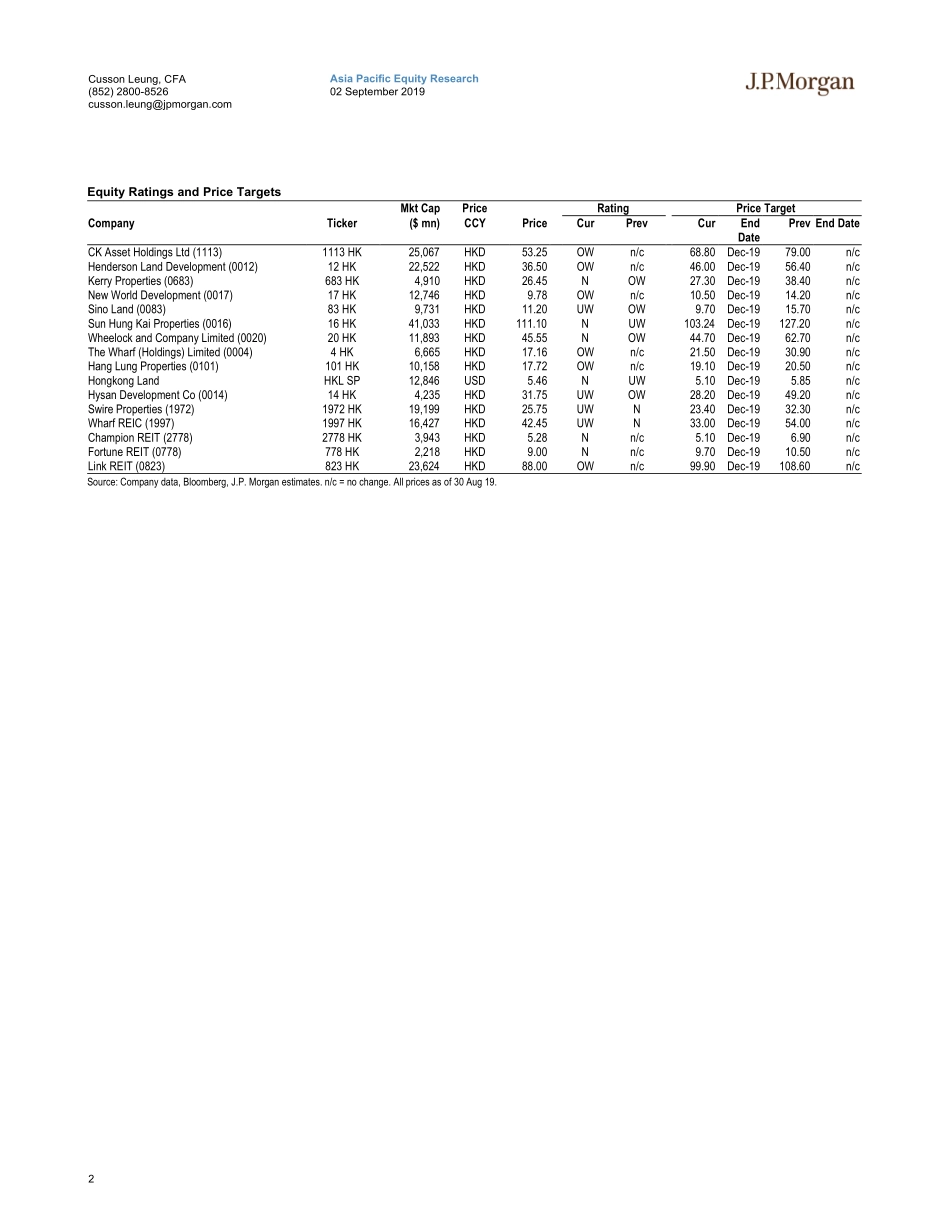

www.jpmorganmarkets.comAsiaPacificEquityResearch02September2019HongKongPropertyNavigatingthedarkness,PartIIHongKong,SingaporeHeadofHKResearch,ConglomeratesandPropertyCussonLeung,CFAAC(852)2800-8526cusson.leung@jpmorgan.comBloombergJPMALEUNGJevonJim(852)2800-8538jevon.jim@jpmorgan.comRyanLi,CFA(852)2800-8529ryan.li@jpmorgan.comKarlChan(852)2800-8513karl.chan@jpmorgan.comAveryChan(852)2800-8659avery.chan@jpmorgan.comJ.P.MorganSecurities(AsiaPacific)LimitedSeepage57foranalystcertificationandimportantdisclosures,includingnon-USanalystdisclosures.J.P.Morgandoesandseekstodobusinesswithcompaniescoveredinitsresearchreports.Asaresult,investorsshouldbeawarethatthefirmmayhaveaconflictofinterestthatcouldaffecttheobjectivityofthisreport.Investorsshouldconsiderthisreportasonlyasinglefactorinmakingtheirinvestmentdecision.Againstabackdropofpersistentuncertainty,wehaveappliedstressteststoalltheHongKongpropertystocksunderourcoverageandshortlistedsixOWstockswithconviction.Thestresstestassumptions—declinesof30%inresidentialprices,30%inretailrentsand40%inofficerents—arenotourbasecase,butwebelievelookingthroughthislenshelpstoidentifythestocksthatstillpresentconsiderablevaluedespitetheshort-termdepressedsentiment.Lingeringuncertainties.Despitethe19%correctionfromtheirrecentpeaks,webelievethemajorityofHongKongpropertystockshaveyettodiscountalltheuncertaintiescomingfrom:1)continuedChina-UStradetensions;and2)thecurrentsocialunrestinHongKongthatistakingatollonthelocaleconomy.Theserisksaredifficulttoquantifyatthisstagegiventheunknowndurationofevents.Asaresultofourstresstesttodeterminebear-caseimpactsforHongKongpropertycompanies,weareconsolidatingourOWlisttoonlysixnames:CKA,NWD,HendersonLand,Wharf,HLPandLinkREIT.WeseefurtherdownsideriskstostockssuchasHysan,SwireProp,WharfREICandSinoLand.Thebear-casescenario.Assumingthecurrenthomeprice-to-incomeratiofallsbackfromthecurrent14xtoitslong-termaverageof10x,thiswouldimplya30%declineinresidentialprices.IfthecurrentsocialunrestinHongKonglea...