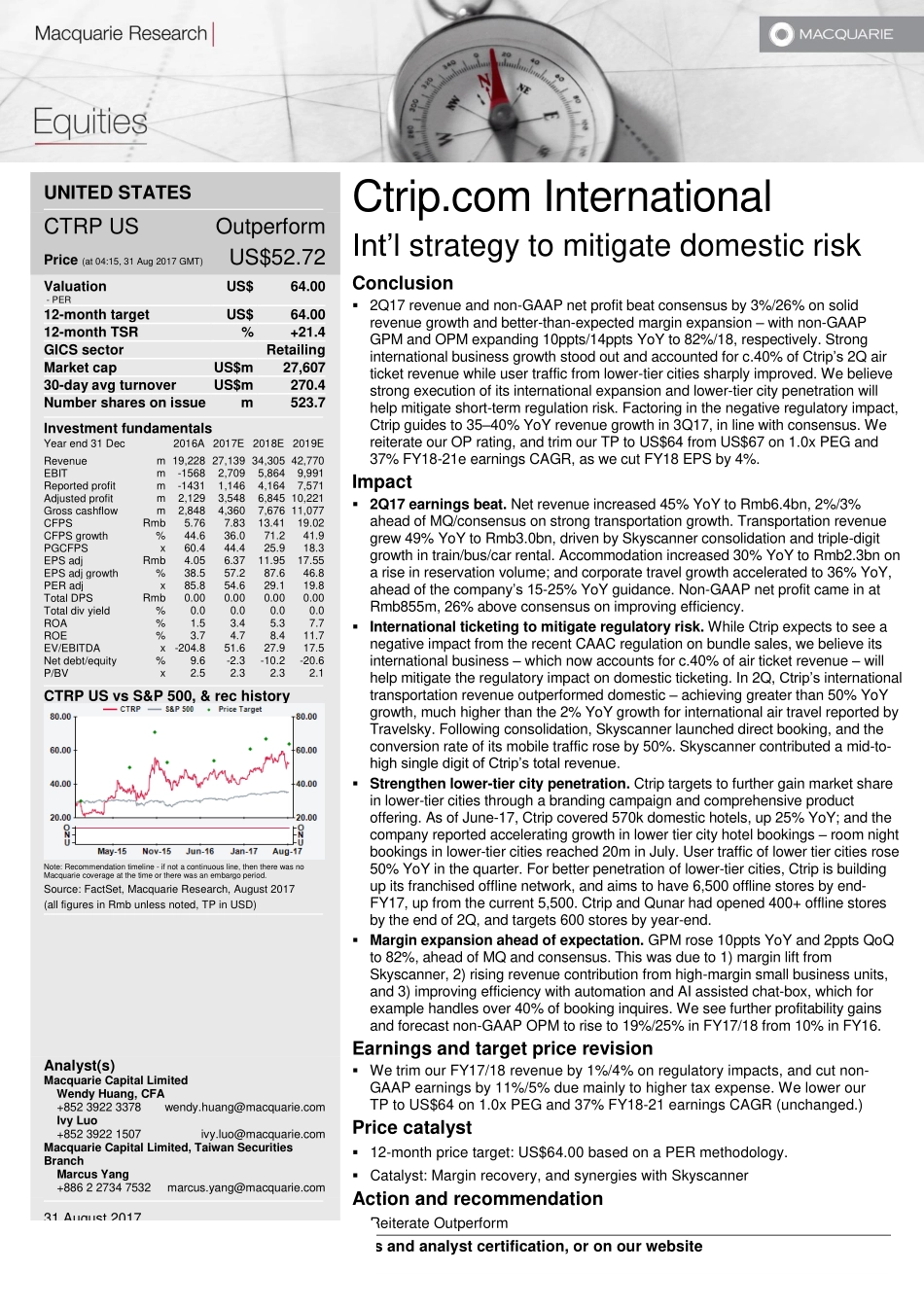

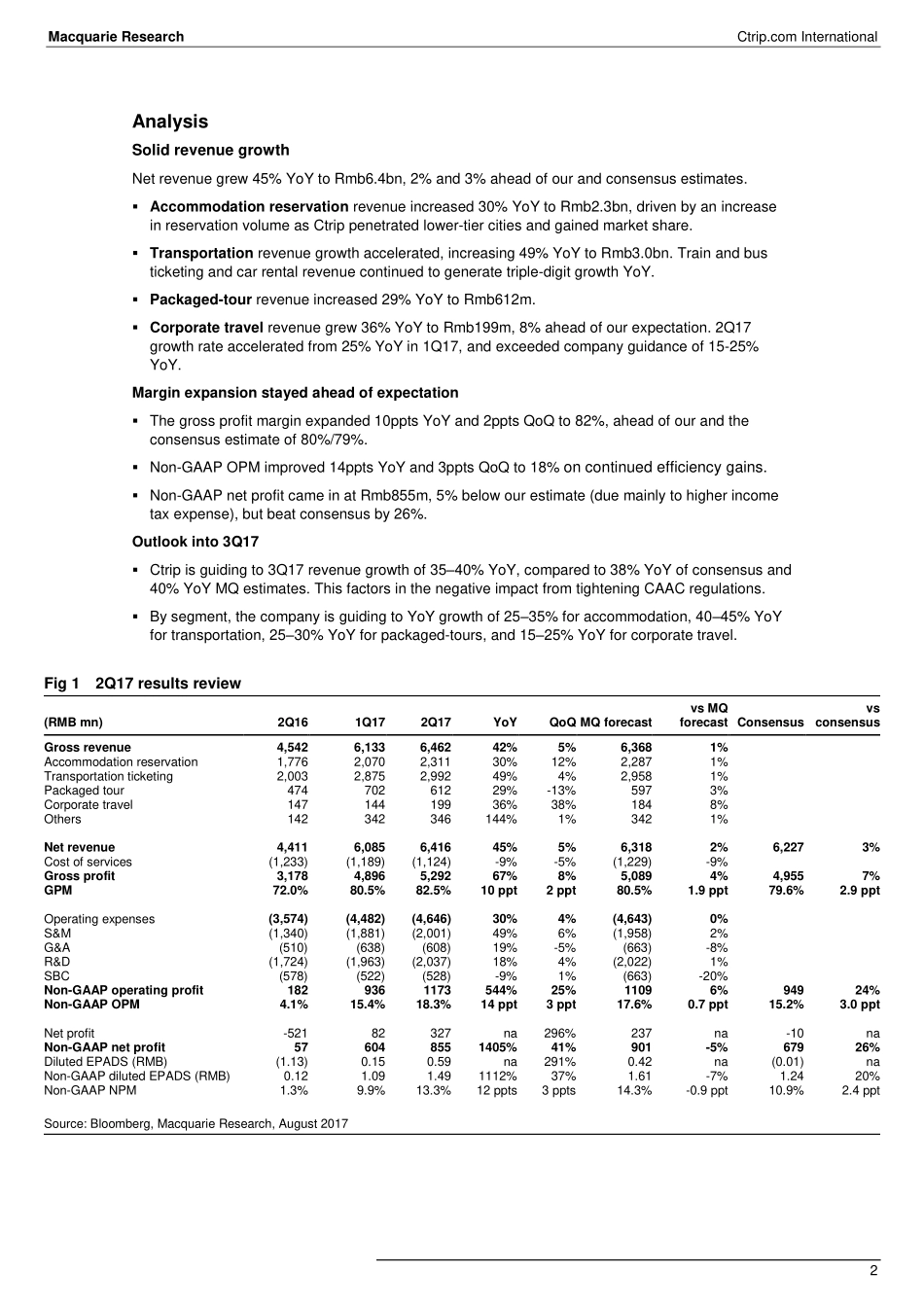

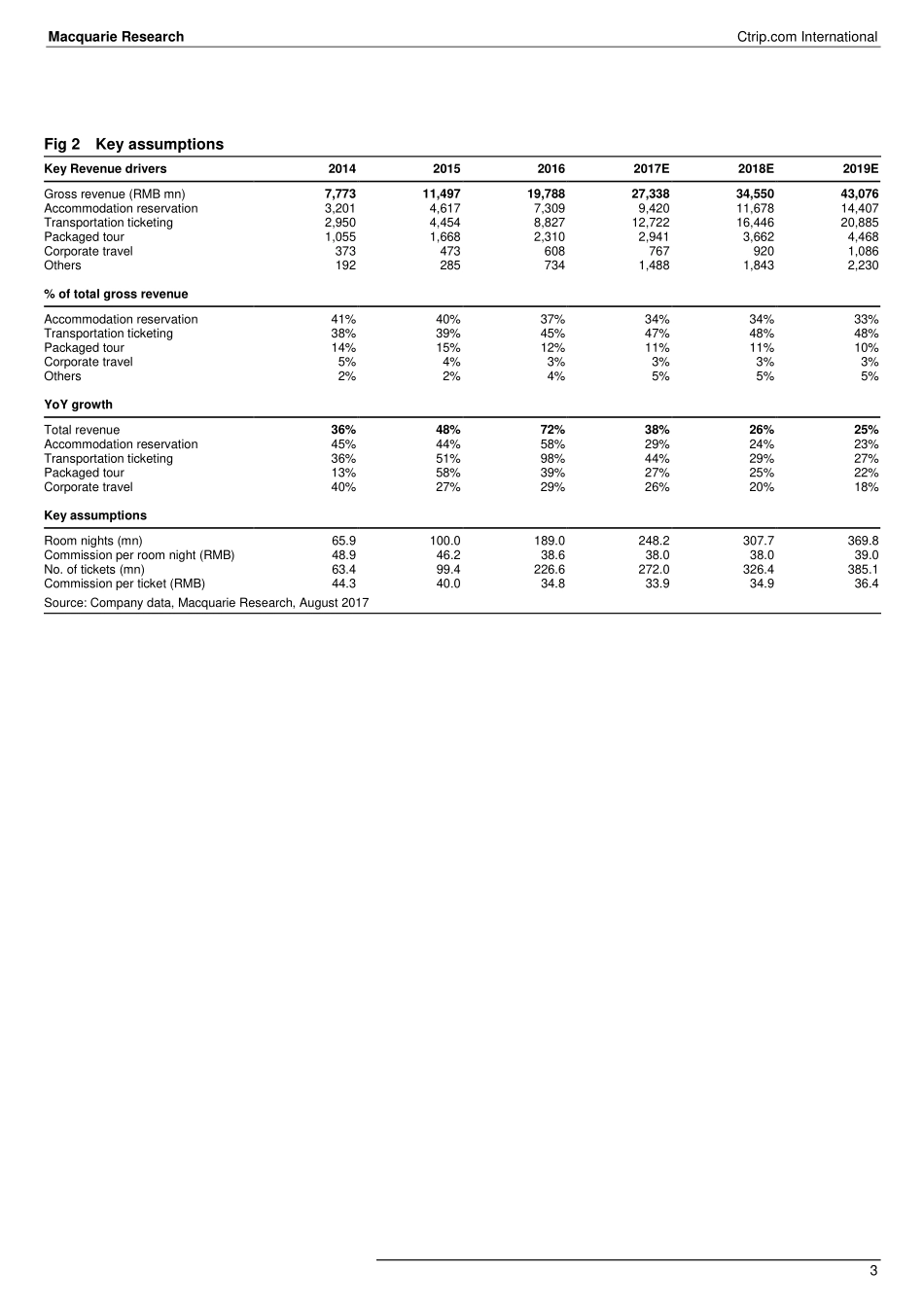

Pleaserefertopage9forimportantdisclosuresandanalystcertification,oronourwebsitewww.macquarie.com/research/disclosures.UNITEDSTATESCTRPUSOutperformPrice(at04:15,31Aug2017GMT)US$52.72ValuationUS$64.00-PER12-monthtargetUS$64.0012-monthTSR%+21.4GICSsectorRetailingMarketcapUS$m27,60730-dayavgturnoverUS$m270.4Numbersharesonissuem523.7InvestmentfundamentalsYearend31Dec2016A2017E2018E2019ERevenuem19,22827,13934,30542,770EBITm-15682,7095,8649,991Reportedprofitm-14311,1464,1647,571Adjustedprofitm2,1293,5486,84510,221Grosscashflowm2,8484,3607,67611,077CFPSRmb5.767.8313.4119.02CFPSgrowth%44.636.071.241.9PGCFPSx60.444.425.918.3EPSadjRmb4.056.3711.9517.55EPSadjgrowth%38.557.287.646.8PERadjx85.854.629.119.8TotalDPSRmb0.000.000.000.00Totaldivyield%0.00.00.00.0ROA%1.53.45.37.7ROE%3.74.78.411.7EV/EBITDAx-204.851.627.917.5Netdebt/equity%9.6-2.3-10.2-20.6P/BVx2.52.32.32.1CTRPUSvsS&P500,&rechistoryNote:Recommendationtimeline-ifnotacontinuousline,thentherewasnoMacquariecoverageatthetimeortherewasanembargoperiod.Source:FactSet,MacquarieResearch,August2017(allfiguresinRmbunlessnoted,TPinUSD)Analyst(s)MacquarieCapitalLimitedWendyHuang,CFA+85239223378wendy.huang@macquarie.comIvyLuo+85239221507ivy.luo@macquarie.comMacquarieCapitalLimited,TaiwanSecuritiesBranchMarcusYang+886227347532marcus.yang@macquarie.com31August2017Ctrip.comInternationalInt’lstrategytomitigatedomesticriskConclusion2Q17revenueandnon-GAAPnetprofitbeatconsensusby3%/26%onsolidrevenuegrowthandbetter-than-expectedmarginexpansion–withnon-GAAPGPMandOPMexpanding10ppts/14pptsYoYto82%/18,respectively.Stronginternationalbusinessgrowthstoodoutandaccountedforc.40%ofCtrip’s2Qairticketrevenuewhileusertrafficfromlower-tiercitiessharplyimproved.Webelievestrongexecutionofitsinternationalexpansionandlower-tiercitypenetrationwillhelpmitigateshort-termregulationrisk.Factoringinthenegativeregulatoryimpact,Ctripguidesto35–40%YoYrevenuegrowthin3Q17,inlinewithconsensus.WereiterateourOPrating,andtrimourTPtoUS$64fromUS$67on1.0xPEGand37%FY18-...