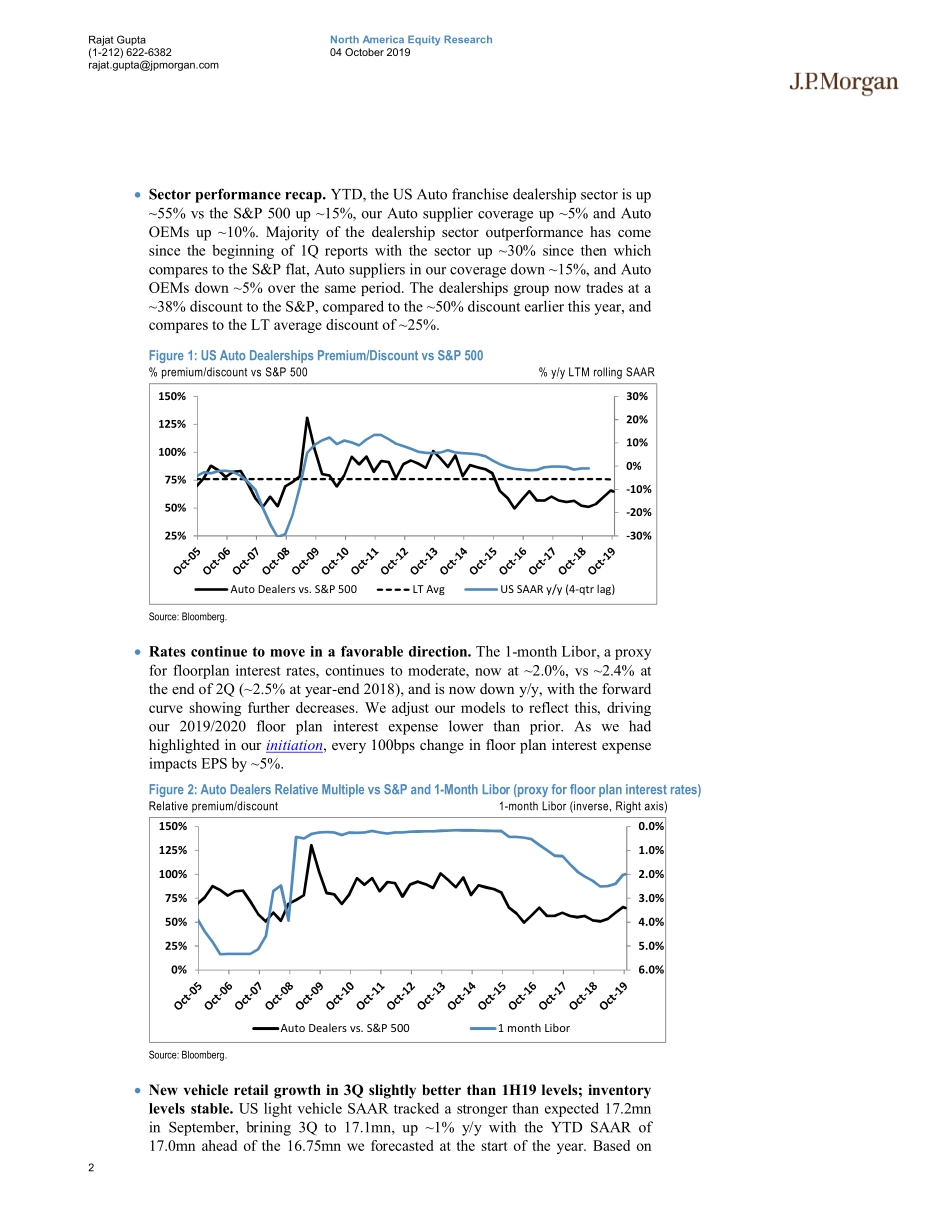

www.jpmorganmarkets.comNorthAmericaEquityResearch04October2019EquityRatingsandPriceTargetsMktCapRatingPriceTargetCompanyTicker($mn)Price($)CurPrevCurEndDatePrevEndDateAsburyAutomotiveABGUS2,002.6296.28Nn/c100.00Dec-2096.00Dec-19AutoNationANUS4,339.5248.11UWn/c44.00Dec-2041.00Dec-19Group1AutomotiveGPIUS1,527.3485.57OWn/c101.00Dec-2097.00Dec-19LithiaMotorsLADUS2,933.98126.22OWn/c141.00Dec-20138.00Dec-19PenskeAutomotivePAGUS3,749.8944.43Nn/c52.00Dec-2055.00Dec-19SonicAutomotiveSAHUS1,224.1928.61Nn/c32.00Dec-2030.00Dec-19Source:Companydata,Bloomberg,J.P.Morganestimates.n/c=nochange.Allpricesasof03Oct19.USAutoDealerships3Q19PreviewExpect1H19TailwindsToContinue;GMStrikeImpactsManageableForNow;LongLAD/GPI,AvoidPAGinto3Q19PrintAutos&AutoPartsRajatGuptaAC(1-212)622-6382rajat.gupta@jpmorgan.comRyanBrinkman(1-212)622-6581ryan.j.brinkman@jpmorgan.comDanielJWon(1-212)622-3221daniel.j.won@jpmorgan.comJ.P.MorganSecuritiesLLCSeepage23foranalystcertificationandimportantdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.Weexpect3Q19AutoDealershipsresultstooutshineotherpartsoftheautomotivesupplychainandseeafavorablesetupatcurrentlevelsintoearningsseason(eventhoughthesectorhasre-ratedby~1,500bpsYTDbuthasde-ratedslightlyoverthelastweek).Afterbetterthanexpected1H19results,wheresame-storegrossprofitgrowthwas+4%forthegroup,drivenprimarilybysolid,+7%,Parts&Servicessame-storegrowth,weexpectfocustoremainonsustainabilityofthesetrends.WebelieveParts&Servicesshouldseecontinuedmid-single-digitsame-storegrossprofitgrowthin3Q19thoughWarrantygrowth,whichcontributed~250bpstothe7%overallParts&Servicesgrowthseenin1H19,couldbelumpyandmorecompanyspecific(basedonrecallexposuretoToyota,GMwhereLAD,ANandGPIhavethemostexposure)whilecompsalsostarttogettougherforsome(ABG,AN,SAH).On...